There is always a lot of noise and numbers in the run-up to the budget. Here are a few facts that might help you wade through this forest of assertions, assumptions and anecdotes.

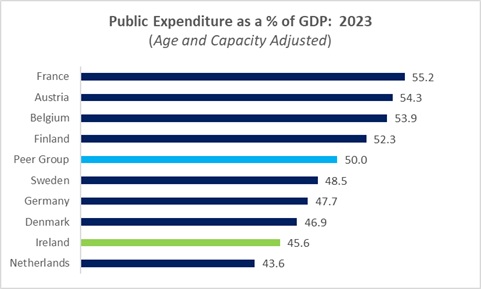

1. Ireland is a Low Spender

A lot of talk about ‘spending getting out of control’ and ‘we need to rein in spending’. Yet Ireland is a low-spender in our European peer-group (high-income EU economies). The Irish Fiscal Advisory Council provides some numbers:

We’d have to spend an additional €13 billion in 2023 to reach our peer group average. This hardly looks like ‘out of control’. In truth, we’re not spending nearly enough.

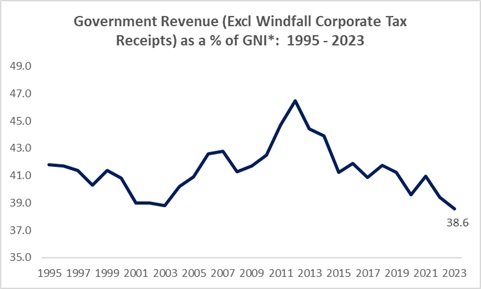

2. Ireland is a Low Taxer

The tax burden! The tax burden! There will be a lot of talk about high taxes (and, so, a plethora of demands to cut taxes). Yet, like spending, taxation is similarly low compared to our EU peers – towards the bottom, again. What’s more, the Government seems determined to drive down government revenue even further. Again, from the Fiscal Council.

In 2023 government revenue as a percentage of GNI* was the lowest in the previous 28 years (and probably much longer if we had the data). 2024 outturn didn’t move the dial. We’re hardly being over-taxed. But when you put the two facts together – low-spend, low-tax – you get the story of an economy with a weak social state.

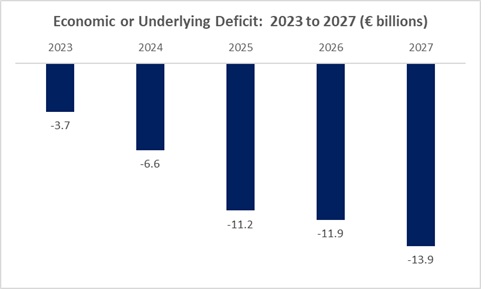

3. Relying on Unreliable Money

The Government is running a significant deficit according to the Central Bank (and others). And it is growing. So how can the government continue cutting taxes and increasing spending? Because it is being bailed-out – by a handful of US multi-nationals whose tax-avoidance strategies results in windfall, or transitory, corporate tax receipts.

Runing this level of deficit is irresponsible when the economy is at, or near, full capacity. It can only fuel inflationary pressures. And if the windfall tax receipts start to wither (the Government has described them as unreliable) or if the economy starts slumping then we will back to austerity.

That’s why the Government itself stated that it would not use these windfall receipts:

‘The Government cannot, and will not, use these transitory receipts to fund permanent increases in public expenditure.’

But they are doing just that. Not only are we relying on unreliable money coming from the tax avoidance of a handful of US multinationals, we are relying on an unreliable government. Quite simply, this is a dangerous space to be in.

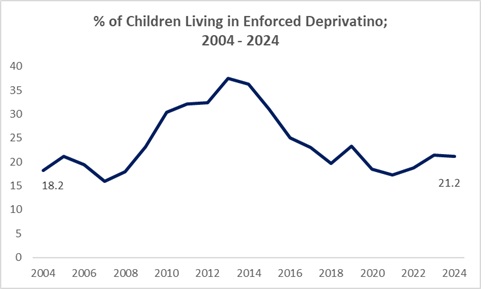

4. Child Deprivation

The CSO measures the number of children living in enforced deprivation. It is a grim statistic.

Over one-in-five children experience multiple deprivation experiences. While this rate has fallen from the recession/austerity period, it is still above pre-crash levels. Over the last 20 years, the average child deprivation rate was 18.5 percent which was pretty bad. After years of recovery and growth, the rate is still above 21 percent.

5. A Short Stat about Profits and Wages

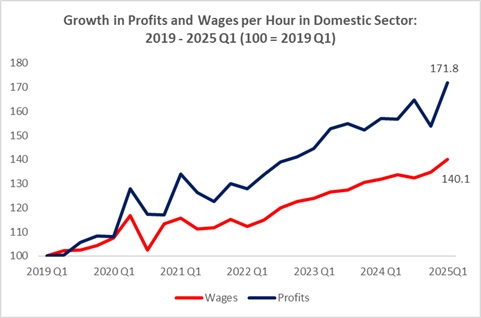

The Covid and cost-of-living crisis years have been good for profits.

Over the six years – 2019 to 2025 (Q1) – profits have increased by 72 percent. Wages increased by 40 percent. Wages are not keeping up with the productivity that employees are producing. In effect, employers are skimming it off the top. How will the Government use the budget and enterprise policy to rectify this? Or is this what they intended all along?

6. SME Struggles

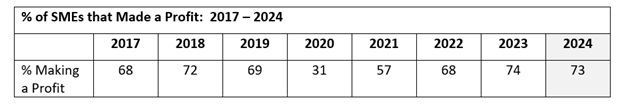

Much of government policy has been justified on the basis of a struggling small business sector: VAT cuts, postponement of the Living Wage, stopping the extension of statutory sick pay, cutting regulations, etc. Are small businesses really in such dire straits? Not according to the small businesses themselves. The Department of Finance Credit Demand survey shows a different picture.

While businesses took a big hit in 2020 and 2021, they quickly returned to profit. In 2024, 73 percent of SMEs reported making a profit – higher than the pre-Covid years. Basing policy on the claim that SMEs are struggling requires the Government to ignore small business owners’ responses to the Government’s own survey.

7. Comparing Living Standards

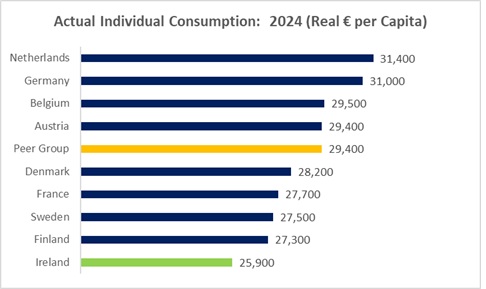

To approximate living standards, Eurostat produces a statistic called ‘Actual Individual Consumption’.

This measures the total value of goods and services actually consumed by individuals, regardless of who paid for them. It includes goods and services purchased directly by households, as well as those provided by the (like healthcare and education) to satisfy individual needs. Taken together, it is one measure of living standards.

We are at the bottom, well below the average of our peer group. Of course, this is not the definitive measurement; there is no one definitive measurement of living standards. However, it is one piece of the picture – and for Ireland, it is a pretty dismal piece.

8. 100 Hundred Years of Infrastructural Solitude

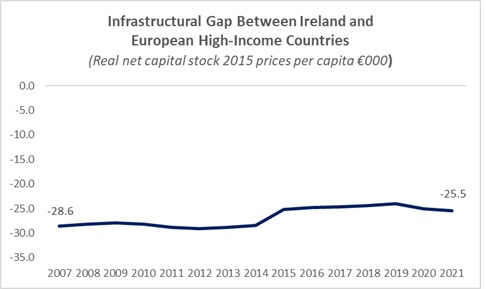

What a hole we have dug for ourselves when it comes to infrastructural quality. We are so far behind we will be in catch-up mode for a long time.

In 2007, Irish infrastructure stock (the stock of houses, hospitals, schools, public transport, etc.) was 29 percent below other high-income European countries. By 2021 we had closed that gap to 25 percent. At this rate, it would take over 100 years before we caught up to the average of our peer group.

Thankfully, the Irish government is proposing to significantly increase our infrastructural spending under the National Development Plan which should bring us up to average in a shorter time. However, we should note:

- The IFAC data refers to real (after inflation) infrastructural stock. If the Government’s fiscal irresponsibility unleashes inflationary pressures, we may end up spending a lot, but getting far less real value.

- Public investment has fallen short of government plans. So be careful when you see big numbers on paper because it’s a long ways to actually building it.

9. VAT Cut-Mania

When you’re not sure what to do, call for tax cuts; in this particular case – VAT cuts.

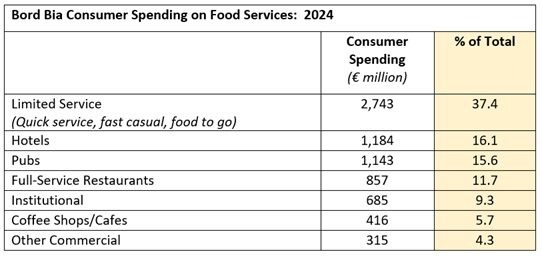

Let’s say that restaurants and coffee shops are in trouble (on a sectoral basis, they’re not). Cutting the VAT rate from 13.5 percent to 9 percent would be one of the last things you would consider. Why? Because restaurants and coffee shops would get very little benefit.

Less than 12 percent of the VAT cut benefit would go to restaurants; less than 6 percent would go to coffee shops and cafes. Over 37 percent would go to fast-food outlets. If you want to help restaurants and coffee shops, cutting the VAT rate makes no sense.

10. Higher and Higher

Ireland is a high-cost country – the 2nd highest in the EU.

When it comes to our friend – Actual Individual Consumption – prices are 41 percent above the EU average. However, when it comes to housing and utilities, we’re 87 percent above the EU average – which puts us at the top of the table (housing only includes rents, it excludes mortgage payments).

These high costs are not something new. Back in 2007, we were the 2nd highest in overall consumption, and housing and utilities. It’s a chronic thing.

So how much is Budget 2026 going to add to those pressures on living costs? And handing out social transfers to people to deal with high prices (e.g. electricity credits) doesn’t really help; it just subsidises the price and potentially fuels even more inflation. Just like the Help to Buy scheme: it helps those people who can qualify but actually pushes prices higher.

* * *

So there you have it – 10 fun facts to help us get through the tsunami of numbers and commentary coming out of the Budget pronouncements.

And if you haven’t had enough of the budget by next Tuesday night, I will be participating in a NERI online-seminar on the budget the next day – Wednesday, October 8th at 2:30 pm. You can register here: NERI Post Budget Analysis online Seminar | Nevin Economic Research Institute.

Leave a reply to Fergal Cancel reply