Apologies for being absent from the debate for so long. I got stuck in traffic. Now, I am looking forward, again, to the analysis, the proposals and, most of all, the engagement with readers and friends. So let’s start. And what better place to start than with the Taoiseach’s early risers?

__________________________________________________________________________________________

“I will never apologise for standing up for people who get up early in the morning, who work nights and weekends, who aspire for something better for themselves and their families. It's their taxes that fund public services and keep our welfare system afloat and they deserve a break. And they know which party is on their side.”

“I will never apologise for standing up for people who get up early in the morning, who work nights and weekends, who aspire for something better for themselves and their families. It's their taxes that fund public services and keep our welfare system afloat and they deserve a break. And they know which party is on their side.”

Thus speaketh the Taoiseach. It wasn’t in the context of extending the power of employees over the wealth they create; it was all about tax cuts. But the issue of national income generation is a provocative one – as is the compensation workers receive for it. Let’s put it into a European context.

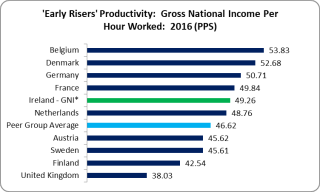

A usual, if somewhat crude, productivity measurement is GDP per hour worked. However, Irish GDP figures are unusable. So are our GNP figures. So for the purposes of this argument I have used the CSO’s modified Gross National Income (GNI) which tries to take into account multi-national accountancy practices. GNI is similar to GNP, adding in EU transfers and contributions. Modified GNI – or GNI* – goes further and strips out re-domiciled business activities, and depreciation on IP and aircraft leasing.

The Irish economy is rather productive, producing more than €49 per hour worked in Purchasing Power Parities (which account for living standards and currency). This is above the average of the other EU countries in our peer group and not too far behind the industrious Germans. In short, we have one of the highest levels of productivity in the EU as measured in GNI.

The Irish economy is rather productive, producing more than €49 per hour worked in Purchasing Power Parities (which account for living standards and currency). This is above the average of the other EU countries in our peer group and not too far behind the industrious Germans. In short, we have one of the highest levels of productivity in the EU as measured in GNI.

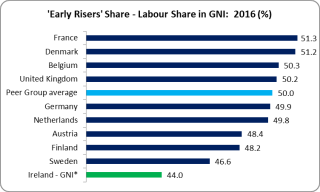

However, Irish workers don’t receive the same compensation for getting up early in the morning, working nights and weekends as their European counterparts.

While Ireland has above-average productivity, labour’s share in that productivity is at the bottom. If we were paid at our EU peer group level, every Irish worker would get, on average, an additional €6,740 in compensation, or a 13 percent pay increase.

If you’re thinking that it is Ireland’s low labour share that leads to high productivity, think on this: Denmark and Belgium have much higher levels of compensation and still top the productivity table.

If you’re thinking that it is Ireland’s low labour share that leads to high productivity, think on this: Denmark and Belgium have much higher levels of compensation and still top the productivity table.

If anything, the above under-states Irish productivity and overstates Ireland’s labour share. This is because some of the actual production of goods and services is removed from GNI in the form of profit repatriation.

The Taoiseach and allied politicians and commentators never mention this. They talk about tax cuts. Of course, tax cuts couldn’t begin to match the benefit that a fair share in the national income would bring. But implementing that fair share would require a substantial shift in power and priority to workers. And there’s a few powerful folk who wouldn’t want that to happen.

Yes, Irish workers get up early and work all manner of hours and days, nights and weekends, generating bucket loads of income for the economy. But when they go to sleep, they’re much poorer than other European workers.

So Irish workers should give the Taoiseach a message: keep your tax cuts, just give us a European-level cut of the wealth that we produce.

Leave a reply to Michael Taft Cancel reply