From this article – In Norway, Start-ups say Ja to Socialism – we can safely say there are at least a few Norwegian ‘entrepreneurs’ who are quite content to work in a high-tax system; indeed, they think it’s good for business. Take Wiggo Dalmo: he worked repairing mining equipment until he set up his own enterprise and in ten years he built up a $44 million business with 150 employees. He did this in one of the most heavily taxed, highest-waged economies in the world. If he was Irish, he’d probably be on Morning Ireland giving out about taxes and wages. But he’s Norwegian. Wiggo said:

"The tax system is good—it's fair. What we're doing when we are paying taxes is buying a product. So the question isn't how you pay for the product; it's the quality of the product.’

For good measure he also added:

‘I’m socialist to the bone.’

Maybe Wiggo and the others in this article are unique. But maybe not. Maybe a high-tax, high-spending, strong social security state is a bulwark for enterprise, not an impediment. We can test this proposition by looking at the number of enterprise start-ups in the high-taxed small open economies of Europe (Other SOE): Austria, Belgium, Denmark, Finland and Sweden. These can be considered our peer group as these are economies with a small domestic market and, therefore, a strong reliance on exports. Let’s canvas the background.

- Personal tax rates for employees are higher in Other SOE – Irish personal tax rates (including PRSI) would have to increase by 17 percent just to reach the average of the other countries.

- Unsurprisingly, the effective corporate tax rate in Other SOE is much higher than in Ireland – three times higher.

- Employers’ Social Insurance in Other SOE is also nearly three times higher than in Ireland

- Labour market flexibility (rules around hiring, firing, etc.) is much stricter than in Ireland

- And wages in the market economy are much higher than in Ireland – the average for Other SOE is €37.90 per hour compared to our €28.70

In the Irish orthodoxy, these European countries should be a disaster zone when it comes to enterprise – unlike pro-business Ireland. But is this the case?

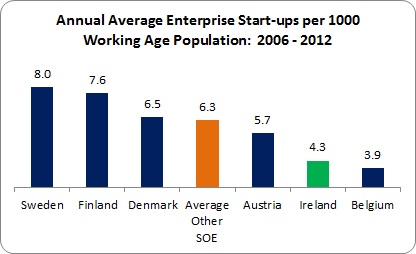

The following looks at the number of enterprise start-ups (births) per 1000 working age population.

We can see that, with the exception of Belgium, all of these other high-tax, high wage, ‘inflexible’ economies have far higher start-ups than Ireland. For Ireland to reach the average of our peer group, we would have to increase business start-ups by over 45 percent.

Another interesting stat: of the business start-ups in Ireland, 17 percent started up with employees. The remainder had no employees; essentially, they were self-employed or own-account workers. The average percentage of start-ups with employees in the Other SOE was 27 percent.

In short, not only does Ireland lag our peer group in terms of business start-ups, Irish start-ups are not as employment-dense.

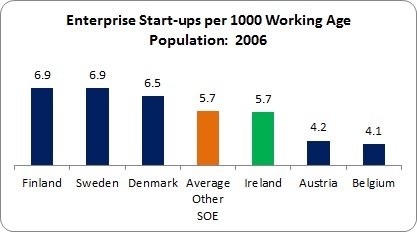

Of course, Ireland was in a bit of a rut between 2008 and 2012 (the last year we have data for). This would depress enterprise growth. So let’s look at 2006 – before the crash when Irish economic growth was strong.

Before the crash, Ireland was average. However, a very high level of these enterprise start-ups was, unsurprisingly, in the construction sector – over a third of Irish start-ups (34 percent). In the Other SOE, it was only 14 percent. When we exclude construction start-ups, Ireland again fell behind the average number of start-ups of the other European countries. This is further noteworthy since in Ireland many of the start-ups outside the construction sector (retail, hospitality) would have been based on the unsustainable demand of the property boom. Even in a high-growth period, low-tax, low-wage Ireland under-performed.

Is there an automatic relationship between high taxes and wages, and enterprise start-ups? No. However, the article did make this provocative description of Norway:

‘Every Norwegian worker gets free health insurance . . . At age 67, workers get a (state) pension of up to 66 percent of their working income, and everyone gets free education, from nursery school through graduate school. (. . . this includes colleges outside the country. Want to send your kid to Harvard? The Norwegian government will pick up most of the tab.) Disability insurance and parental leave are also extremely generous. A new mother can take 46 weeks of maternity leave at full pay—the government, not the company, picks up the tab—or 56 weeks off at 80 percent of her normal wage. A father gets 10 weeks off at full pay.’

This can lead us to a provocative observation: enterprise flourishes in societies marked by high levels of social cohesion, social protection, strong public services and wages. In other words,equality and social cohesion are the necessary ingredients for enterprise development.

In my previous post, I looked at ‘the corporation’, how it was not ‘owned’ by the shareholders, how it could become a new commons – a social and collective space shared by all stakeholders. Now we can go further: a society that has a strong public realm and greater equality is more pro-enterprise.

So the next time you hear a business representative giving about taxes and spending and wages and the need for ‘flexibility’, you now know: they are not representing the interests of business or their members; they are just regurgitating passé ideology.

Progressives should now enter this debate – enter stage-left.

Leave a reply to Colin Walsh Cancel reply