Today, hundreds of Irish Life workers are taking industrial action against their employer – the beginning of a month long series of actions. At stake are three inter-related issues: the company’s attempt to impose a new pay-bargaining structure, the persistence of poverty pay at the company, and management’s unilateral attempts to decide which employees it will bargain with and which it won’t.

Today, hundreds of Irish Life workers are taking industrial action against their employer – the beginning of a month long series of actions. At stake are three inter-related issues: the company’s attempt to impose a new pay-bargaining structure, the persistence of poverty pay at the company, and management’s unilateral attempts to decide which employees it will bargain with and which it won’t.

But this is more than just a dispute over pay and conditions. What is at stake is the employer’s attempt to make a fundamental break between pay and profits by pitting workers’ against each other – between companies and across sectors. It is about management's refusal to acknowledge the role that workers play in generating wealth.

A few weeks ago I wrote about how employees are considered a cost to an enterprise (We are Not a Cost) which drives an agenda of wage suppression. In that post I explained that basic national accounting categories view labour and capital as ‘equivalent’ – jointly creating value-added in a firm. In this categorisation labour is not a cost but a necessary input (imagine a firm trying to create value-added without labour). Wages are the compensation to workers paid out of value-added; similarly, profits are the compensation to owners likewise paid out of value-added.

Therefore, as value-added grows, workers bargain for their proportion of the growth they generated. Irish Life management wants to put an end to that.

The new pay structure (one which is gaining traction throughout the US and Europe) seeks to link wages in Company A to the average median wage that pertains in comparable Companies B, C, D and so on. Therefore, if workers in the other companies don’t get an increase, neither will workers in Company A – regardless of how profitable Company A is.

It gets worse. The comparator is not an objective set of figures such as the CSO produces. It is a secret and unverifiable dataset which is produced by salary data companies who are quite upfront about what they are up to – helping companies to make ‘savings’ on their payroll. The comparator is skewed from the outset.

The ‘genius’ of this approach (from a management perspective) is that with companies comparing their respective payrolls with each other, a vicious cycle of wage suppression or stagnation is created – as long as no company breaks the cycle by providing an increase. No wonder 70 percent of Irish Life employees do not expect a pay rise in the near future – because the new pay structure doesn’t allow for it.

This is not just about stacking the deck against wages, it also about stacking the deck for profits. Irish Life is now owned by Great West Life – a multinational assurance company based in Canada. And a highly profitable one at that.

With wages stagnating a growing share of value-added can be shifted towards profits – along with higher dividends for the shareholders and rising remuneration for senior executives (especially if remuneration is based on share value). In short, labour gets less and less of the wealth they have created.

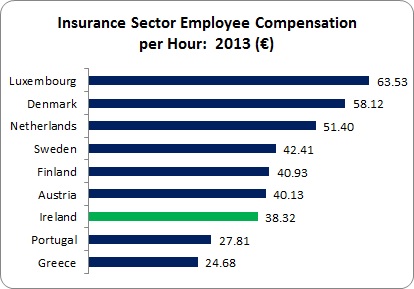

It’s not as if Irish employees are somehow overpaid. Compared to their European counterparts, Irish employee compensation in the insurance sector is below average.

Of the countries reporting, Irish compensation ranks only above the poorest countries in the EU-15 – Portugal and Greece. Of course, this is an average. This doesn’t reflect the pay scale of most employees in the sector – high executive pay can skewer these results. But they are indicative.

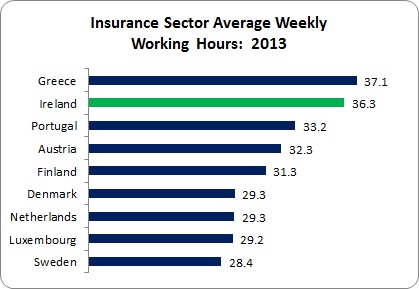

Not only are Irish employees in the insurance sector relatively low-paid compared to most other EU-15 countries, they work longer hours.

Irish insurance employees’ work longer hours than in most other EU-15 countries.

So lower-paid and working longer hours: It is this wage suppression that leads to poverty pay. While low-pay is usually associated with the retail and hospitality sectors, in the Irish Life call centre in Dundalk between 30 and 40 percent of employees are paid below the Living Wage.

However, Irish Life management, not satisfied with a pay structure that breaks the link between profits and wages – is now trying to break links within the workforce, between those workers with whom it will bargain with and those who they won’t. And the category of those employees with whom they are refusing to bargain with is growing (funny that).

You can see where this might all end. The pay of workers – which should be intrinsically linked to value-added (or, in another variant, productivity) – is being broken. Instead, in secret, wages will be compared with workers in other companies and sectors so that through a mutually reinforcing cycle, wages will be suppressed. Inflation won’t matter, profits won’t matter, affordability won’t matter. In short, workers won’t matter.

That this is occurring in Irish Life is particularly ironic. It was formed as a public enterprise company during the 1930s because the market for life assurance was small, in danger of insolvency and out of reach for most households. For the next few decades Irish Life grew to become a profitable leader in the market. It was one of the first companies to be privatised in the anti-public enterprise craze in the 1980s. It ended up back in public ownership when Permanent TSB came under public control during the banking crisis. Irish Life then had the dubious distinction of being privatised twice – when it was sold off again, this time to Great West Life.

And throughout all that, it was the employees who built up the stability and reputation of the company, under public and then private ownership. That’s why the employees’ slogan in this industrial action has the potential to strike a resonance:

'We are Irish Life'

This slogan challenges the idea that workers are a cost, a commodity to be bought at the lowest possible price. It defies a process that seeks to airbrush their input into the company out of existence. It lays equal claim to the collective activity that is a company – the collective process of wealth generation.

That’s why should support the workers in Irish Life. Their slogan – We are Irish Life – speaks for all of us in our own workplaces.

And imagine if that caught on.

* * *

You can follow the campaign at Supporting Irish Life Workers (and give it a like) at: https://www.facebook.com/SupportingIrishLifeWorkers/?fref=ts

And you can tweet your support at #WeKnowIrishLife

Leave a comment