They will be popping champagne corks in the mansions and manor houses throughout the country.

‘As resources become available we will progressively abolish the USC . . . ‘

Thus declared the Minister for Finance in his budget speech.

The Universal Social Charge is one of the best anti-avoidance taxes we have. The truly comfortable classes can drive a coach-and-four through income tax with all the reliefs, allowances and exemptions. But the USC? They can hire an army of accountants but it won’t do them much good. The USC attaches itself to gross wages with very few and mostly minor reliefs. But now the USC is on the endangered list – and the safari is on.

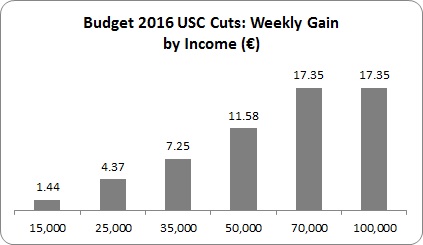

To get an idea of who will get the benefit of abolishing the USC (I’ve discussed the broader issue here), let’s take a quick look at the cuts in Budget 2016.

There are two points here.

- First, the gains to really low incomes are limited because they don’t pay much tax to start with. But let’s not forget that over 500,000 people earn below €15,000 (or 29 percent of all income-earners). About 20 percent are already exempt from USC so Budget 2016 changes don’t affect them.

- Second, a percentage cut will give higher nominal benefit to those on higher incomes – but the nominal benefit stops at €70,000 since that’s when the 8 percent tax kicks in.

To get a more robust reading of the redistributive impact of the USC cuts, let’s go to the ESRI who ran a simulation a few months ago, armed with data from the EU Survey of Income and Living Standards data. They found the following.

The biggest beneficiaries are the top 20 percent households (the ESRI measured a cut in the standard rate to 5.35 percent – so a slight difference but the ratios between the decile groups remain the same). On average, the top 20 percent households will get nearly twice the benefit as the ‘squeezed middle’.

And when they get around to abolishing the whole thing, the higher income groups will benefit more because the 8 percent top USC rate on incomes over €70,000 will be gone.

The kicker in all this is that the higher income groups are not only getting a big tax boost, this is on top of pay increases – larger than low and middle income groups. In the last year, managers and professionals saw their income rise by over €800; all other employees together experienced a loss.

Here’s another kicker: apart from pensioners, all other adults reliant on social protection (Jobseekers, lone parents, the sick and disabled, etc.) will find their income cut after inflation – and that’s including the Christmas Bonus.

The USC is labelled as the most ‘hated’ tax. By whom? Two reputable polling agencies showed that the majority of people – a significant majority – wanted additional resources put into social investment. That inconvenient finding is conveniently ignored.

It is understandable that people are aggrieved. Average personal tax rates increased by 25 percent during the recession through irrational austerity measures. At the same time real wages were falling, working hours were reduced, income supports (e.g. Child Benefit) were cut, and indirect taxes were increased. This grievance has coalesced around the USC which has become the totem for all this austerity irrationality. However, this didn’t happen by accident. The debate was hijacked by those who had the most to gain by the abolition of the USC – higher income groups.

An innovative government (another adjective: progressive) would take a different tack. It could, for instance, start integrating the USC into PRSI in order to build a stronger social insurance economy. From this, a number of benefits could be rolled out: pay-related unemployment and sickness benefit, stronger maternity benefits and family allowances, free health (GP and prescription medicine), etc. This would benefit low and average income earners through providing stronger income supports and public services which they rely on more than those on higher income groups.

Or that innovative, progressive government could go further – and scrap the income tax system with its plethora of reliefs, allowances and exemptions, and substitute a stronger USC system with more graduated rates to increase progressivity. The benefit of this approach is that you can raise more revenue with lower marginal rates. That’s what can happen when extend the tax base to all income and end the activities of the tax avoidance industry.

This can still happen. But if this government is re-elected, it is clear that abolition of that most effective anti-avoidance tax – the USC – is front and centre.

And if they are re-elected, we’ll no doubt hear more champagne corks popping. Pass the Dom Perignon.

Leave a reply to Sam Hamill Cancel reply