Last night on Prime Time Brendan Burgess, from Ask About Money, stated that high-income earners in Ireland pay more tax than high earners in other countries.

‘We have a very low direct tax economy in this country for the lower and the middle paid and very high taxes for the upper paid. And that’s something people don’t appreciate. And they need to appreciate that.’

Let’s do some appreciation. Are we a ‘very low’ direct tax economy? Direct, or personal, taxes include income taxes, social insurance (PRSI) and other taxes on income such as Ireland’s Universal Social Charge or Germany’s surtax.

We are low-tax, well below a lot of other countries. But we are not that far behind the EU-15 weighted average, not that far behind ‘high-tax’ Sweden and ahead of another ‘high-tax’ economy, France. So I don’t know that I would call it ‘very low’ but we certainly should be doing better.

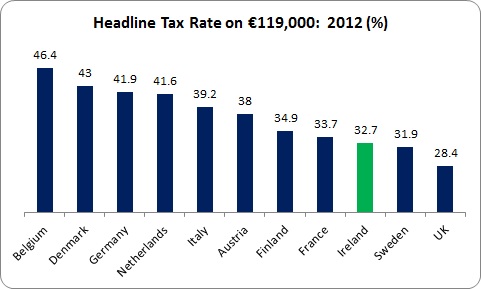

But what about that ‘very high taxes for the upper paid’? We don’t have ‘effective’ tax rates for different income groups to compare (that is, the tax rate when all reliefs and deductions are taken into account). We only have ‘headline’ tax rates – which only include basic reliefs like personal tax credits. But the following headline tax rates come from the OECD Benefit and Wages database. The highest level of income for Ireland in the database is €119,000 (a couple, both working) so I’ll use that to compare with the same level of income in other countries.

Headline tax rates on Irish high-earners are well below most other countries. If they were living in Germany they’d be paying €11,000 more in income taxes and social insurance.

There is caveat in this. In Ireland, taxpayers get relief on pension contributions, mortgage interest, health insurance and a rake of business investments. Do taxpayers have access to the same level of reliefs and allowances? More? Less? We don’t have easily accessible comparable data. (Also, the tax rate for Italy in the above chart is for €107,000 – the highest level of income in the OECD database).

However, when looking at headline rate, Irish high-earners are not over-taxed in comparative terms.

And there are some further explanations needed (the type of explanations that rarely get a hearing on current affairs programmes). Take the example of Sweden. The chart above shows Swedish headline rates lower than Ireland. In the first total direct taxation chart, Sweden is only slightly above Ireland. Some might find this surprising since we all think of Sweden as high-taxed.

The fact is that direction taxation on Swedish employees are relative modest (though there are high consumer taxes such as VAT). It is high-tax because of the huge (and I mean huge) contribution from employers. For instance – on incomes of €119,000:

- Irish employers would pay €12,800.

- Swedish employers would pay €37,400.

It is a similar story with France, where employers could pay nearly €48,000 In fact, Swedish and French employers pay more in social insurance than employees pay in direct taxation. In Ireland employers’ pay only 34 percent of the amount paid by employees.

High employers social insurance contributions in these countries effectively subsidise lower rates on employees – while at the same time paying for a range of services that we don’t have (free health care, subsidised prescription medicine, a range of benefits (pensions, unemployment, sick-pay) that are pay-related, subsidised childcare, etc.).

We are comparable to the UK but even here there is a catch. The above table refers to taxes on income. But in the UK, there is a very high level of property tax (Council tax). Take the example of the two high-earners in Ireland and the UK, owning a house valued at €600,000 (or £487,000 in the UK). What are their levels of property taxes?

- In Ireland: €1,080

- In the UK: €3,100

The UK figure is for Islington Council. There will be variations depending on the Council but the level of Council tax will be much, much higher than our property tax. When this is factored in, the gap between Irish and UK levels of tax narrows considerably. (As an aside, I don’t know why we feel compelled to compare ourselves with a country with high levels of poverty and inequality, low wages and low productivity).

To conclude, Irish high-earners are not overly taxed – nowhere near it. When it comes to direct taxes, we are a low-taxed economy for all income groups. There is a need to take a cold, hard look at how we organise our taxation system – in particular, looking at the ultra-low level of contributions from employers. We need a long-term strategy instead of knee-jerk, regressive calls for tax cuts.

Most of all, we could do with fewer assertions on current affairs programmes that fly in the face of facts. But maybe that’s a wish too far.

Leave a reply to The Dork of Cork Cancel reply