This is a guest post by Michael Burke. Michael works as an economic consultant. He was previously senior international economist with Citibank in London. He blogs regularly at Socialist Economic Bulletin. You can follow Michael at @menburke

Most people don’t care much about GDP (Gross Domestic Product) or most other acronyms that get bandied about on the economy. For good reason.

The purpose of economic policy is, or ought to be, about achieving the optimal sustainable improvement in living standards for the population. If businesses produce goods that no-one buys and they accumulate as unsold inventories, or if the buying power of businesses or households declines so that imports fall, both of these count as increases in GDP.

What really matters is if the economy and society as a whole is moving forwards, if people see an increase in their living standards and reasonably expect that the next generation or two will see the same.

In that light, the latest forecasts from the Central Bank of Ireland are not very encouraging. Sure, there is a forecast of 2.1% real GDP growth for the economy in 2014. But in terms of real wages, on average they will be zero as a projected 0.5% increase in wages is effectively wiped out by the anticipated level of inflation. Government current spending is also expected to fall in 2014 more than it did in 2013, so living standards for most people will actually decline again.

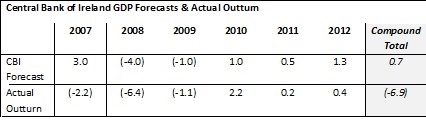

It has to be said too that the Central Bank doesn’t have a great track record when it comes to forecasts. At the same time last year it expected GDP growth to be 1.3% but now it estimates it was just 0.4%. These aren’t massive differences, and everyone is entitled to forecast error. But the cumulative effect of the central bank’s forecasts is quite stark. The table below shows how the CBI’s forecasts (made in January/February each year) have differed from the outturn in the same year.

Source: CBI Q1 Quarterly Bulletins/Economic Commentaries

If the CBI’s forecasts once again are an overestimate, then the likelihood is that real wages will actually fall once more and the effect of government cuts might be felt even more sharply.

How Can We Grow & Be Better Off?

Quite reasonably most people are also a bit fed up of being told how bad things are- they want some good news, or at least a plan for improving matters. Yet even on the CBI’s rosy forecasts it ought to be clear that current policies aren’t working to grow the economy, let alone improve living standards.

In addition, the commentary in its latest forecast is very revealing. Without getting bogged down in technical detail the CBI argues that:

- We shouldn’t pay too much attention to the ‘patent cliff’ of pharmaceutical companies based in Ireland as it doesn’t really affect real output or employment in Ireland

- Ditto activities in the IFSC

- Disregard investment data as these are distorted by aircraft orders, which don’t really happen in Ireland, or affect output or employment

- The CBI doesn’t say it but the same could be said of ‘computer services’ in Ireland. Yet with Dell announcing a redundancy programme this sector is heading in that direction

It is officially recognised that there is an awful lot of fake activity taking place in Ireland. The challenge is to make it real, with high skilled jobs, real output and rising living standards. How can that be done?

Thankfully, while much of Europe (including Britain) is increasingly insular, nostalgic and hostile to both outsiders and change, that is not the case in Ireland. We are willing to learn from other’s success.

To take just one example, there is a lot of financial and legal expertise in Ireland related to aircraft leasing. But there is almost no aircraft warehousing, repair, maintenance or construction. Singapore used to be in the same position. But it transformed its industry so that all of those now take place domestically and it claims to be the world’s leading hub for this sector. It is certainly a leader in Asia.

That position remains unfilled in Europe and Ireland has a skills advantage. But to capitalise on that requires investment – in hangars, machinery, people and transport networks on a very large scale. The private sector won’t do it on its own; they didn’t in Singapore. It was investment led by the government which transformed the industry.

A similar approach could be adopted with computer services, finance, pharma, etc. If large multinationals are here, or pretending to be here for tax purposes, why not invest so that they and Irish companies actually initiate production here? The same could be said of medical products, education, creative industries such as film and TV, etc.

I know, I know, I know. There’s no money left. But Singapore got loans from international agencies (and their European equivalents are awash with cash), the government borrowed money for investment, they taxed companies (at a far higher rate than Ireland at 17%), and gave tax concessions for genuine productive investment. There is a very large return on this government-led investment.

In fact it is one of the great myths that the Asian Tiger economies are low-tax, small government ones. The role of government has been increasing all through the Tiger years, unlike the fake Celtic Tiger. It also happens that corporate tax rates are generally higher in fast-growing Asia than in moribund Europe.

What’s in place now is a miserable deficit-reduction strategy which isn’t getting very far (see Table 8 of the latest CBI Quarterly Bulletin- the current government deficit rose last year).

Instead, how about a strategy for growth?

Leave a comment