The Government will soon be issuing a consultation paper on

the forthcoming Broadcasting Charge to be levied on all households. This is intended to replace the television

license fee and will be applicable regardless of whether a household has a

television. The rationale for this move

is that people access television content via other devices such as tables and

smartphones.

There will be a number of issues debated, notably the funding

of other media outlets besides RTE (though it should be noted that already 7

percent of the license fee revenue goes to the BCI Broadcasting Fund for projects

of a public service nature produced by independent producers and broadcasters).

Minister Pat Rabbitte has given a commitment that the charge

will not exceed the current television fee of €160. Given that there is near universal television

ownership, the move to a household-based, rather than a television-based charge

is not unreasonable. According to the CSO’s

Household Budget Survey, over 97 percent of households own a television,

with 65 percent owning two TV sets or more.

If one accepts that a television is a necessity – not only

for communication but recreation as well; if one accepts that public service

broadcasting is a ‘public good’; then even the television license fee could be

considered a tax by any other name. The Broadcasting

Charge will confirm that – all households will be required to pay it.

I suspect that the Government will introduce a flat-rate

charge at the current level of the TV license fee. This would effectively mean no change for households. But

is there an alternative means to finance the broadcasting charge – one that is

more socially equitable and economically efficient?

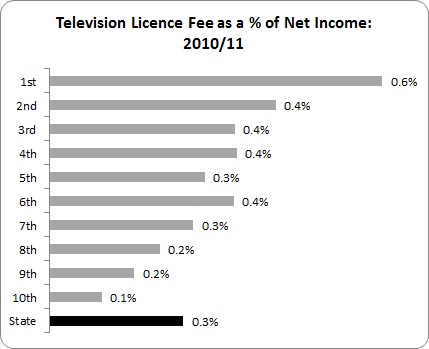

First, let’s look at the distributional impact of the

television fee – that is, how it impacts on particular households by income

group. The following examines the

license fee as a percentage of net disposable income broken down by deciles.

Unsurprisingly, the license fee is regressive – impacting more

harshly on low-income groups. For the

lowest income groups, the license fee takes up over 0.6 percent of net income;

for the highest income group it makes up only 0.1 percent of net income. The national average is approximately 0.3

percent.

This is to be expected.

Any flat-rate charge, fee or levy is going to be regressive. Of course, not every tax or charge need be,

or can be, progressive. VAT, for

instance, is highly regressive but it raises over €10 billion a year. Instead, one has to look at the overall

impact of the taxation system.

However, where possible, we should minimise the extent of

regressive charges and levies. And the

new broadcasting charge is an opportunity to do so. Why not levy income – all income: work income, social protection, capital

income (i.e. capital gains, inheritances, etc.). Since everyone will be charged why not attach

it to the ability to pay?

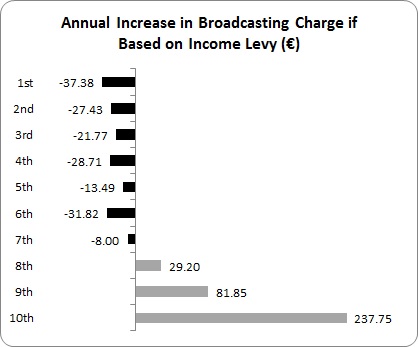

On average, households pay 0.26 percent of net income on the

television license. What would happen if

we turned the flat-rate charge of €160 per household into a 0.26 percent levy

on all income?

As seen, the majority of households would benefit. Higher income households, in particular the

top 10 percent, would experience an increase in the charge.

The social equity benefit is obvious but there is also an

argument in economic efficiency. The

benefit to the lower households would no doubt result in higher consumer spending

which would boost domestic demand, while the higher impact on the top income

deciles would mostly result in reduced savings.

While the amounts per household are small, if you multiply that by over

1,000,000 million households, the benefit mounts.

There may be administrative obstacles to implement an

income-based levy, though for in-work income, including capital income, the

Revenue Commissioners could collect it on an agency basis. The levy could be deducted at source by the

Social Protection department, though there may be legal issues that would have

to be addressed. Even with deduction at

source, social protection recipients would experience considerable gain. For instance, a lone parent household with

two children currently pays €160 for the television license; under the above proposal

the cost would fall to less than €42.

There would be additional benefits. First, it would greatly reduce avoidance

(which the Minister puts at 20 percent).

Second, as incomes rise, the revenue from the charge would rise

automatically. This extra revenue could

be invested in non-RTE supports for community and non-profit media outlets

including on-line, in order to develop alternatives to commercial and oligopolistic

media.

This is only a small intervention. But social equity and economic efficiency is

about a multitude of small interventions as much as it is about major policy

departures. Certainly the proliferation

of charges impacts most on low-income groups:

bin charges, the upcoming water charges.

So wherever we can convert a charge or levy into a more progressive

structure we should.

In time the small benefits would mount up.

Leave a comment