Public sector pensions – is there any three-word formulation

more likely to angry up the blood? Not

likely (except, maybe, ‘public sector pay’). Mention public sector pensions in polite

company and animal sounds will be heard.

We are constantly told that we can’t afford public sector pensions, they

are a burden on the taxpayer (the private sector taxpayer, the public ones

don’t count as they will become a burden when they retire), that they will in a

few years sink the economy. Listening to

the debate, you’d think it was public sector pensioners that caused the fiscal

and economic crisis, sank the banks and forced us into a bailout.

But a few facts that are emerging suggest otherwise (a few

facts are always a healthy tonic to unsubstantiated assertions). WorldByStorm over at Cedar Lounge Revolution pointed

to the Sunday Business Post article based on documents obtained under the Freedom

of Information legislation:

‘A quarter of public service pensioners receive a pension of

only €5,000 annually, according to government documents [and] almost half of all public service pensioners

get a pension of about €10,000 or €11,000 annually.’

25 percent received a pension of only €5,000? Almost half on €11,000 or less? Can this be true? And, if so, where does that leave the ‘public-sector-pensions-are-ruining-us-school’?

Well, yes, it can be true.

The latest Analysis

of Exchequer Pay and Pensions Bill shows that the average public sector

pension is €20,800 a year. It should be

noted that much of this includes payments for spouses. Further, many recipients do not receive a social

insurance top-up pension.

Of course, this doesn’t cost the state an average €20,800

per year. Some of this will be returned

via the tax system. Further, the pension

income is returned to the economy in spending, resulting in greater economic

activity and consumption tax revenues.

This doesn’t deter the great campaigners. Eddie Hobbes on Prime Time railed against the

cost public sector pensions. He

claimed he didn’t want to go after low and average income pensioners, only the

ones at the top, However, when it was pointed out that cutting

pensions at the top would save very little money, Hobbes avoided the

question. So much for the great

campaigners against public sector pensions.

I have not yet been able to find a full income distribution

breakdown of public sector pensions (more time spent on the wonderful

KildareStreet.com might elicit this).

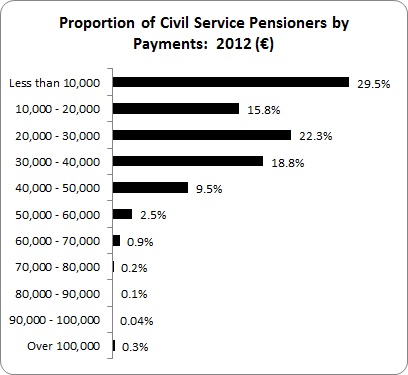

However, I did find a breakdown for civil service pensions. This doesn’t include health, education and

local authorities.

- 45 percent of retired civil service employees receive a

weekly pension of €385 or less (or an annual €20,000). 68 percent receive a pension of €577 per week

or less.

- On the other hand, only 4 percent receive pensions of over

€50,000 and only 76 civil servants received a pension of over €100,000 (0.3 percent).

The average civil service pension is approximately €22,800

so this is probably a good proxy for the remainder of the public sector.

So what would happen if we started taking a slash-hook to

public sector pensions? How much money

would it save? A series of cuts was put

to the Minister:

- €12,000 or less:

exempt - €12,000 – €24,000: 6

percent reduction - €24,000 – €60,000: 9

percent reduction - €60,000 – €80,000: 20

percent reduction - €80,000 to €100,000:

50 percent reduction - Over €100,000: upwards

of 100 percent reduction

How much would this save?

According to the Minister it would come to €10 million. And, correctly, he further stated this would

be reduced by lost taxation. I was

surprised at how small this amount is but one reason is that so many public

sector workers have pensions of less than €11,000 (nearly half).

So we get a lot of smoke on this issue but few facts. We have people attacking public sector

pensions but, in truth, they are attacking retired people on very small

pensions. We have unsubstantiated

claims, and scare-mongering.

Just what we’ve come to expect from what can be loosely

called ‘the national debate over the economic crises’.

Leave a reply to Orla Cancel reply