With considerable speculation about an impending deal on bank

debt, with the Taoiseach and the German Chancellor jointly stating that Ireland

is a ‘special case’, it is helpful to remind ourselves just how special a case we

are.

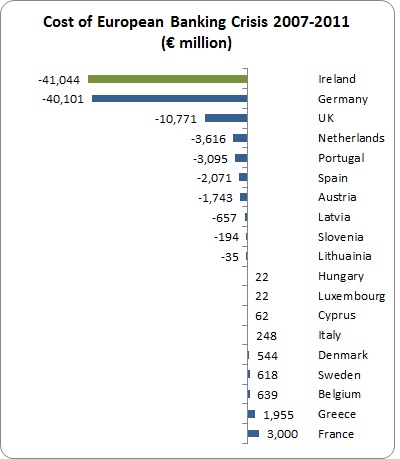

Eurostat, the EU Commission’s data agency has calculated the

cost of the banking crisis in each EU country. The following focuses on the cost to general

government budgets. Ireland has really

taken one for Team EU.

Yes, there’s wee Ireland up at the top, just edging

out Germany for the dubious title of spending the most on the banking

crisis. €41 billion to date according to

the Eurostat accounting data (this doesn’t count the billions ploughed into the

covered banks from our National Pension Reserve Fund as this was not counted as

a ‘cost’ to the General Government budget).

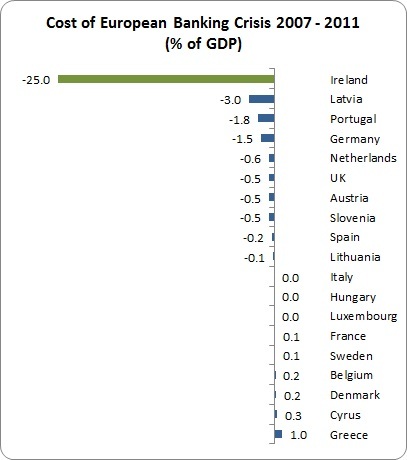

Of course, this doesn’t give the best picture. What happens when we look at the cost as a

percentage of GDP?

Ireland may not win football’s European Championship but

when it comes to banking debt we are Barcelona, Bayern Munich and Manchester

United all rolled into one with Real Madrid for a bench. Germany may have run Ireland close in the

nominal amount of banking debt but when it comes to a proportion of GDP, it is just

pennies behind their sofa. For Ireland, it’s the entire house.

Here’s another little stat to chew on. The European banking crisis is just that – a

European crisis. But as we know, this

has not been addressed at European level.

Rather, the cost has been delegated to individual countries regardless

of their size or ability to pay. For

instance:

- Ireland makes up 0.9 percent of the EU

population - The Irish economy makes up 1.2 percent of EU GDP

Ok, we’re small. So

how much of the entire European banking debt have we paid?

- The Irish

people have paid 42 percent of the total cost of the European banking crisis

We may be minnows when it comes to population and economic

size, but when it comes to banking debt we are the whale in the pond.

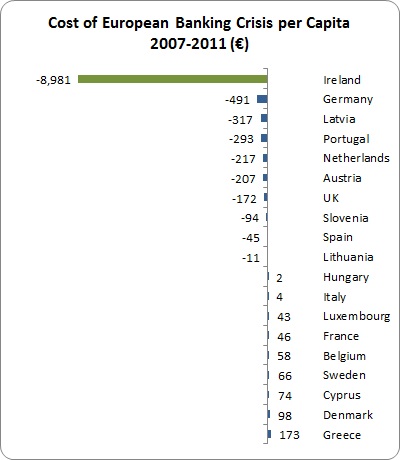

One more breakdown.

How much have countries paid per capita?

The European banking crisis to date has cost every

individual in Ireland nearly €9,000 each.

The average throughout the EU is €192 per capita. I really don’t know what you can say after

that.

So, Ireland is a really, really special case. We require a really, really special

solution. The Government (and we must

always remember that this mess wasn’t created on their watch) has a real

challenge in the negotiations over bank debt.

But there is a bottom-line here.

If any deal does not qualitatively alter these dismal

statistics, then it won’t be a deal worth applauding. The Government may be tempted to

return to the Irish people waving a sheet of paper claiming ‘a bank debt deal for our

time’.

But if are still paying nearly €9,000 each while the

remainder of the EU pays only a fraction of that, then it is no deal at all;

just a re-arranging of Euro notes – a lot of Euro notes – on the decks of a sunken

ship.

Leave a reply to CMK Cancel reply