In defending Budget 2013 Labour has argued that it contained

€500 million in a ‘wealth tax package’ or revenue from taxation on high income

groups. This, goes the argument, is

evidence of Labour’s influence on the budget – revenue that would be missing

were Labour not in Government. So what

are the measures that add up to €500 million?

And is this sum robust?

First, we have a problem with labelling. While some Labour TDs have called this a ‘wealth’

package, the only tax on wealth (defined as an asset) is the property tax. However, they do not refer to this and with

good reason – the property tax will attract revenue from high income

groups. So Labour is not referring to

tax on wealth but rather on personal or capital income.

The list that Labour has been putting forth includes: a mansion tax on properties worth over €1

million (this is a small tax on wealth), an increase in the USC on high-income pensions,

extending PRSI to trade and unearned income, reducing tax reliefs for large

pension pots, an increase in Capital Gains tax, Capital Acquisitions tax and

Deposit Interest Retention Tax (DIRT), etc.

So does all this add up to €500 million?

Let’s look at the measures that will be introduced in Budget

2013.

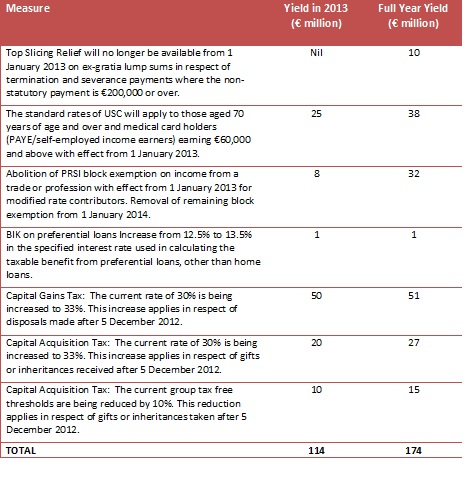

In the above measures we find that €114 million will be

raised in 2013 with a full year yield of €174 million – though this latter

figure is slightly inflated by an extension of the PRSI base on to unearned

income that won’t be introduced until 2014.

This seems a long ways away from the €500 million package

Labour has referred to. What else could

there be, that is not captured by the table above?

Deposit Interest

Retention Tax: This has been

referred to as a tax on high incomes and clearly high income groups are more

likely to hold more cash than the rest of us.

However, low and modest income groups also have deposits. And the tax rate is somewhat quirky. If interest on deposits were included in the

income tax regime, low-modest income groups would pay only 20 percent while

those on the top rate would pay 41 percent.

As it is, low-average income groups pay more under DIRT and high-income

groups pay less. Nonetheless, let’s

allow this a tax on high-income groups, knowing that others will be caught.

Pre-retirement access

to funded Additional Voluntary Contributions: this is the provision that allows people to

draw down 30 percent of their AVC prior to retirement. This is intended to give a boost to consumer

spending (more on this in a later post).

Holders of AVCs would usually be higher income earners and if they pull

down this money they will be taxed at the marginal rate – for most this would

be 41 percent. However, this is not a

tax. If I don’t pull down my AVC, I face

no tax. In essence, the 41 percent tax I

would pay is the price for being allowed to draw down the money. And if no one, or very few, draw this down,

there is no gain to the Exchequer. This

is not a tax and shouldn’t be included.

Changes to the

maximum allowable pension fund: this

refers to withdrawing relief from large-pension pots. This is a good step. The problem is that this is not part of

Budget 2013. This is intended to be

introduced in 2014. We have no details

of how this will be achieved or what the estimate of €250 million revenue is

based on. If we allowed this as part of

the calculation then we would have to spread the impact over two years which

would dilute the impact of the €500 million package. It’s not consistent to include this in the package

since it plays no part in Budget 2013.

‘Mansion Tax’: as compensation for not achieving an increase

in the USC on incomes over €100,000, Labour was able to get an increase in the

property tax of 0.25 percent on houses valued over €1 million (but only on the

portion that exceeds €1,000, 000). The

Minister has provided no estimate as to how much this will bring in. The Commission on Taxation, using 2004

valuation data, assumed that there were 3,000 houses valued at €1 million or

more. However, this was a guestimate and

was not grounded in any data. But

assuming 3,000 houses in this category, and an average value of €2 million, the

mansion tax would raise approximately €7.5 million. Let’s include that.

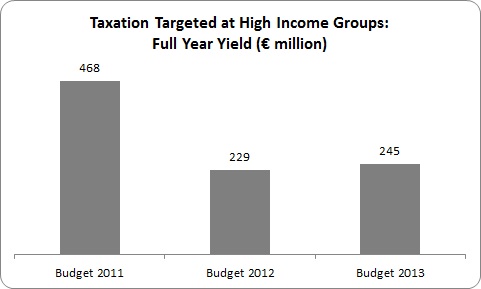

Now we have a sum of €168 million in 2013 and €245 million. One could make an estimate of property tax

revenue from high-income groups that don’t have houses valued at €1 million or

more, but even if we could agree the assumptions, the sum would only push up

this total by a relatively small amount.

How does this compare to the previous two budgets?

In last year’s budget, €229 million was raised from taxes

targeted primarily at high-income groups.

The big items were changes to capital income and DIRT.

In Budget 2011, Fianna Fail’s farewell budget, nearly €470

million was taken from primarily high-income groups. The big items were the abolition of the PRSI

ceiling for incomes above €75,000, restrictions on legacy property reliefs,

PRSI on pension contributions (this raised €60 million but, like DIRT, would have

hit some average incomes), other pension contribution changes, DIRT and capital

income. Of course, this was also a

budget which hit low-income earners through cuts in personal tax credits (much

like the current abolition of weekly PRSI allowance) and the Universal Social

Charge.

So Budget 2013 is not much different than last year and is

yielding less than Budget 2011 when it comes to targeting high-income groups.

Of course, some may insist on adding the €250 million in

changes to the pension pots which was announced Wednesday but won’t be

implemented until 2014 – and in a way we don’t know yet. But that would only be taking the

progressivity from the 2014 budget and inserting in this one artificially. To my mind, let Budget 2014 speak for itself

and hope that Labour can build on it.

It is hard to see where Labour’s ‘€500 million wealth tax

package’ is coming from, But in one

sense I doubt that it will have much political impact. It will be little solace to low-paid PAYE

workers affected by the PRSI changes, or medical card holders facing a trebling

of prescription charges, or parents seeing their Child Benefit cut – little solace

to be told that x amount of money is being levied on high income groups. For one is concrete – the impact on one’s own

household where the increase is almost, if not fully, unaffordable; the other

is abstract or, at least, distant – the impact on a household that can afford

it anyway.

For therein lies the problem that Labour faces. I have no doubt that this is not the budget

that Labour backbenchers would have introduced. Using inflated or highly contestable figures

to counter what is a regressive budget will not diminish the cuts and

regressive taxes. The cold political

reality, being in government with a larger party that does not share its

values, is that they may have to vote for budget not of their making.

‘May’ being the operative word.

Leave a reply to Colum McCaffery Cancel reply