We are constantly assured (warned) that ‘everything is on

the table’. All manner of tax increases

and spending cuts are being considered, and none are ruled out in principle. So, goes the script. There is one issue,

however, that is not on the table. It is

not even in the room. It is not even in the

house or lurking around the grounds. And

that issue is the corporate tax rate. Why?

If we increased the corporate tax rate, this would undermine

our ability to attract foreign direct investment. This, in turn, would result in fewer jobs

being created and put current jobs at risk; further, it would lower exports

which would skewer our balance of payments.

All that value-added and economic activity would be jeopardised.

Before we confront this argument, let’s first look at how

successful multi-nationals (MNCs) are in racking up profits in Ireland (also, this

analysis from Michael Burke is also worth a read). From this, we might get a sense of how

sensitive they would be to an increase in the corporate tax rate. For, in truth,

they

are really really racking up the profits.

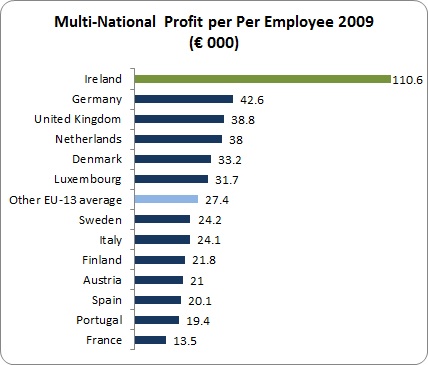

Ireland is not just a league-leader, it is off the

chart. MNCs here make more than four

times the profit per employees than the average of the other EU-15 countries

reporting (no data for Belgium or Greece). No wonder more and more multi-nationals

are making Ireland their home. It should

be noted that this Eurostat data does not include the financial sector so the

massive profits being made in the IFSC are not included. Nor does the above include taxation – we’ll

come to this later.

Not only are MNC profits high in Ireland, they are

resilient. 2009 was the year that saw

global profitability fall. But not in

Ireland. Whereas in 2009 profits fell in

the other EU-13 countries by an average of 17 percent, in Ireland they fell by

less than 1 percent.

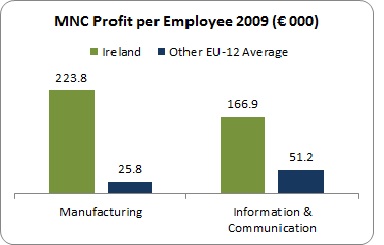

This is just the overview – let’s look at some key MNC

sectors in Ireland. In the Manufacturing

and Information & Communication sectors, Irish MNC profits are through the

roof.

In the Manufacturing sector, MNC profitability in Ireland is

nearly 10 times that of MNCs in other countries. In the Information & Communication, the

ratio is more than three-to-one.

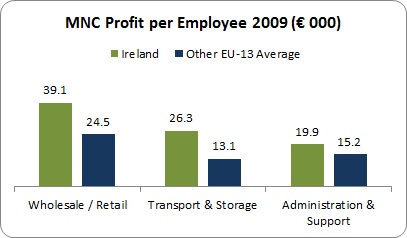

In other sectors, MNCs in Ireland also exceed the EU average

but not to the same degree.

In each of these sectors – particularly retail and transport

– MNC profits in Ireland significantly exceed the average of other countries.

Only in two sectors – the Professional & Scientific and

Accommodation – is MNC profit in Ireland lower than the average of other EU

countries. These two sectors, however,

are relatively small, making up less than 2 percent of the turnover of all MNCs

in Ireland.

Another insight is MNC by home country. US multi-nationals have a strong presence in

Ireland – making up nearly two-thirds of all MNC turnover in Ireland. American MNCs take €240,000

in profit per employee here in Ireland; in the other EU countries, they take

only €31,800. More interesting, despite

the global recession, American MNCs increased their profit per employee in 2009

by over 8 percent in Ireland. In other EU

countries, American MNCs suffered a loss of nearly 21 percent.

Another, albeit smaller category, is

MNCs owned by ‘offshore financial centres’ (OFCs). One would assume that these would be

primarily involved in the financial sector. But the data here refers to the non-financial

business sector. These OFCs are still

relatively small (making up only 3 percent of all MNC turnover in Ireland). But they are growing. In the dark days of 2009, OFCs saw their

turnover nearly double over 2008, with the number of OFCs operating in Ireland also

doubling. And no wonder: they take nearly €61,000 in profits per

employed in Ireland while in other countries this figure is nearly half –

€34,300.

Of course, there is an

Alice-in-Wonderland character to all these numbers. Profits, turnover, value-added – these are

all distorted by transfer pricing. MNCs

do not actually produce these levels of profit in Ireland – not all of them;

they ‘report’ a considerable level of profit here, taking advantage of transfer-pricing

in order to exploit our ultra-low corporate tax rates and the facility to

engage in global tax avoidance (which is why a US Senate Committee described

Ireland as a tax haven – see page 30).

But we should also take note: all of the above reports profits before

tax. If we had an after-tax figure, we’d

find the gap between MNCs in Ireland and the other EU countries grow even

wider. For instance, Germany comes

second when it comes to MNC profit per employee at €42,600. On that they pay a headline corporate tax

rate of 30 percent. In Ireland, with

MNCs taking €110,600 per employee, the headline rate is 12.5 percent. Yes, the effective tax rate (after reliefs

and allowances) will be lower – but it will be lower for both countries.

Profits

are rising in Ireland. They

increased by 4 percent in 2010 and 7 percent in 2011. According to the CSO, this is largely

accruing to multi-nationals.

So here is a question: if all things are on the budgetary table, why

is there no place for an increase in the corporate tax rate? This would not undermine pre-tax profits, and

even if it were raised by a mere 2.5 percent, it would still be lower – much

lower – than almost any other European country.

And here is another question: where in Europe, indeed the world, can MNCs

make as much profit as in Ireland even if the corporate tax rate were

increased?

So, why is the issue of the corporate

tax rate taboo? That’s an easy question

to answer: because it has

been elevated to almost metaphysical status. In the Dail the Taoiseach stated

piously:

‘The key elements of

the Jobs Initiative included: reaffirming, as the Minister for Finance repeated

yesterday, that our 12.5% corporate tax rate remains sacrosanct . . . ‘

To declare something sacrosanct is not an invitation to

debate. It is a threat. For to challenge the sacrosanct

is to engage in heresy, blasphemy, apostasy.

So suck it up. Cut

homecare help, bash low-paid workers (public and private), slash social

protection, close down services, tax average income earners even more. But don’t anyone dare mention the holy of

holies – the corporate tax rate.

As

Minister Creighton says – stop whingeing.

In each of these sectors – particularly retail and transport

– MNC profits in Ireland significantly exceed the average of other countries.

Only in two sectors – the Professional & Scientific and

Accommodation – is MNC profit in Ireland lower than the average of other EU

countries. These two sectors, however,

are relatively small, making up less than 2 percent of the turnover of all MNCs

in Ireland.

Another insight is MNC by home country. US multi-nationals have a strong presence in

Ireland – making up nearly two-thirds of all MNC turnover in Ireland. American MNCs take €240,000

in profit per employee here in Ireland; in the other EU countries, they take

only €31,800. More interesting, despite

the global recession, American MNCs increased their profit per employee in 2009

by over 8 percent. In other EU

countries, American MNCs suffered a loss of nearly 21 percent.

Another, albeit smaller category, is

MNCs owned by ‘offshore financial centres’ (OFCs). One would assume that these would be

primarily involved in the financial sector. But the data here refers to the non-financial

business sector. These OFCs are still

relatively small (making up only 3 percent of all MNC turnover in Ireland). But they are growing. In the dark days of 2009, OFCs saw their

turnover nearly double over 2008, with the number of OFCs operating in Ireland also

doubling. And no wonder: they take nearly €61,000 in profits per

employed in Ireland while in other countries this figure is nearly half –

€34,300.

Of course, there is an

Alice-in-Wonderland character to all these numbers. Profits, turnover, value-added – these are

all distorted by transfer pricing. MNCs

do not actually produce these levels of profit in Ireland – not all of them;

they ‘report’ a considerable level of profit here, taking advantage of transfer-pricing

in order to exploit our ultra-low corporate tax rates and the facility to

engage in global tax avoidance (which is why a US Senate Committee described

Ireland as a tax haven – see page 30).

But we should also take note: all of the above reports profits before

tax. If we had an after-tax figure, we’d

find the gap between MNCs in Ireland and the other EU countries grow even

wider. For instance, Germany comes

second when it comes to MNC profit per employee at €42,600. On that they pay a headline corporate tax

rate of 30 percent. In Ireland, with

MNCs taking €110,600 per employee, the headline rate is 12.5 percent. Yes, the effective tax rate (after reliefs

and allowances) will be lower – but it will be lower for both countries.

Profits

are rising in Ireland. They

increased by 4 percent in 2010 and 7 percent in 2011. According to the CSO, this is largely

accruing to multi-nationals.

So here is a question: if all things are on the budgetary table, why

is there no place for an increase in the corporate tax rate? This would not undermine pre-tax profits, and

even if it were raised by a mere 2.5 percent, it would still be lower – much

lower – than almost any other European country.

And here is another question: where in Europe, indeed the world, can MNCs

make as much profit as in Ireland even if the corporate tax rate were

increased?

So, why is the issue of the corporate

tax rate taboo? That’s an easy question

to answer: because it is no longer a

policy issue around which we can have a rational discussion. Rather, the corporate tax rate has

been elevated to almost metaphysical status.

The Taoiseach in the last budget stated

piously:

‘The key elements of

the Jobs Initiative included: reaffirming, as the Minister for Finance repeated

yesterday, that our 12.5% corporate tax rate remains sacrosanct . . . ‘

To declare something sacrosanct is not an invitation to

debate. It is an injunction not to

debate. For to challenge the sacrosanct

is to engage in heresy, blasphemy, apostasy.

So suck it up. Cut

homecare help, bash low-paid workers (public and private), slash social

protection, close down services, tax average income earners even more. But don’t anyone dare mention the holy of

holies – the corporate tax rate.

Leave a comment