What are to make of the CSO’s release of new GDP figures? The Irish Times claimed it showed the domestic economy growing for the first time in two years. The Independent claimed it put our targets at risk. Davy says don’t worry; the first quarter decline is not ‘too troubling’. Others have pointed out the first quarter slump is worse than in Spain and Italy. What are we to believe?

First, you can take figures contained in the CSO release and weave all sorts of stories. Second, instant media coverage demands instant analysis – analysis that might not bear up when the figures are subject to closer scrutiny or additional information comes to light. Third, it depends on your starting point.

The fact is that there are good numbers, bad numbers and curious numbers. And they come with all manner of caveats. Let’s go through some and see where we get.

First, for last year GDP rose by 1.4 percent, GNP fell by 2.5 percent along with domestic demand (excluding exports and imports) which fell by 3.7 percent. GDP rose after the CSO revised the last quarter of last year which showed growth (previously they estimated it fell). Last year GDP came in twice as high as the Government estimated. It further means that the economy did not fall into recession late last year as we didn’t register a decline in two successive quarters.

You can see how these few facts can be spun: good news – GDP grew more than expected and we avoided recession; bad news – domestic economy got hammered again and GDP includes multi-national accounting which muddies our national account waters.

Second, what about the first quarter of this year? Here is a big caveat: revisions come late and can be substantial. For instance, the final figures for the last quarter of last year showed a substantial revision. Three months ago (provisional estimate) showed a final quarter GDP decline of 0.2 percent. The CSO’s final estimate today shows a rise of 0.7 percent. That’s a big revision. What this means is that we won’t get the final estimate for the first quarter of this year until we are into the fourth quarter. This is a serious defect from an analysis and policy-making perspective.

But let’s run with the first quarter figures released today, noting that they can be revised. What have we got?

- Compared to the previous quarter (October-December last year), GDP fell by 1.1 percent, GNP fell by 1.3 percent but domestic demand actually rose by 1.5 percent. This latter figure was highlighted by the Finance Minister at his press conference today.

- Compared to the first quarter of last year, GDP rose by 1.4 percent, GNP rose by 0.5 percent but domestic demand fell by 1.3 percent.

So how would you write that story?

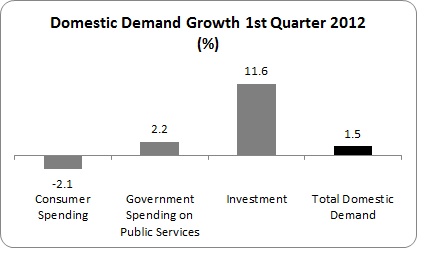

Let’s look at three interesting numbers. First, domestic demand – since this is something that many of us have been focusing on for some time. The quarterly increase should be good news but there are caveats.

Consumer spending, the largest category of domestic demand (it makes up two-thirds of domestic demand) fell. This is not surprising, given the VAT increase and recent Retail Sales Index numbers. Government spending on public services rose. This is surprising and will be reversed over the year as the Government intends to cut this category.

The investment is a real curiosity. Did businesses actually ramp up investment in this period? If so, this is good news for the future. But there are issues here – namely, the role of aircraft leasing. This is a big category and could distort the overall figure, if there was a substantial increase. In any event, it is hard to see investment maintaining this growth throughout the year. The Government is expecting an overall decline of 2.5 percent.

So we have a domestic demand figure which will be hard to maintain since government spending will fall, not increase, while investment may not sustain this growth. This is a wait-and-see indicator.

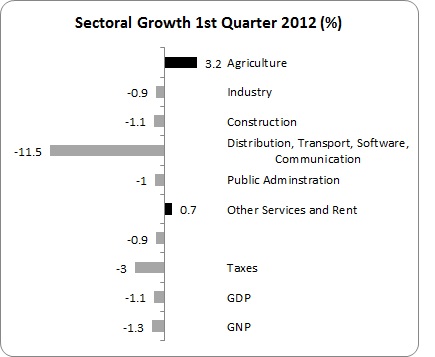

The second indicator is constant growth by sector.

All sectors, bar the small agricultural sector and other services sector (which is the largest and includes financial), fell. Still, construction fell by less of a pace than previously but industry fell after three quarters of consecutive growth. Most worrying is the fall of the Distribution, etc. sector – falling 11.5 percent. Were it not for growth in the large other services sector, GDP and GNP would be looking a lot worse. These trends will need to be monitored as it is the industry and distribution sectors which are big job providers.

Third, GNP is continuing to lag GDP. This is due to money flooding out of the economy – repatriated profits, interest on borrowing, etc. While quarterly movements can be volatile, a clear trend is emerging.

Given our outflows, it is getting more difficult to define the economy in terms of GDP, when we are left with so much less.

There is no conclusion here. There is no final wrap-up. The economy is still in flux with a number of indicators going in different directions – and many curious results which may become more explicable with further data.

But there are some indicators that things are not going so well. Good exports, retail sales, employment, wages, loans to households and non-financial companies – all have experienced falls in the last month and/or quarter.

In this period of flux, however, the Government is at least standing strong: they see nothing in recent data to suggest that their policies are not working, that austerity is still depressing domestic growth.

And that may be the worst news behind the CSO’s release.

Leave a comment