First there was Claiming our Future with its bold but common-sensical proposals to promote growth and equity in the economy. Now we have the Nevin Economic Research Institute (NERI) laying down a new fiscal framework to pursue such an alternative economic strategy. And it poses a real challenge to all progressives.

Some of us have just been working at the edges of the pond. For instance, some of us have argued for a freezing of current public expenditure at current levels up to 2015, substituting tax increases in place of spending cuts, and relying on an investment programme (mostly paid out of own resources) to increase our productive capacity in the medium-term. Of course, this approach accepts real cuts in the overall spending package (after inflation) but the argument is that savings on unemployment costs can be redirected into other areas of current spending. It still represents an expansionary fiscal platform, but a tight one.

NERI, however, runs past us all, jumps into the pond with both feet and starts splashing the water all around – including all over us. They, too, propose an expansionary programme but instead of freezing public spending, they want to increase it – increasing it to EU averages in the long-term. This would be combined with increasing government revenue to similar EU levels.

Let’s look at the differences – comparing Government projections, a ‘freeze-spending’ scenario, and NERI’s proposals. The following looks at overall spending minus interest payments – that is, primary expenditure.

As seen, while freezing spending would provide an additional €4.3 billion for current and capital spending above the Government’s projections, NERI’s proposals would provide an additional €9.8 billion. That’s a mighty sum.

The objections will be loud and voluminous – you’re adding to debt, you’re avoiding tough decisions (no one ever mentions avoiding bad decisions), you’re padding an already wasteful and inefficient public sector, etc. etc. and more etc.

But let’s briefly looks at some of the issues NERI’s proposals raise.

The first is whether you use GDP or GNP (or more properly GNI – which is GNP plus net EU payments) to measure spending. This is one of those bottom-less pit debates where consensus is almost impossible. I don’t intend to re-run the arguments here. However, it is worth noting that while Irish GDP per capita exceeds the EU-15 average, owing to the froth of multi-national accounting, Irish GNI per capita is about average. Average income, average spend – that’s NERI’s approach.

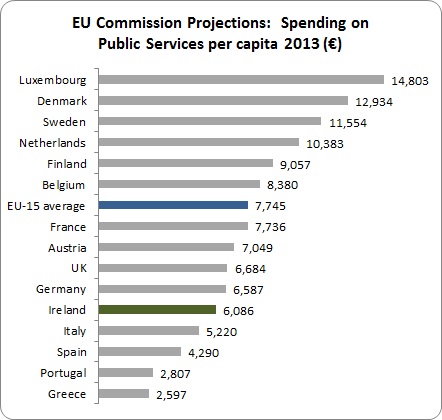

This suggests another approach to looking at expenditure. The following looks at Government spending on public services per capita. This is useful category given that overall spending can be skewered by pension expenditure in EU countries with a much older demographic.

Ireland would have to increase its spending on public services by €7.5 billion just to reach the average EU-levels. There’s doing more with less as the mantra goes; then there’s doing less with a lot less.

Second, NERI’s proposes to increase Government revenue to EU-15 averages. This would be a substantial sum. By 2017 it would mean €13 billion extra. I can hear a big gulp. But the important point here is that this doesn’t mean that this amount must be met by increasing current tax levels. Increasing growth and employment will make up a large part of this gap.

For instance, the Government intends to increase tax by €3 billion over the next three years. However, they project government revenue will increase by €7.5 billion. Growth will increase government revenue by nearly two-thirds; the fiscal adjustments will only account for a third. And that’s in a scenario where the Government is cutting investment and domestic demand. Imagine the increase in government revenue in a scenario where investment and domestic demand is increasing.

Third, the idea that public spending is a drain on public finances has been firmly established in the public debate by the austerity orthodoxy. NERI’s programme challenges this view.

For instance, the ESRI shows that increasing spending on public services by €1 billion (a combination of increased employment and wages) would mean an increase in the borrowing requirement of €580 million in the first year. Increasing income tax by €1 billion would reduce the borrowing requirement by €744 million. In other words, a straight one-for-one increase in income tax and spending on public services would result in a net reduction in the borrowing requirement.

This is not an argument that we can spend our way out of a recession. We can’t, we must invest. But it is an argument for a more sophisticated fiscal approach which uses a number of instruments in a carefully calibrated way. Increasing taxation beyond the economy’s capacity to absorb it (such as happened in the last few years) while increasing public spending without regard to productivity (which happened under Fianna Fail’s failed programme in the late 1970s) is a recipe for a real mess.

However, increased spending combined with similar increases in taxation can be a net boost to the economy and public finances. Imagine if we introduce a wealth tax and took the proceeds to roll-out an early childhood education network – that would be a boost in the short and long-term.

None of the above constitutes a ‘model’. There is still considerable work to be carried out. But there is considerable evidence to show that NERI’s programme would work, that Claiming our Future’s vision is achievable.

NERI has jumped into the pond and is splashing the water all around. I suggest we all follow suit. I have dipped my toe in. And the waters of an expansionary economic strategy are just fine.

Leave a comment