A lot of people are going to find it difficult in 2012, what with the economy returning to recession and all. But for one group, it will be business as usual: Anglo-Irish creditors. And that business will mean that they will be repaid in full.

Indeed, it’s already started. On Tuesday, a payment of €2.1 million was made to unsecured bondholders. Okay, its small beer compared to the billions Anglo is going to cost Irish people each year for the next two decades or so. Still, nice money for those who gambled on a seedy little bank back in the roller-coaster days (the bond was issued in January 2007).

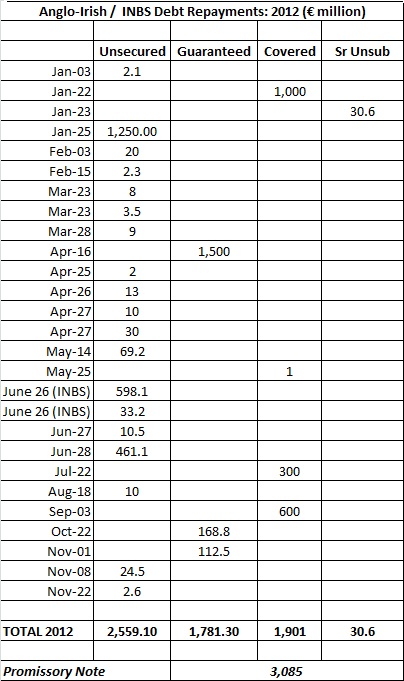

But that is only the beginning. Here is the schedule of repayments for Anglo and Irish Nationwide creditors in 2012, courtesy of Nama Wine Lake.

In 2012, Anglo/Irish Nationwide will be paying back €6.3 billion to its creditors – of which €2.6 billion is unsecured.

And then there’s next instalment in the never-ending Promissory Note story: €3.1 billion paid by the Government to Anglo to help them pay off their creditors.

Now, no one believes this is rational or equitable or justified. Even Government Ministers don’t believe it is. So what does it say for our politics that we are forced to continue a repayment regime for non-existent banks that could end up costing the state over €80 billion over the next 20 years even though no one on this island believes this is rational or equitable or justified? Not a lot.

So what can we do? Do something different, do a different politics, do what is rational and equitable and justified. Build the biggest possible coalition – labour and business, right and left-wings, young and old, PAYE and self-employed, Liverpool and Man United supporters – around one simple demand:

STOP MAKING THE PAYMENTS

Stop paying the unsecured bondholders, stop paying the promissory note. Stop this economic madness.

There’s not much time left. The next big payment is due on January 25th; a €1.25 billion payment to unsecured bondholders. The next big drawdown on public finances will take place at the end of March; the €3.1 billion promissory note. The very first step is to start telling people – through the social media, through the mainstream media, in the pubs and shops, getting on the rooftop and shouting it to our neighbours. The next step is to tell people that it doesn’t have to be.

It’s either that or we accept that 2012 will be the Year of Anglo.

Personally, I don’t want to live in that year.

* * *

NOTE: I refuse to refer to the Irish Banking Resolution Corporation – the amalgamation of Anglo-Irish and Irish Nationwide. Even the title ‘Resolution’ is an insult to our intelligence. I refuse to participate in this offensive make-over.

Leave a comment