Given that Ireland’s corporate tax rate is in the news, it is well to get a grip on some facts in the debate.

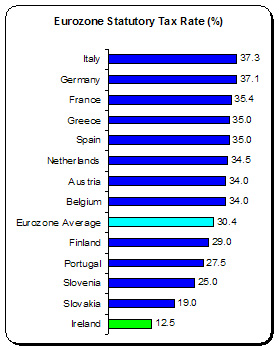

1. Ireland’s headline tax rate of 12.5 percent is the lowest in the Eurozone. At the higher end are It  Germany, France, Greece and Spain with statutory tax rates at 35 percent. Ireland comes in at the bottom. The average tax rate is 30.4 percent (data for Cyprus, Estonia, Malta and Luxembourg are not available).

Germany, France, Greece and Spain with statutory tax rates at 35 percent. Ireland comes in at the bottom. The average tax rate is 30.4 percent (data for Cyprus, Estonia, Malta and Luxembourg are not available).

So if there is a problem with race-to-the-bottom corporate tax rates – with countries slashing tax rates in order to woo multi-national investment – there is certainly a legitimate complaint against, what is called among certain Irish circles, our ‘competitive tax rate’.

However, statutory is one thing. What happens in the real can sometimes be different.

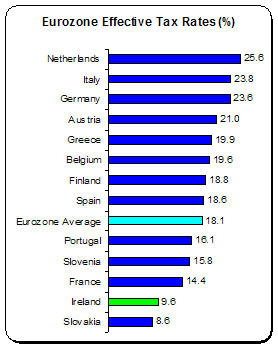

2. And when it comes to that ‘effective corporate tax rate’, things are different. Effective corporate tax, like effective income tax, is the rate which is paid once reliefs, allowances, exemptions and depreciation is taken into account. When this is done, what do tax rates look like?

The average corporate tax rates – over 30 percent statutory – falls to18 percent effective. Ireland is near the bottom but not at the bottom – that dubious prize goes to Slovakia. And who is next to Ireland?

France. Its falls from over 35 statutory percent to 14 percent effective – nearly a 50 percent fall. France is below the Eurozone average. France, like Ireland, is a low-corporate tax economy. Tsk Tsk.

France. Its falls from over 35 statutory percent to 14 percent effective – nearly a 50 percent fall. France is below the Eurozone average. France, like Ireland, is a low-corporate tax economy. Tsk Tsk.

This is not to defend Ireland’s low-tax status. It is both unsustainable and regressive; it is the ultimate admission of failure: having failed to build a strong indigenous enterprise base, we now have to prostrate ourselves before mobile international capital with our low-tax offerings.

But the fact is that throughout Europe, corporate tax rates have been falling for years. Using OECD data we find that the average statutory rate in the EU-15 fell from 35 percent in 2000 to 27 percent today. It is reasonable to assume effective tax rates fell accordingly. I doubt that Ireland was mentioned as a factor in the parliamentary debates that sanctioned these cuts in corporate tax rates. Rather, this is part of the general economic-race-to-the-bottom and a misplaced belief that low corporate tax rates are a precondition to enhancing business activity.

[NOTE: In any event, this debate isn’t about corporate tax rates. It’s about the Common Consolidated Corporate Tax Base and the ability of the Irish tax regime to hoover up profits generated in other economies. In this scenario, we can keep our low statutory tax rates but will have to give up generous transfer pricing policies. The pressure on this point could become irresistible].

We shouldn’t mind lectures from abroad about Ireland’s inequitable corporate tax rate. But it’s a bit rich coming from those Eurozone leaders and ministers who insist that European citizens bear the cross of private banking debt, that private capital be given free reign among public services, and that wages should be kept down and down to promote corporate profits whose tax rates are continually being cut. It’s not as if Ireland acting unilaterally on tax rates can do much to reverse this dismal trend globally. But a European power-house like France – that’s a different matter.

The next time Enda Kenny finds himself at a Eurozone meeting he should lead the fight-back against the race-to-the-bottom economics.

And the first person he should invite into that fight-back is the French President who promotes, and presides over, a low-corporate tax rate economy.

Leave a comment