A number of commentators have referred to the rejoicing of Fine Gael and Labour TDs (even if some were disappointed by Cabinet appointments or lack of). There is another constituency which can also be particularly pleased – the corporate and business sectors. They have been exempted from making any contribution to repairing the public finances or providing resources for badly needed economic and social investment.

This shouldn’t be too surprising – the role of this sector rarely featured in the election debate. Still, with all that talk about ‘burden-sharing’ and ‘sharing the pain’ and ‘everyone making a contribution’, there might have been some anxious nights among corporate executives. But not to worry, the Programme for Government has allayed all fears. It specifically commits the new government to:

- Keeping the corporate tax rate at 12.5%

- Maintaining the standard 10.75% rate of employers PRSI

Whatever about the tax rate – which is now such a sacred cow we must bring the best of our harvest as offerings – the reference to employers’ PRSI is curious. In any event, employers’ PRSI for part-time, low-paid workers is to be halved for the next two-and-a-half years.

The Irish corporate and business sector makes the least contribution to public finances than almost all their counterparts in other EU-15 countries. In the Eurozone in 2008, the combined receipts from the combined corporate tax rate and employers’ PRSI reached 10.6 percent of GDP; in Ireland it reached 6.2 percent. We’d have to raise the corporate/business contribution to public finance by billions just to reach the Eurozone average.

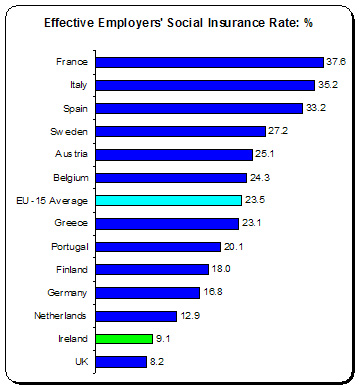

The employers’ PRSI rate, in particular, is low by EU standards. This is from a study that attempted to measure the effective rate of employers’ social insurance contributions. As can be seen, Ireland ranks at the bottom (with the UK, the two Anglo countries with the weakest social insurance systems). Irish employers’ PRSI would have to double to reach the EU average.

The employers’ PRSI rate, in particular, is low by EU standards. This is from a study that attempted to measure the effective rate of employers’ social insurance contributions. As can be seen, Ireland ranks at the bottom (with the UK, the two Anglo countries with the weakest social insurance systems). Irish employers’ PRSI would have to double to reach the EU average.

But anyone raising these points will be met with a tsunami of shock and horror. How can anyone propose imposing more costs on the business sector? This would harm competitiveness, lose jobs, drive enterprises into liquidation and spin the earth of its axis. Of course, this ignores the relative health of the corporate/business sector as a group (accepting that many businesses are under pressure – mostly from the austerity measures imposed by Government policy). For instance, Eurostat finds that in 2009:

- Profits (gross operating surplus) in Ireland made up 44.7 percent of GDP; in the EU-15 it was 37.9 percent.

- The share of profits in gross value-added in non-financial corporations was 51.5 percent in Ireland; in the Eurozone it was 37 percent.

So how can the Government get out of this commitment? By simply building on social insurance (it could also introduce a temporary corporate levy but that would take some courage). For instance, why shouldn’t employers’ pay half of the proposed mandatory health insurance packages? This might involve a new 2 percent social insurance levy for employers.

This would hardly affect our export competitiveness. According to the Forfas data, such a levy would amount to 0.2 percent of the turnover base of our manufacturing and internationally-traded services sector.

We’re going to have to start thinking brave thoughts, outside the box, taking on the dismal consensus and vested interest groups.

We’re going to have to start troubling the peaceful sleep of the corporate sector.

Leave a reply to Radler Cancel reply