During the campaign, Fine Gael accused Labour of being a high-tax party, based on some artful manipulation of numbers. The fact is that is there was little difference between the two parties over the amount of taxation they proposed to raise up to 2014 (Fine Gael proposed to raise €2.7 billion while Labour intended to raise €2.9 billion – and both of these were less than Fianna Fail’s target of €3 billion).

And therein lies the problem; for both parties signalled during the campaign that they would maintain the low-tax model. Indeed, it could turn out even more low-tax than it was before. This will put downward pressure on future spending on public services, investment and income support.

What are the comparisons with other EU states? Using the Fianna Fail tax projections (which both Government parties accepted during the campaign) we find the following: namely, that Irish taxation, as measured as a % of GDP, will continue to remain low and lag European norms.

What are the comparisons with other EU states? Using the Fianna Fail tax projections (which both Government parties accepted during the campaign) we find the following: namely, that Irish taxation, as measured as a % of GDP, will continue to remain low and lag European norms.

But we should bear in mind that by 2014 we will be making more interest payments. When we factor this in we can see how really low our new low-tax model will be. For instance, in 2007, Ireland had to raise 1.4 percent of GDP in taxes to make interest payments; in 2014 we will have to raise 5.5 percent of GDP in taxes to make interest payment. So when we remove the amount tax earmarked for interest payments, what do we have left?

The amount of tax available for public services, investment and income support falls considerably. And it should be borne in mind that by 2014 the state will have to absorb higher unemployment and related payments than prior to the recession (the EU Commission estimates that Irish unemployment will still be in double figures) and increased pensioner payments. This raises questions about how we are going to fund public services, investment and other income supports in addition to higher unemployment and pensioner expenditure.

The amount of tax available for public services, investment and income support falls considerably. And it should be borne in mind that by 2014 the state will have to absorb higher unemployment and related payments than prior to the recession (the EU Commission estimates that Irish unemployment will still be in double figures) and increased pensioner payments. This raises questions about how we are going to fund public services, investment and other income supports in addition to higher unemployment and pensioner expenditure.

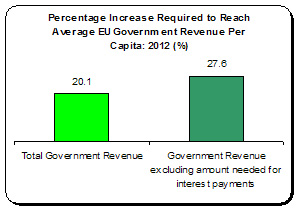

Of course, there is the perennial question of whether we should use GDP or GNP (or GNI) as the comparator. This debate can sometimes become scholastic. Let’s cut across this by examining a more precise measurement – Government revenue per capita in 2012 as projected by the EU Commission (for Ireland I use the Fianna Fail budgetary projections which will be adhered to by the new Government)

Ireland would have to raise Government revenue (primarily taxation) by over 20 percent just to reach the average EU tax revenue per capita. However, when we exclude interest payments – which allows us to focus on how much tax revenue is raised per capita for spending on public services, investment and income support – we find that Ireland would have to raise taxation by over 27 percent.

Ireland would have to raise Government revenue (primarily taxation) by over 20 percent just to reach the average EU tax revenue per capita. However, when we exclude interest payments – which allows us to focus on how much tax revenue is raised per capita for spending on public services, investment and income support – we find that Ireland would have to raise taxation by over 27 percent.

That’s how low tax is falling in our low-tax economy.

Unless the new Government has a radical re-think of policy post-2012, we will find ourselves raising less and less tax to cover public services, investment and income support, while falling further and further behind European norms.

Leave a reply to Michael Taft Cancel reply