It’s bad enough the debate has not asked the fundamental question of why, after a series of austerity budgets, the deficit did not fall, borrowing costs shot through the roof and growth rates were slashed. It’s as if none of this happened and the only way we can climb out of the fiscal crisis is to . . . pursue more austerity budgets.

Constantine Gurdgiev makes this argument over on his blog – that the cause of the burgeoning deficit is the increase in Government expenditure and not declining tax revenue. He grounds this argument in an exercise comparing current public expenditure to 2007 tax levels. From this he concludes:

‘ . . . between 2008 and 2010 the Government would have to cut expenditure by some €10.3 billion in order to bring fiscal balance to the receipts fixed annually at 85% of 2007 levels. And these are net cuts! Alternatively, only €13 billion of the total cumulative 2008-2010 deficits of €49.1 billion can be accounted for by a decline in tax revenue below equilibrium level. The rest, my friends, is due to over-spending…’

Welcome to the new austerity-denial school – commentators who claim that we really haven’t had austerity or only a little bit but, in any event, not enough. Let’s go through some of the numbers and see how this holds up.

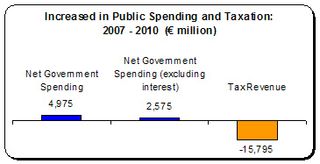

Between 2007 and 2010 we find that net Government spending has increased by less than €5 billion while tax revenue fell by nearly €16 billion. Over three-quarters of the deficit is due to falling tax revenue. However, there are important caveats.

Between 2007 and 2010 we find that net Government spending has increased by less than €5 billion while tax revenue fell by nearly €16 billion. Over three-quarters of the deficit is due to falling tax revenue. However, there are important caveats.

For instance, when one excludes interest payments, net public spending increased by only €2.6 billion, or 1.8 percent annually. Tax revenue, however, fell by 11.1 percent annually.

Second, there are many non-discretionary spending categories – and these are critical to understanding public spending patterns. Take pensioners: people get old and there’s little the Government can do about that (though, the Government is raising the retirement age in 2014 which will slow the rate of expenditure). State pension expenditure grew by 21 percent between 2007 and 2010 (or nearly €800 million). Even though the Government has cut these payments – abolishing the Christmas bonus – they will rise in any event.

The biggest growth category, apart from interest payments, has been unemployment payments. Jobseekers Benefits and Allowance has grown by an extraordinary three fold – or nearly €3 billion in the three years. And this is despite the Government’s extraordinary austerity measures. And this doesn’t count all unemployment-related expenditure: mortgage interest/ rent supplement, back-to-school payments, medical cards, etc. When one factors in all this – the non-pension/unemployment costs – public spending has actually fallen.

And then there’s the simple matter of demand. More people mean more demand on public services, expenditure and income support. Even with emigration, the population is estimated to increase by 3.6 percent between 2007 and 2010.

If we take public spending (excluding interest payments) per capita, we find that total public spending has increased by ½ percent annually for last the three years. Given the rise in unemployment and related payments, the extra demand on public and social services, the rise in old age demographics – we can hardly make a claim about ‘over-spending’.

In one calculation, Constantine assumes tax revenue in 2007 to be 85 percent of the actual intake – to account for the property-related tax bubble. Even if we do that, we’d find that the fall in tax revenue accounts for 63 percent of the deficit – 77 percent if we exclude interest payments. No matter how many games we play with this, the result is the same: it’s falling tax revenues, not rising spending.

There are many causes for falling tax revenue – the asset-bubble burst, the fall in employment and wages, and declining profits and consumer spending. And a major contributor has been the very austerity policies which some commentators are eager to downplay, ignore, if not outright deny.

We know this: if we continue with austerity policies, tax revenue will remain sluggish and the deficit will remain high. If we haven’t learned that from the last couple of years, then we have learned nothing.

Leave a comment