With more interest being expressed (finally, finally) in growth rates, what are the forecasters saying. Well, Ernst & Young forecasts have just been published and their numbers are bad. They are worse than bad. They are so bad you’d wonder how it could get any worse. And the problem is – they are not alone.

A number of commentators are now coming round to the view that deficit-reduction is highly dependent on growth rates. Without growth in economic activity, jobs, incomes there is little hope that we will ever get out of the Stabilisation Fund. But going by some of the latest projections, we will never get out of it.

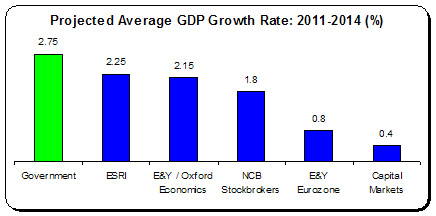

Even the most optimistic of the forecasters are coming in well below the Government’s projections.

And remember: the ESRI reminds us that if we stray too close to the 2 percent growth line we could end up in ‘prolonged deflation’ – a condition of chronic low-growth, high-unemployment and mounting debts.

Turning to GNP – our domestic economy which generates most of the tax revenue – there are fewer projections (international forecasters mostly concentrate on GDP). But those few still remain pessimistic regarding average GNP growth rates up to 2014.

- Government: 2.1 percent

- E&Y / Oxford Economics; 1.8 percent

- NCB Stockbrokers: 1.3 percent

Now here are two questions:

1. How can you repair public finances with growth rates fluctuating between 1 and 2 percent?

2. How can you generate sufficiently high growth rates to repair public finances while at the same time pursuing a fiscal policy that is deflating growth?

And here's the final question:

3. How can anyone believe that the current policy of cutting another €15 billion is anything other than an ideological obsession indifferent to how the real economy operates?

Leave a reply to Dave C Cancel reply