While a nation was parsing the Taoiseach’s metaphorical breathalyser results, the work of providing a clear alternative to his Government’s failed fiscal strategies continued apace. The Community Platform launched its 4Steps2Recovery campaign. It proposes a fiscal package of €3 billion of tax increases for the next budget – a package that would primarily impact on high-income groups. The campaign proposes to raise €3 billion through:

While a nation was parsing the Taoiseach’s metaphorical breathalyser results, the work of providing a clear alternative to his Government’s failed fiscal strategies continued apace. The Community Platform launched its 4Steps2Recovery campaign. It proposes a fiscal package of €3 billion of tax increases for the next budget – a package that would primarily impact on high-income groups. The campaign proposes to raise €3 billion through:

- A reduction of regressive tax expenditures (i.e. tax breaks, allowances, reliefs and exemptions)

- Introduction of a wealth tax (in reality, a genuine property tax)

- Base taxation on citizens rather than residence, thus targeting tax exiles

- Extending PRSI contributions, the Health and Income levies to all income above the relevant thresholds to all income, regardless of source

This, claims the group, would obviate the need for capital and current spending cuts and, so, be far more beneficial for the economy. Would it? Let’s run some numbers.

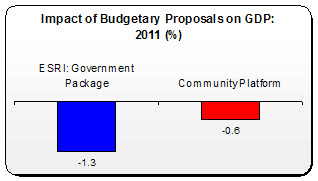

The ESRI modelled the Government’s proposed €3 billion budgetary package, though this was before it was announced that there would be more spending cuts. Nonetheless, it’s a good baseline. The ESRI concluded that the Government proposals would cut GDP growth by ‘approximately one percent’. To get a bit more exact, using the ESRI’s fiscal multipliers, I estimate GDP reduction to be -1.3 percent.

The consequence of this is obvious, as the ESRI makes clear:

'In addition, the level of employment is lower and emigration flows higher than in the absence of such a package. These are real costs attached to the programme of fiscal consolidation being pursued by the government.’

How does the Community Platform proposals compare? Because they drive fiscal consolidation entirely through taxation, the negative impact on GDP is less.

Whereas the Government’s original package will reduce GDP growth by -1.3 percent, the impact of the Community Platform’s proposals would only reduce growth by -0.6 percent. And even this probably over-states the negative.

Whereas the Government’s original package will reduce GDP growth by -1.3 percent, the impact of the Community Platform’s proposals would only reduce growth by -0.6 percent. And even this probably over-states the negative.

This is because the ESRI multipliers estimate the impact of tax increases on all taxpayers – including low and average income earners. However, the Community Platform’s proposals target high-income earners. A fall in their disposable income is less likely to impact on domestic demand than hitting lower-income earners. And by deflating the economy less, there will be fewer jobs lost as a result.

If we just stopped there, we would assess the impact of the Platform’s proposals to be superior to that of the Government’s. But there are further benefits inherent in the Platform’s programme.

For if the entire €3 billion ‘fiscal adjustment’ is driven by taxation, there is no need to cut capital spending by €1 billion as the Government proposes. Therefore, this cut can be restored. We can measure this by reference to the Lane-Benetrix multipliers. This data shows that restoring, or increasing, capital spending by €1 billion will increase GDP by nearly 0.8 percent of GDP.

This may not seem like much but in terms of job creation it will have a positive impact. According to the Department of Finance, an increase of €1 billion in capital spending will create between 8,000 and 12,000 jobs in the short-term. Of these, between 4,000 and 5,000 jobs will be permanent. Given that the ESRI, the Central Bank and FAS have all projected employment to fall next year, the Platform’s proposals will turn that negative growth into a positive one.

And there’s additional fiscal benefit to this job creation. 8,000 to 12,000 new jobs will boost tax revenue and consumer spending while reducing unemployment costs. Therefore, the Platform’s proposals are superior in terms of reducing the deficit.

Of course, this doesn’t solve the unemployment or the fiscal crisis – but the Platform isn’t claiming it will. But what it does claim – with considerable justification – is that its proposals will be more beneficial to the economy and even act as a stimulus.

There’s more to be done. We need to harness every resource for investment purposes – telecommunications, energy, green construction, school buildings, human resources. We need to remove the deflation out of the economy by starting to restore public spending cuts – public service cuts, social welfare cuts, cuts to purchases from the private sector, public sector wage cuts for the low paid.

But what the Platform has done is provide us with just that – a new platform to construct an alternative fiscal framework; one that could lead us out of the deflationary doldrums we’re stuck in and into something approximating growth and, eventually, prosperity.

Now that’s something we can all raise a glass to.

Leave a comment