Do not be confused. The Government’s recently announced increase in electricity prices through the Public Service Obligation levy (PSO) is a tax, pure and simple. And it’s a very bad tax.

Do not be confused. The Government’s recently announced increase in electricity prices through the Public Service Obligation levy (PSO) is a tax, pure and simple. And it’s a very bad tax.

The PSO levy subsidises electricity suppliers who are required to purchase electricity from renewable and peat-generated sources. This is because the costs of electricity from those sources are ‘uncompetitive’. In other words, the cost of electricity generated from these sources are higher than other sources and, if it was left to the ‘market’, no on would buy their high-priced product. The State requires suppliers to buy these products and, in return, they are compensated. The Commission on Energy Regulation has assessed that the cost of the subsidy is approximately €157 million.

In principle, there is nothing wrong with subsidising producers of renewable and peat-generated electricity. There are sound social, environmental and long-term economic reasons (which the market can’t accommodate) for subsidising these activities. The problem is the manner of the subsidy.

The state can do one of two things (or some variant):

- It can directly subsidise the producers of renewable and peat-generated electricity or the energy suppliers who are required to purchase that electricity out of general taxation

- It can impose a tax on all electricity consumers and distribute the proceeds to the producers or the suppliers.

The difference is key. In the first option, companies are directly subsidised from the Exchequer. This increases current expenditure which has to be met by increased general taxation, borrowing or cutting back on other spending. But it doesn’t affect the price.

In the second, a tax is levied on all consumers – in other words, the subsidy is paid through higher prices. But it doesn’t directly affect the Exchequer.

What the Government is doing transferring the cost of the subsidy from the Exchequer to the consumer and the wider economy through higher energy costs.

The levy is regressive. If the subsidy was paid out of general taxation, this would mean that, by and large, people with taxable incomes would pay (you could always impose a special levy on high incomes to pay for the €157 million but let’s not get all Leveler about this).

However, the levy will be paid by everyone, regardless of income or employment status – from the elderly pensioner living alone to high income households, from profitable companies to unprofitable companies. And this will be regressive as low-income households pay a higher proportion of their income on electricity than higher income households according to the latest CSO data.

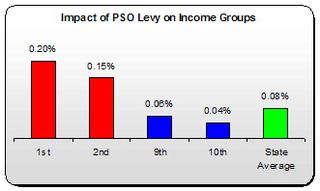

The lowest income households – the 1st and 2nd deciles – pay three to four times more of the disposable income on electricity than the highest or 10th decile, households. So it’s no surprise that a levy on electricity prices will be highly regressive. As I’m using numbers from the CSO 2005 survey the percentages will have changed but the ratios between low and high incomes will stay roughly the same.

The PSO levy will be regressive. It will impact on low-income households five times harder than on higher income groups. This is socially unjust.

The PSO levy will be regressive. It will impact on low-income households five times harder than on higher income groups. This is socially unjust.

It is also economically irrational. As pointed out in the previous post, domestic demand in the economy remains weak (‘anaemic’ is the word the ESRI used). The last thing – the very last thing – you do is to fleece low and average income earners who are more likely to spend. High income groups will easily absorb the minuscule impact on their incomes; those on lower incomes will compensate by reducing spending in other areas.

This is not an argument against public subsidy to renewable energy producers. If anything, there might be an argument for increasing that subsidy.

The problem is the way the subsidy is being delivered. What the government is doing will be bad for most households, it will be bad for the economy, it will be bad for those non-energy businesses who are reliant upon consumer spending, it will be bad for fuel poverty.

You couldn’t make this stuff up.

Leave a comment