In a previous post we saw that public sector labour costs are below-average by EU-15 standards. The argument that Irish public sector workers are ‘over-paid’ in relation to their European counterparts holds no water whatsoever. However, that doesn’t answer the charge that, regardless of comparative costs, we just have to cut public sector wages because of the fiscal crisis. No matter how unjust it might seem, public sector workers’ must suffer cuts in living standards so that we can bring the fiscal deficit under control by 2014.

In a previous post we saw that public sector labour costs are below-average by EU-15 standards. The argument that Irish public sector workers are ‘over-paid’ in relation to their European counterparts holds no water whatsoever. However, that doesn’t answer the charge that, regardless of comparative costs, we just have to cut public sector wages because of the fiscal crisis. No matter how unjust it might seem, public sector workers’ must suffer cuts in living standards so that we can bring the fiscal deficit under control by 2014.

The truth is that cutting the public sector payroll will have almost no effect on the fiscal deficits, while at the same time being economically damaging. Indeed, it might end up actually increasing the deficit burden. How does this work?

A simple, slide-rule approach might suggest that cutting €2 billion will reduce borrowing by €2 billion. This is our experience at the household level. When our spending exceeds income, we cut spending to stop the cash-flow deficit. We stop eating out, turn off lights in unused rooms, buy cheaper wine, take fewer holidays, postpone replacing the car, etc. One thing is certain: when we cut spending at household level we rarely if ever cut our income.

This is not the case at the level of the economy. When the Government cuts spending it cuts its own income: for instance, cutting public sector wages reduces tax/PRSI revenue. But it also cuts other people’s income. This reduces consumer spending, which harms businesses, which in turn can harm employees (wage or hour cuts, even lay-offs); this in turn reduces tax revenue further while driving up unemployment costs. When the Government cuts spending it sets in motion a downward spiral that spreads throughout the economy.

We can measure these reductions – approximately. The ESRI ran two simulations in early 2009 showing how (a) a public sector wage cut and (b) a cut in public sector employment would harm the economy but have little effect on public finances. Both simulations were intended to reduce public spending by €1 billion each. Will this reduce borrowing by €2 billion? No.

According to the ESRI, the impact of the measures in the first year

- Consumer spending falls by over €1 billion (what businesses would support that?)

- Employment falls by approximately 20,000 – this can lead to either higher dole queues or emigration

- GDP falls by €1.5 billion – deepening the economic decline

In short, these measures wreak a terrible toll on the economy and economic activity. So what is the effect on the borrowing requirement? Minimal.

In short, these measures wreak a terrible toll on the economy and economic activity. So what is the effect on the borrowing requirement? Minimal.

In the first year, the borrowing requirement will fall by 0.5 of GDP (this year our borrowing requirement is expected to be 11.7 percent). After all this economic carnage, this is not much of a fiscal return. But there’s another important twist to this dismal tale.

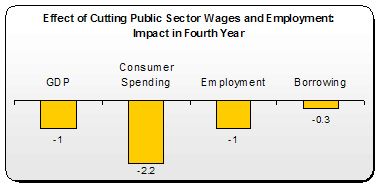

The impact of these cuts gets worse over the years: consumer spending is cut even further and the downturn in the GDP accelerates.

So much for the theory of ‘taking the pain up front’. In fact, the pain gets worse.

As a consequence, the ‘savings’ to the Exchequer gets less. By the fourth year the impact on borrowing is reduced – to 0.3 percent. This impact on borrowing is fractional at best.

As a consequence, the ‘savings’ to the Exchequer gets less. By the fourth year the impact on borrowing is reduced – to 0.3 percent. This impact on borrowing is fractional at best.

And what will be the effect on the overall debt level? None. By 2014, cutting the public sector payroll will reduce the borrowing requirement by €915 million (not the headline €2 billion cut). However, the negative economic impact will reduce the GDP by over twice that amount – €2 billion. The debt burden doesn’t fall and it may even rise.

So let’s summarise: we’ve cut economic growth, cut consumer spending – forcing more enterprises up to the wall, and cut employment; all to reduce borrowing by 0.3 percent and with no effect on the overall debt. I just have one question: who thinks up these proposals?

Needless to say, the numbers are on such a knife-edge that, combined with other deflationary cuts, the impact on the borrowing requirement could actually be negative. Perversely, cutting wages and employment could end up worsening the fiscal crisis. When the economy does return to growth, when it starts to climb out of this recessionary hole – it will do so with a giant anchor tied to its ankles.

So why is the Government proceeding with such cuts when all the evidence shows that they will have almost no impact on the fiscal deficit or the overall debt burden?

It only makes sense when we understand the Government’s real agenda: maintaining the low-tax economy. Only by cutting public sector spending – regardless of the harm to growth, jobs and spending – can they keep tax levels at their historical lows (for discussion of this – see here).

Public sector workers are engaged in industrial action to defend their living standards. But now we can add another purpose to their action – an attempt to reverse an irrational economic policy that is doing such harm; to both private and public sector workers, and to business.

That is what this battle is about. We can only hope that the women and men in the public sector win. If they do, we all win.

Leave a comment