With industrial action in the public sector ramping up a couple of notches, it is worth revisiting a couple of issues in relation to pay. A critical issue is the fiscal benefit or otherwise that accrues to the Exchequer from cutting public sector wages – I will examine this in the next post. Here, let’s take a look at another issue – a comparison of public sector labour costs throughout Europe.

With industrial action in the public sector ramping up a couple of notches, it is worth revisiting a couple of issues in relation to pay. A critical issue is the fiscal benefit or otherwise that accrues to the Exchequer from cutting public sector wages – I will examine this in the next post. Here, let’s take a look at another issue – a comparison of public sector labour costs throughout Europe.

During the last year and a half it has often been asserted that we have, in European terms, a highly paid public sector workforce. My favourite headline comes from the Sligo Champion which, not satisfied with parochial European comparisons, declared:

'We have the highest paid public servants in the World'

Quite a claim – especially when there is no data to back this up.

One of the problems in comparing public sector wages internationally is that there is no internationally agreed definition of ‘public sector’ employee. For instance, in Ireland are ESB workers ‘public sector’? They’re not private sector as the company is publicly owned. However, they don’t fall into the category of ‘General Government Employee’ nor are they paid out of the Exchequer pay and pension budget. Defining these ‘public enterprise’ workers is one of the complications international agencies face when defining ‘public sector’ or ‘Government employees, especially when different countries have widely varying organisational practices.

However, the EU Klems database compiles comprehensive data on total labour costs and total hours worked by various economic sectors. Some of these can be directly related to the public sector – in particular NACE L: Public Administration & Defence. Throughout Europe, including Ireland, it is likely that all employees in this category will be public sector workers (unlike NACE N: Health & Social Work where, in Ireland, only about 55 percent of all employees are in the public sector).

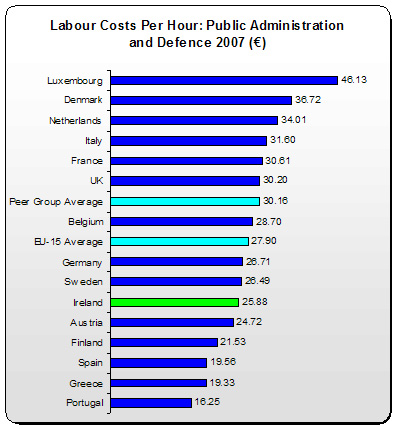

So what do we find when we compare labour costs (wages plus employers’ payroll contributions) in the public administration sector which, in Ireland, makes up approximately 100,000 employees?

- Irish labour costs rank 10th out of the EU-15

- Irish labour costs per hour are €2.02 below the EU-15 average – or 7.2 percent

- When compared with our peer group in the EU-15 (excluding the poorer Mediterranean countries), Irish labour costs per hour are €4.28 per hour below average – or 14.2 percent.

The Sligo Champion might want to revisit their headline.

Of course, this is before both the pension levy (which wouldn’t show up as a pay cut in these tables) and the Budget 2010 pay cuts (which would). So there is a reasonable chance that Irish public sector labour costs will have fallen further behind European averages. (I won’t even go into PPPs, factoring in living standards; Irish public sector wages would fall even further behind European averages).

This data might be surprising for those who give the headlines the benefit of the doubt. But it shouldn’t be. As has been continuously pointed out, Ireland is a relatively low-waged economy – both private and private.

No doubt, the counter-argument will be, ‘Regardless of comparisons, we have to cut public sector wages because of the fiscal crisis we are in’. We will deal with that issue in the next post.

But let’s at least start setting the record straight – a record that has been distorted by unsubstantiated assertions… Irish public sector labour costs are not high, the men and women who have been subjected to an average 14 percent pay cut over the last year, are not by comparison expensive to employ.

If anything, by European terms, we are getting a good deal.

Too bad public sector workers – who offer a considerable amount for relatively low cost – aren’t getting the same deal.

Leave a reply to Mack Cancel reply