The Government announced that the 2010 budget would be the worst and that in subsequent years the level of fiscal contractions – either in pubic expenditure cuts or tax increases – would be much less than previously projected. In other words, the worst is over. You could hear a national sigh of relief. You could also see a few eyebrows being raised. Truth is, the numbers to sustain a ‘worst is over’ scenario don’t work. Indeed, we are into the land of smoke and mirrors and more smoke – a land in which the Government are the premier cartographers.

The Government announced that the 2010 budget would be the worst and that in subsequent years the level of fiscal contractions – either in pubic expenditure cuts or tax increases – would be much less than previously projected. In other words, the worst is over. You could hear a national sigh of relief. You could also see a few eyebrows being raised. Truth is, the numbers to sustain a ‘worst is over’ scenario don’t work. Indeed, we are into the land of smoke and mirrors and more smoke – a land in which the Government are the premier cartographers.

In April, the Government projected a fiscal contraction schedule of €11 billion in the three years 2011-2013. In the recent budget this had been written down substantially – by half, to €5.5 billion (with another €1 billion in 2014, the new target year for Maastricht compliance). This would appear to be a substantial ‘taking-the-foot-off-the-deflationary-pedal’. What could be the reason?

One reason its not is economic growth. In the April budget, GNP for 2013 was projected to be €163.7 billion. In the recent budget, that GNP figure was written down to €152.3 billion. This is quite a write-down – over €10 billion less. In any other context, that would mean less tax revenue, more unemployment costs, less economic activity. Whatever the context, we can assume that the need for less fiscal contraction is not because the economy is estimated to be stronger; it will actually be weaker.

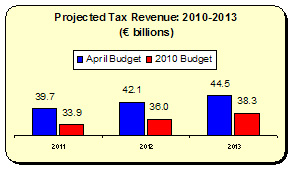

What about tax revenue? Could that explain the need for less contraction? No. The Government is projecting much lower tax revenue over the next few years. The difference is quite considerable – in the three years 2011-2013 the Government intends to take in €18 billion less.

What about tax revenue? Could that explain the need for less contraction? No. The Government is projecting much lower tax revenue over the next few years. The difference is quite considerable – in the three years 2011-2013 the Government intends to take in €18 billion less.

There is a slight reduction in capital expenditure, which accounts for some of the difference. The Government will be spending approximately €1 billion less on capital expenditure than projected in April. It should be further noted that payments to the National Pension Reserve Fund will be cut substantially. In April, the Government intended to resume its 1 percent of GNP payments into the Fund in 2011. Now, however, they will suspend payments in the year, put aside only ½ percent in 2012 and will not resume full payments until 2013. However, while this will save money on the Exchequer Borrowing Requirement, it has no impact on the deficit as measured under the Maastricht Guidelines.

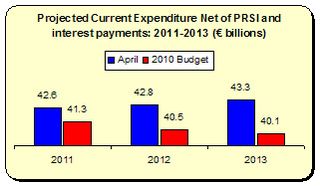

So – less economic growth, less Government revenue, and only slightly less capital expenditure; the explanation for the need for less fiscal contraction lies in the Government’s intention to cut current expenditure even further than previously projected. In other words, the fiscal contraction hasn’t gone away – it has just been buried in the current expenditure projections.

The Government intends to spend nearly €7 billion less than it had projected back in April (excluding PRSI and interest payments).This reduction in current expenditure is roughly equivalent to the claimed reduction in the fiscal contraction level. This is a fairground shell game – where did the fiscal contraction go? It didn’t go anywhere – it was just moved: from the fiscal adjustment line item to the current expenditure line item.

The Government intends to spend nearly €7 billion less than it had projected back in April (excluding PRSI and interest payments).This reduction in current expenditure is roughly equivalent to the claimed reduction in the fiscal contraction level. This is a fairground shell game – where did the fiscal contraction go? It didn’t go anywhere – it was just moved: from the fiscal adjustment line item to the current expenditure line item.

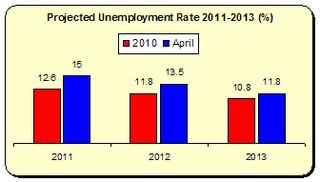

There is one caveat. Unemployment is projected to be lower than previously estimated in the April budget. This can result in lower Government expenditure. Based on the increase in unemployment costs  between 2008 and 2010, every 1 percent on the Live Register is equivalent to €400 million. Therefore, the decreased estimates in unemployment would save the Government approximately €2 billion over the three year period. But – and this is a big but – that’s only if the Government doesn’t increase social welfare rates. Given that inflation is expected to run at 6 percent, this is not likely to happen. In that instance, the savings will be less. In any event, by 2013 unemployment is projected to be 1 percent lower. This would account for only a small proportion of the substantial decline in projected current expenditure. There are other strange things at work here. For instance:

between 2008 and 2010, every 1 percent on the Live Register is equivalent to €400 million. Therefore, the decreased estimates in unemployment would save the Government approximately €2 billion over the three year period. But – and this is a big but – that’s only if the Government doesn’t increase social welfare rates. Given that inflation is expected to run at 6 percent, this is not likely to happen. In that instance, the savings will be less. In any event, by 2013 unemployment is projected to be 1 percent lower. This would account for only a small proportion of the substantial decline in projected current expenditure. There are other strange things at work here. For instance:

- In the April budget the Government projected that unemployment would fall by 1.5 percent in 2012. Yet, they projected current expenditure to rise slightly. Therefore, they didn’t assign in any savings on unemployment costs to the bottom line.

- However, in the 2010 budget, the Government projects unemployment to fall by 0.8 percent in 2012. Yet, they are projecting a fall of nearly €900 million in current expenditure in that year.

The difference cannot be explained by the reduced unemployment costs. It can only be explained by a determination to hide the fiscal contraction in the current expenditure projections.

This hide-and-seek approach to fiscal policy is of a piece. The Government has been playing games with these numbers ever since the January Addendum when they created a new category – the consolidated fiscal objective – which hid all sorts of spending cuts and tax increases. This game, however, blew up in their face when the EU Commission slapped an excessive deficit procedure on the Government because they didn’t believe the budgetary numbers.

In conclusion, the April Budget announced a fiscal contraction schedule of €11 billion in the years 2011-2013. In the 2010 Budget this was reduced to €5.5 billion. But further, below-the-radar, contractions are projected in current expenditure (€6.8 billion) and capital expenditure (€1 billion). Only a small portion of this can be explained by future reduced unemployment costs.

The worst is not over. It will just be given a new name, it will be hidden in numbers – but the effect on public services and living standards will be the same.

The ‘worst’ has just been given a make-over.

Leave a reply to Michael Taft Cancel reply