So, Professor John O’Hagan wants to cut economic growth, undermine business profits and throw more people out of work while saving only a fractional amount on the borrowing requirement; not to mention the risk of embedding debt into the economy going forward. Not a good day's work.

So, Professor John O’Hagan wants to cut economic growth, undermine business profits and throw more people out of work while saving only a fractional amount on the borrowing requirement; not to mention the risk of embedding debt into the economy going forward. Not a good day's work.

Now, I’m positive Professor O'Hagan doesn’t want any of this to happen. But what we want and what we get can sometimes be completely different things – especially when we ignore the effects of what we want on the real world. Therefore, for the sake of clarity, let’s start with this.

Cutting public sector wages is economically wrong, fiscally irrelevant, and will postpone the commencement of economic recovery.

Those calling for public sector wage cuts mean well, I’m sure. When Professor O'Hagan calls for 20 percent wage cuts, you can really feel those good intentions. But to paraphrase Colm McCarthy

‘The Government hasn’t run out of compassion, but it has run out of economic growth.’

Let’s go through the indicators to show that the last thing the economy needs is public sector wage cuts.

Consumer Spending

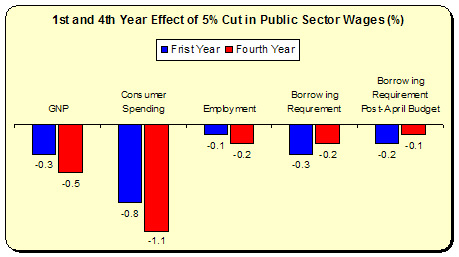

Our first stop is the ESRI, its fiscal multipliers and consumer spending. When they ran the numbers on the economic effects of cutting public sector wages by 5 percent they found that consumer spending really gets hit. In the first year they projected there would be nearly a 1 percent reduction in spending. That’s a reduction of around €670 million.

The collapse in consumer spending has been a major contributor to our recessionary free-fall for a very good reason – it makes up over half of our national income. Between 2008 and 2010, the ESRI estimates that consumer spending will fall by over 11 percent (compare this to the overall fall in the Eurozone of about 1 percent).

This will mean less turnover for business. Question: if you were an owner/manager of a business selling goods and services into the domestic economy – would you want to add, as Professor O'Hagan suggests, to this collapse in consumer spending? Or would you want to see more people with more money in their pockets (answers to be written on the back of a postcard and sent to ISME).

And it is inevitable that consumer spending will fall. The ESRI projects that, arising out of a 5 percent cut in public wages, overall wages in the economy will fall by nearly €1 billion.

Employment

This leads us to the second point – falling consumption results in falling employment. The ESRI estimates that in the first year, nearly 2,000 jobs could be lost (resulting in an increase in the Live Register, emigration or people falling out of the active labour force).

Professor O'Hagan poses the debate as one of public sector pay cuts vs. public sector job losses. This is, to my mind, wrong and misses the point entirely (the real debate is whether you reflate or deflate the economy). Still, you don’t have to agree to acknowledge the effect of public sector wages cuts: it will result in job as the effects of reduced consumer spending spread out through the economy. And those losses will not be in the public sector, they will be in the private sector.

Economic Growth and that Pain Thing

What does this mean for the economic growth? Remember, our paraphrased Mr. McCarthy – whatever about compassion, we’re running out of growth. Between the start and the end of this recession, the economy will have bled nearly €550 million a week. Cutting public sector wages will add to this effect – reducing the GNP by nearly €450 million in the first year.

Okay, maybe this is all worth it – y’know, that no-pain-no-gain thing. Maybe lengthening and deepening the recession, putting more enterprises up against the wall, throwing more people out of work (people in the private sector) is the price we must pay to bring our fiscal deficit under control. The problem with Professor Hagan’s proposal is that we get the pain for sure, but we don’t get any gain.

The ESRI estimates that cutting public sector wages will reduce Government expenditure by approximately €1 billion. However, when you factor in the lost tax revenue and the impact on reduced spending (less indirect taxes, less business taxes) and the job losses (higher government expenditure, less income tax/PRSI revenue), they estimate the net saving to the will be €667 million.

However, this figure was calculated before the increased levies in the April budget. An Saoi and I recalculated the after-tax revenue arising from a 5 percent public wage cut post-April and found the Exchequer would gain only €545 million. And this doesn’t take into effect the deflationary impact that such cuts would have on the economy.

So where does that leave us? To save €500 million or so, we have to cut growth by €450 million. We’re running to standstill. And the effect on the deficit? Fractional. The ESRI projects the borrowing requirement will fall by 0.3 percent. Using the post-April calculations, the reduction is less – closer to 0.2 percent. That’s a big hit to the economy for so little fiscal gain. This is the ultimate running-in-quicksand exercise.

But what abut the long game? Wouldn’t it be better to take that pain ‘upfront’? If we do, then we can put it behind us and get on with growing the economy? Is this the case? No, in fact the opposite is the case. It will dog us for years down the line.

The fourth year effect of public sector wage cuts is even worse. It drags down GNP, consumer spending and employment further, while the effect on the borrowing requirement becomes even more fractional. Pain ‘upfront’ equals more pain down the line; the deflationary effects stay with us like the reek of burnt toast.

Whenever people try to explain this natural economic process they are met with a torrent of indignation:

‘You’re defending people who make hundreds of thousands of Euros a year while the rest of us are being fleeced!!!’

Listen, if someone, some political party, some interest group wants to cut the wages of those at the very top of the pay scale, my attitude is, ‘Well, if you makes you feel good, do it. It won’t have any effect on the public sector pay bill or the borrowing requirement but sure, knock yourselves out.’

Those at the very top of the public sector pay scale – earning over €200,000 a year – are a rare species. They make up less than 1 percent of all public sector workers. At the other end, however, 50 percent (more after the pension levy) earn less than the average industrial wage; while 85 percent earn less than €60,000. Proposals to cut wages at the upper end have little to do with economics or even good book-keeping; it’s more to do with gesture politics.

Economic Recovery Postponed

The really frustrating thing is that we may be blowing an opportunity. I emphasise ‘may’. Davy Stockbrokers are one of the very few commentators predicting growth for next year. They predicate that growth on a resumption of consumer spending. They’re pretty much alone on this issue but their argument is that the fall in consumer spending has been matched by a similar rise in the savings ratio – an increase which they believe is unwarranted given our demographic spending patterns. They project a slow reduction in savings and, so, an increase in consumption.

I’m not so sure about this (An Saoi suggests there’s some odd things going on with our savings stats). And clearly a recovery based on spending can only go so far. Sustained recovery will be based on investment that creates jobs and raises productivity – an investment financed by our positive debt profile and low net debt ratio. However, such investment would take time to kick-in. In that gap we would need a ‘growth-bridge’. Consumer spending is one of those bridges.

There may be a small window to take advantage of increased consumer spending. As Eurozone recovery takes root, the ECB will start raising interest rates to ensure inflation doesn’t take root. This may rebound on consumer spending, as will energy price rises, the planned carbon tax and tax-based consolidation policies in the future (and let’s forget all that private debt to deleverage).

So if Davy is right, it may only be temporary. But that temporary could be crucial.

But Professor O'Hagan would burn any potential bridges. It’s interesting to note that Davy’s projected increase in consumer spending is equivalent, according to the ESRI, to the fall in that spending if the Government proceeds with wage and job cuts in the public sector. Simply put, these cuts (combined with others the Government may be planning) will postpone the bottoming out of this recession.

That’s why we should support the public sector workers as they approach their days of industrial actions. Their actions might, just might, deter the Government from pursuing overly-deflationary measures, would help stabilise consumer spending and the jobs based on that spending. It may be a defensive action (much trade union action necessarily is) but it is a defence of the economy.

It’s not an economic alternative in and of itself, but it can point the way to that alternative, one based on reflating the economy through investment in our economic base.

And it would certainly be better than Professor O'Hagan’s deflationary vision of a low-growth, high-debt future.

Leave a reply to Michael Taft Cancel reply