The discussion on Frontline last night at some points bordered on the surreal. Take the discussion on taxation. The question was posed – how high would tax have to rise in order to generate €4 billion tax revenue (as opposed to cutting €4 billion). The first thing that struck me was – why was this discussion taking place? Is there anyone in the current debate who has called for an increase of €4 billion in taxes in the upcoming budget? If there is, I must have missed that meeting. It could be an interesting hypothetical laboratory question – much can be learned by such exercises. But I would have thought that Frontline was more interested in discussing the specific issues in the current economic and fiscal crisis. Essentially, panellists were asked to find an answer to a question that no one has asked.

The discussion on Frontline last night at some points bordered on the surreal. Take the discussion on taxation. The question was posed – how high would tax have to rise in order to generate €4 billion tax revenue (as opposed to cutting €4 billion). The first thing that struck me was – why was this discussion taking place? Is there anyone in the current debate who has called for an increase of €4 billion in taxes in the upcoming budget? If there is, I must have missed that meeting. It could be an interesting hypothetical laboratory question – much can be learned by such exercises. But I would have thought that Frontline was more interested in discussing the specific issues in the current economic and fiscal crisis. Essentially, panellists were asked to find an answer to a question that no one has asked.

Of course, such unasked questions provide an opportunity to mislead the debate. For instance, Suzanne Kelly, a tax lawyer, stated:

‘If you want to collect €4 billion through the income tax mechanism . . . I would say to you, the way you’d have to do that would be to raise the 41 percent higher rate to 75 percent and it would have to be applied principally to married couples at €75,000 or more. So if you have a Guard married to a nurse and they earn a €1,000 over €75,000 you would have to collect €750 in tax from them . . .'

Oh, my. A top rate of tax of 75%. And on a married couple (who are likely to have children). And at the current thresholds we have today. Well, you won’t find many people relishing that prospect. And that’s the point. These are scare stories, nothing more; frightening the children at bedtime to ensure they dream of public spending cuts.

Even Minister Lenihan dons a Halloween mask to haunt the crèches of our nation:

‘Mr Lenihan said the marginal rate of tax is 53 per cent and that if the Government was to increase it further to raise an extra €1 billion “everyone or every couple earning over €100,000 would pay tax at a marginal rate of 63 per cent’.

What Kelly and Lenihan are doing, in presenting this fright-fest, is deliberately manipulating figures and concepts. In particular:

- The marginal rate of tax refers to the amount of tax you pay on every extra Euro you earn. For instance, if you’re on the higher rate of tax, combined with the levies, you’re marginal rate of tax rate is 53 percent. For every extra Euro you earn, you pay 53 cents in tax.

- The effective rate of tax refers to the amount of tax you pay as a percentage of your income.

Many commentators want you to ignore the latter and concentrate on the former. That’s because the former, the marginal tax rate sounds, well, more frightening. But it doesn’t tell the true story.

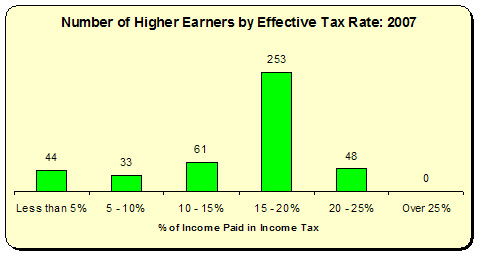

Minister Lenihan embarrasses himself when he trots out numbers like these because it is clear he hasn’t even read the reports his own Department produces. The Department produced a survey – a sampling of 439 high earners – and assessed how much actual tax they paid as a percentage of their income (the effective tax rate). The results make for some sobering reading.

When we look at how much actual income tax is paid by higher earners, the perspective changes dramatically:

- 10 percent paid less than 5 of their income on income tax

- Nearly a third paid less than 15 percent

- Only 11 percent paid more than 20 percent

- But: no one in this survey paid more than 25 percent

In 2007, the marginal tax rate would have been 43.5 percent. But that figure is a long ways away from the reality of those who pay less than five percent of their income on income tax. Or 10 percent. Or 15 percent.

How does this happen? The survey publishes a list of tax breaks that primarily only high earners can access – about 54 of them. These reliefs, allowances, exemptions all reduce the tax liability for those on high income.

Let’s put these in perspective. In 2007 the effective tax rate (these don’t include discretionary reliefs such as mortgage interest, VHI, etc.) was for a single person PAYE person on:

- €30,000: 8.3 percent

- €40,000: 14.5 percent

- €50,000: 20 percent

Now compare that to the chart above.

Minister Lenihan and many commentators don’t want you to see any of this. And, indeed, it is hard to see. The level of secrecy and opaqueness in the tax system is part and parcel of Ireland’s world class standing as one of the most secretive tax havens (take a look at this – personally, if I have to live in a tax haven, sipping Pina Coladas and frying prawns on a beach in Bermuda seems preferable).

How can this be addressed? We already have a structure in place. For the super earners – those on €500,000 or more – they can avail of tax breaks until the cows give beer. But no matter how many they avail of, they must pay a minimum effective tax rate of 20 percent.

So why not increase this small amount and lower the thresholds. Is it too much to ask that those who earn €100,000 per year pay an effective tax rate of 25 percent? For those on €200,000, 30 percent? For those on €500,000, 35 percent?

This wouldn’t raise a pot of gold. But it wouldn’t be a pot of nothing. And the great thing is – you wouldn’t have to raise the marginal tax rate one cent.

The really frightening thing is the way that Ministers and commentators work so hard to conceal these basic facts from the national debate. But that doesn’t mean we have to follow suit.

A little night-light will keep those scary monsters at bay – even Government Ministers.

Leave a reply to Irish Mammy Cancel reply