Some arguments I just don’t get. For instance, if I were an owner or manager of an enterprise that sold goods and services into the domestic economy (that’s most enterprises) I would be concerned at falling consumption. After all, if people cut their spending, my sales fall. If people are worried about holding on to their jobs, my sales fall. If people’s wages or hours are cut, my sales fall. And if people are made redundant, my sales really fall.

Some arguments I just don’t get. For instance, if I were an owner or manager of an enterprise that sold goods and services into the domestic economy (that’s most enterprises) I would be concerned at falling consumption. After all, if people cut their spending, my sales fall. If people are worried about holding on to their jobs, my sales fall. If people’s wages or hours are cut, my sales fall. And if people are made redundant, my sales really fall.

The best thing for my business would be to see more money in people’s pockets, more people at work, more confidence in the economy.

Therefore, the last thing I’d like to see is some of ISME’s proposals being implemented; namely cutting social welfare, cutting public sector wages (at least those on low and average incomes who make up the bulk of my customers and the bulk of the public sector payroll) or see any worker – public or private sector – lose their jobs. All these would represent a real blow to consumer spending and consumer confidence.

But ISME seems to be acting less like a representative of the interests of their members and more like a PR machine on behalf of certain neo-liberal nostrums. They seem intent on pursuing policies that would directly impact on their members – and not in a good way.

Just yesterday, ISME’s Mark Fielding was on the New at One, having a go at David Begg’s recent call for a new fiscal policy. Fair enough – how else would you know it’s an ISME representative if they’re not attacking trade unionists?

Interviewer: What is your reaction to the trade unions’ declaration that the sky is blue?

ISME Representative: This is just one more example of trade union bullying and intimidation. They threaten to paralyse the economy. Now they're making demands on the sky. The Government must ignore them.

Okay, tongue in cheek but the following real exchange wasn’t that much less surreal.

RTE: From your own point of view . . . if there’s less money circulating in the economy your members are going to have less money coming in the door to their businesses.

FIELDING: Yes. And at that moment that is happening as well. But it’s happening because of economic uncertainty and because of a lack of consumer confidence. People are afraid to spend at the moment because we don’t know where we are going at the moment. They’re look at the Government dithering at the moment and wondering – are we going to see a Bord Snip or not, are we going to water it down.

This is strange even by ISME’s standards. In essence, Fielding is saying there is less spending in the economy because people are concerned that the Government might not have the will to cut people’s disposable income which would result in . . . less spending. Hmmm.

Now, if I were an owner or manager of an enterprise, I would be seriously concerned. Here’s why.

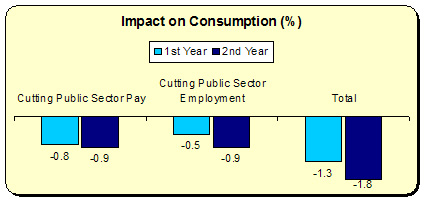

Even with the recession slowing down – tax increases and public spending cuts will hamper consumer spending. The ESRI provides some indication of the likely impact on consumption.

We see that, in both expenditure cuts, consumption falls considerably. Combined, they total nearly a 2% cut. To put some numbers on this, based on ESRI projections for next year, we could eventually see a fall of €1.5 billion by the second year. That’s a lot money taken out of consumer circulation – and this will be felt in firms’ turnovers.

We see that, in both expenditure cuts, consumption falls considerably. Combined, they total nearly a 2% cut. To put some numbers on this, based on ESRI projections for next year, we could eventually see a fall of €1.5 billion by the second year. That’s a lot money taken out of consumer circulation – and this will be felt in firms’ turnovers.

This is not a good time for this to occur. Though some forecasters are now a bit more upbeat about consumer spending (Davy forecasts consumer spending to increase by 1.5 percent next year), the Retail Sales Indexhas yet to stabilise according to the latest data.

The last month we have data for, July, shows a month-on-month decline. That this occurred after a volume increase in June (the first monthly increase Since September of last year), shows that consumer spending remains fragile. This is confirmed by Exchequer returns which saw VAT revenue coming in well under target. In September, VAT receipts fell 13% below the monthly target. We have some ways to go before consumer spending stabilises.

The last month we have data for, July, shows a month-on-month decline. That this occurred after a volume increase in June (the first monthly increase Since September of last year), shows that consumer spending remains fragile. This is confirmed by Exchequer returns which saw VAT revenue coming in well under target. In September, VAT receipts fell 13% below the monthly target. We have some ways to go before consumer spending stabilises.

Yet, rather than address the fall in consumption, ISME ups the deflationary stakes by calling for social welfare cuts, including Child Benefit cuts. If the McCarthy Report recommendation is implemented – the cut in €850 million in social welfare cuts will make another dent in consumption, especially as this will hit people who have a higher propensity to spend.

The CSO is still recording a fall in prices. This will force businesses to (a) drive down prices, or (b) drive down their costs – of which wages will be one. In the former, revenue will fall further if it is not being recouped through an increase in volume. Of course, it can get to such a stage that a business can’t cut prices anymore and goes out of business.

In the latter, while it may seem ‘penny-wise’ at the firm level to cut wages (reducing costs), it would be ‘pound-foolish’ at the national level because it would lead to a further reduction in consumption – spiralling ever downwards.

And in both cases, public finances worsen as deflating prices and falling wages undermines tax revenue.

If I were an owner or manager of an enterprise I would know this instinctively. I would want the Government to reflate the economy – to do everything possible to maintain and enhance incomes, maintain and expand employment. Because that will increase my turnover and end the need to cut margins to attract volume, traffic, football. The deflationary pressures would stop and the economy could start spiralling upwards.

That’s when you pursue fiscal consolidation strategies – after the economy is on growth path. That’s when it will get produce positive rather than negative returns.

If I were an owner or manager of an enterprise, I would cancel my membership to ISME.

Leave a comment