Great. Coming home from a few days break and there’s the IMF, holding open the cell door. The projections are worrying enough, though hardly new. Still, to be reminded one more time that the economy is crashing through the double-digit barrier – it doesn’t really perk up your day. The real worry is the prescription, the ‘medicine’ they propose. This will be a real fillip for the government, the orthodoxy, the Right. For the IMF is proposing nothing less than a massive hollowing out of the economy and public realm. With international blessing, Fianna Fail will up the ‘cut’ stakes while the Left and the trade union movement is in danger of marking time.

Great. Coming home from a few days break and there’s the IMF, holding open the cell door. The projections are worrying enough, though hardly new. Still, to be reminded one more time that the economy is crashing through the double-digit barrier – it doesn’t really perk up your day. The real worry is the prescription, the ‘medicine’ they propose. This will be a real fillip for the government, the orthodoxy, the Right. For the IMF is proposing nothing less than a massive hollowing out of the economy and public realm. With international blessing, Fianna Fail will up the ‘cut’ stakes while the Left and the trade union movement is in danger of marking time.

Ah, the IMF; its track record of interventions doesn’t fill one with warm, fuzzy feelings. Just ask Argentina or Kenya or most other countries that have had to slash n’ burn their economies to get a ‘bailout’ (never mind the dictators that the IMF supported – dictators that ran parallel slash n’ burn policies against their own populations). And, so, the IMF and Ireland:

‘. . . the execution of their ambitious consolidation plan (i.e. the Government’s expenditure cuts) will require a continuing commitment to address sensitive expenditures, including the public wage bill and the scope of social welfare programs. . . To bear fruit these efforts will require determined execution over several years.’

What a future. First, they propose that ‘social welfare expenditures must better target the vulnerable’. This is code for wide-scale means testing. Indeed, the IMF welcomed the Government’s commitment to move away from universalism. This is a bit of a hoot.

Ireland has the least amount of universal payments in the EU – by a wide margin. Whereas, only 11% of all social benefits are means-tested in the EU, Ireland leads the means testing league at nearly 25% (compare this to Denmark and Sweden where only 3% of benefits are subjected to means testing). Moving away from universalism? We’re already there.

While Child Benefit is usually held up as the main ‘universal’ payment – one to be targeted through means testing or taxation – there is another target: social insurance. We can expect the Government to dilute the insurance principle and move towards means-testing Jobseekers’ Benefit, Disability Benefit, etc.

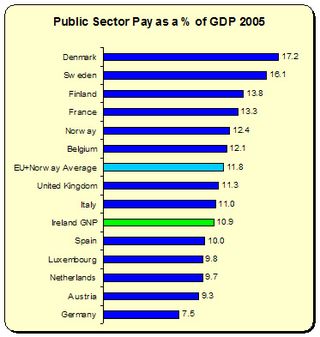

Secondly, the IMF calls for further public sector wage cuts and/or cuts in employment. Surprise, surprise. The IMF is deeply, deeply concerned that public sector employment grew from just under 14% of total employment, to just under 16% in 2008. Now, you might not think this sounds like much. That’s because it isn’t. But it’s enough to get the IMF worked up – never mind that Irish public sector pay costs lag behind most other countries as a proportion of GDP; never mind that Irish employment of civil servants is the fourth lowest out of 26 OECD countries (civil servants as a percentage of total employment). New report – same ol' scapegoats.

Secondly, the IMF calls for further public sector wage cuts and/or cuts in employment. Surprise, surprise. The IMF is deeply, deeply concerned that public sector employment grew from just under 14% of total employment, to just under 16% in 2008. Now, you might not think this sounds like much. That’s because it isn’t. But it’s enough to get the IMF worked up – never mind that Irish public sector pay costs lag behind most other countries as a proportion of GDP; never mind that Irish employment of civil servants is the fourth lowest out of 26 OECD countries (civil servants as a percentage of total employment). New report – same ol' scapegoats.

The IMF doesn’t even bother assessing the negative impact (i.e. multipliers) of large-scale cuts in wages, Government consumption/investment, social welfare, etc. on the economy. Instead, they offer us a faith-based approach to fiscal correction; that somehow hollowing out the economy will lead to growth and consumption and investment. How? They never quite say. They focus on one thing and one thing only: the deficit. And what an accountancy-inspired focus it is.

They are proposing the Government – if it is to reach fiscal nirvana – will have to cut current public expenditure by over 23% by 2014. To give you a snapshot idea of what this means, it calls for the Government to cut expenditure by over €12 billion in 2009 terms. You could abolish the Department of Education and still fall well short of the intended target.

In one respect, this is all nothing new. We’ve been feeding off a steady diet of cuts and contraction since this recession gig got hopping. So what’s one more ‘expert’ commentary? Little in itself. It’s the impact on an alternative dialogue, though, that makes one depressed.

ICTU is otherwise engaged, trying to find some traction in talks with the Government to reach an agreement that will, regardless of minimalist measures to protect jobs and pensions, reflect the broad thrust of the IMF.

Labour’s reaction to the IMF report was to use its analysis to bash the Government over past mistakes. This is a fine as far as it goes but the fact is that even the dogs in the street are familiar with the arguments over the property bubble. What the Left has failed to do to date is mount a fundamental challenge to the very premises of the IMF report and the orthodoxy’s prescriptions; namely, the cuts agenda. The Dail debate can give the Left an opportunity to correct this. Let's hope the jump in with both feet.

For without that fundamental critique, we allow the IMF to rule us by default, by setting the mood music, by establishing the most rigid of parameters. We are trapped, prisoners. We get to choose our warders but we don’t get to leave. We get to decorate our cells but we must pay respect to the walls. We get the semblance of choice but really, there is only one choice.

The IMF’s choice. A logical end to a desultory debate.

Leave a reply to Barry Cancel reply