Ronan Lyon has written an instructive post on the ‘Thorny Issue of Teachers’ Pay’. So useful, in fact, that it was highlighted on Irish.economy and in the Sunday Business Post. And boy has it stirred comments on both websites. Cutting to the quick, Ronan concludes that Irish primary school teachers are paid too much – at least, when compared with teachers in other EU countries. Therefore, in these cash-strapped times, if we want to increase investment in education then we must address the issue of those over-paid teachers. This might be valid if Ronan’s conclusion on pay is correct.

Ronan Lyon has written an instructive post on the ‘Thorny Issue of Teachers’ Pay’. So useful, in fact, that it was highlighted on Irish.economy and in the Sunday Business Post. And boy has it stirred comments on both websites. Cutting to the quick, Ronan concludes that Irish primary school teachers are paid too much – at least, when compared with teachers in other EU countries. Therefore, in these cash-strapped times, if we want to increase investment in education then we must address the issue of those over-paid teachers. This might be valid if Ronan’s conclusion on pay is correct.

There are three basic statistics derived from the OECD’s Education at a Glance upon which Ronan bases his conclusion.

First, he highlights the fact that Irish school teachers – after 15 years of service – earn considerably more than their peers in Eurozone countries. He doesn’t put exact numbers on this, but his graph tells his story.

Second – and here he does put numbers on it – Ronan shows that Irish teachers earn more per day than teachers in Eurozone countries. Even after the pension levy, Irish teachers are the highest paid. Ronan says:

‘ . . . the amount paid for every day spent teaching in Ireland looking pretty unsustainable. Factoring in the pension levy only scratches at the surface of the problem.’

Third, he calculates teachers’ net pay – after tax and PRSI. This, if anything, shows that Irish teachers’ pay is higher still.

Do his arguments stand up? Let’s investigate – using primary school teachers' pay scales.

Do Teachers Earn More Annually?

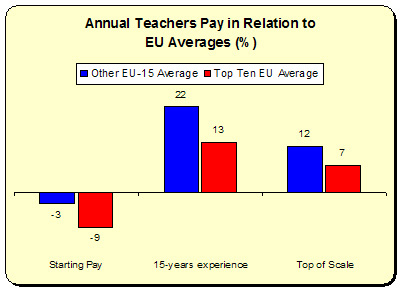

Do teachers earn more annually than teachers in other countries? Well, yes and no. Already, Ronan’s conclusion begins to fray. Why? Because he selects only one pay grade, whereas the OECD presents data for three. Looking at all three grade scales, the situation becomes a little more complex.

Ronan’s contention seems to be confirmed when we examine teachers with 15 years experience – Irish primary school teachers earn 22 percent above the average in other EU-15 countries, and 13 percent above the average in the top ten EU economies (of which we are one).

Ronan’s contention seems to be confirmed when we examine teachers with 15 years experience – Irish primary school teachers earn 22 percent above the average in other EU-15 countries, and 13 percent above the average in the top ten EU economies (of which we are one).

However, starting off, Irish teachers are paid below average – in the case of the top ten significantly so: 9 percent. At the top of the pay scale, Irish teachers are better paid but less than those on 15 years experience. So we can conclude:

- Irish teachers start off earning below average, but through the years – due to increments and other pay benefits that come with experience – become higher paid. However, at the top of the scale the ratio between Irish pay and other EU teachers contracts.

Exactly where in that pay scale Irish teachers turn from being below-average pay to above-average pay the OECD doesn’t state. So we don’t know the extent of any savings that might accrue to the Exchequer through aligning pay with the EU average because we don’t have the comparisons to hand.

What we can conclude, however, is that Ronan selected the one category that fit his conclusion – teachers with 15 years experience. Had he selected starting pay, he would have to conclude that Irish teachers are paid below average. Had he selected the top pay scale, he could have stated Irish teachers are above average – but not significantly so (only 7 percent when compared to our peer group). In common parlance, this is called skewering the evidence to fit your conclusion. It’s not a practice designed to aid the debate, only a partisan position in that debate.

Pay According to Working Time

The second piece of evidence Ronan produces is pay per day, based on the OECD’s data for the number of days spent teaching. From this, Ronan shows that Irish teachers earn more per teaching day than teachers in any other Eurozone country. It’s interesting that he selected this category but didn’t use the others that the OECD presents – specifically, the number of working weeks and the number of hours actually spent teaching. For instance, Irish primary teachers spend approximately the same number of days teaching as the average EU teacher. Ditto for the number of weeks per year teaching.

But, as we know, the Irish work longer hours than their EU counterparts. Is this the case with Irish teachers? Yes. Irish teachers work longer hours instructing children than teachers in any other EU-15 country (as well as teaching the highest number of pupils per class). So how does Irish pay per teaching hour stack up in comparison?

As can be seen, for starting teachers, their hourly pay is substantially less than their counterparts in the EU-15 and the top-ten EU economies: 16 percent less than the former and a sizeable 25 percent less than the latter.

As can be seen, for starting teachers, their hourly pay is substantially less than their counterparts in the EU-15 and the top-ten EU economies: 16 percent less than the former and a sizeable 25 percent less than the latter.

For the teachers with 15 years experience, we find that they are no longer ‘highly’ paid. In comparison with the EU-15, they are paid 5 percent more than the average, but in comparison with the top-ten EU economies they are paid 7 percent less than average.

As for those at the top of the scale – Irish teachers earn less than the hourly average.

So whichever way we spin it, pay per teaching hour is lower in almost all categories of teachers, regardless of the benchmark Again, Ronan didn’t refer to this category of working time – it wouldn’t have suited his argument. If teachers’ hourly pay were aligned to EU averages, than we would be actually be increasing pay across most scales. Of course, we could reduce their working hours but that would mean hiring more teachers – more public sector workers; I’d be interested to hear Ronan’s thoughts on that one.

There is a category for ‘working time required at schools’ but a large number of countries are absent from this data. More importantly, it doesn’t tell us the actual time teachers spend at school. So I can understand why Ronan didn’t refer to this data.

Net Income of Teachers

Ronan provides us with his own calculations on net income for teachers in the Eurozone which doesn't feature in the OECD data (at least, I can’t find it; if it is there, I would appreciate it if someone could point it out). Unfortunately, Ronan doesn’t explain how he arrived at these figures.

I’m guessing he took tax percentages supplied by the OECD Benefit and Wages database and applied it to the Education at a Glance salary figures. This is not without some justification, but the problem is that these are two different methodologies using different currencies (national currencies in the OECD Benefits database, dollar-PPPs in the OECD Education figures). If this is what Ronan has done, it should be treated as an approximation. And it would explain why he uses Eurozone comparisons, as the Benefit database uses national currencies for non-Eurozone EU countries.

That’s a minor quibble – telling people how you arrive at figures (something that should be done as a matter of course). But Ronan has opened up a wider debate that goes beyond teachers’ salaries; namely, how we consume services in society. Irish tax/PRSI levels are low – and so are the monetary benefits of public services. In other EU countries, it’s just the opposite – high taxes/social insurance in return for free or below-market cost services.

In Ireland we get to keep a lot more of our gross pay (which, in the private sector, is low by EU standards) but out of that we

- Have to pay GP doctors’ bills and prescription medicine at market rates

- Don’t get the same pension coverage and retirement income

- May have to pay out enormous sums for nursing homes and elder-care for our relatives

- Pay one of the highest levels of childcare costs

- Suffer some of the poorest infrastructures (public transport, tainted water, cultural and recreational activities, etc.).

Not to mention fundraise – along with-teachers – for basic equipment in our notionally free primary schools.

I’ve always wondered what a survey that took account of all these costs would say about comparative living standards and ultimate cash-in-hand – never mind the security of social protection and services.

Now, if Ronan is suggesting that once we get out of the recession we should start increasing tax levels so we can get free health and medicine, subsidised childcare, PRSI earnings-related pensions, etc. – well, I’m with him. But let’s be clear: this will mean higher corporate and payroll taxes, higher taxes on capital and wealth, in addition to higher income taxes and PRSI contributions.

In short, to look at one side of the equation – low taxes – without looking at the other side – foregone consumption of important services for free or at non-market rates – doesn’t get us very far. For it is an equation that goes beyond data sheets and to the heart of the debate over the failed low-tax, low-spend, low-investment, low-service model that Ireland has pursued.

* * *

So where does all this leave us?

-

Ronan’s selection of data was just that – selective. He presented only those categories that might suit his argument and ignored other, more inconvenient ones.

-

Were Irish primary school teachers’ pay aligned with the hourly EU average – we would be paying most teachers more and/or cutting their working time in the classroom. If the latter, this would require employing more teachers.

-

Most of all, Ronan does the debate over public sector pay a disservice by employing these sleigh-of-hands and not discussing the full range of data.

What both Ronan and I have done is analyse the raw salary tables. Neither of us have factored in the working conditions of teachers (Irish classrooms are some of the largest in the industrialised world). And even Pat Leahy accepts:

'. . . the consistently high scores achieved by Irish pupils in international rankings suggest that they (teachers) should be paid more than in many other countries.'

Were these two factors accounted for, we might come up with a more complete – and completely different – picture than what Ronan presents.

If there are pay anomalies let’s find out what they are. I, for one, wouldn’t be surprised to find them. In fact, the shocker would be if there were none – either in the private or public sector; especially given that we have one of the highest income and wealth inequalities in the EU. Anomalies feature in even the most efficient and egalitarian systems.

It’s one thing, though, to do the hard work to bring those anomalies to light, never mind address them in a rational and beneficial manner. It’s quite another to selectively use data to support a misleading (to put it mildly) generalisation.

Ronan recommends that we look up the ‘facts’ on the OECD website:

‘. . . even if you hate absolutely everything I’m saying here, do take the opportunity to wander around its facts and figures.’

I’d recommend that Ronan do just that. And this time, look at all the data – not just those he doesn’t hate.

Leave a reply to Nike Lunar Max Cancel reply