The RTE Prime Time programme last night contained some of the most misleading (to put it mildly) presentation of facts and subsequent analysis to have been aired in a long time. Make no mistake about it: we are being prepared for the economic abattoir. And if you need any proof that the Left is rapidly losing this debate, indeed is not even at the debate, you only need to watch this programme. And be afraid.

The RTE Prime Time programme last night contained some of the most misleading (to put it mildly) presentation of facts and subsequent analysis to have been aired in a long time. Make no mistake about it: we are being prepared for the economic abattoir. And if you need any proof that the Left is rapidly losing this debate, indeed is not even at the debate, you only need to watch this programme. And be afraid.

It started with Government bonds. This may not be sexiest topic, but as I mentioned before – this is where the battle lines are being drawn: over wage cuts, over public spending cuts, over general tax increases; for deflationary policies that will hollow out the economy and living standards for years to come.

Strangely, yesterday should have been good news. The National Treasury Management Agency successfully sold a €4 billion Bond issue. Chicken Little commentators have been saying that Irish public finances are getting so bad that investors wouldn’t put up money for the Government to borrow. But the NTMA confounded this analysis. Investors are still ‘buying’ Government debt.

Prime Time acknowledged that – but only grudgingly, and then dismissed it. Instead, it focused on the ‘cost of borrowing’. The NTMA has to pay out 4 percent for the bond issue. That’s 2 percent more than what the German government has to pay. Much was made of the fact that last September, Irish and German rates were pretty much the same. Thus,this widening gap is proof that international investors, concerned that Ireland might default on its debt owing to the budget crisis, was forcing a higher price on Irish borrowing. Soon, they might stop lending to Ireland altogether. Then, Armageddon.

Let’s deconstruct this pottage and first praise the work of the NTMA – a public sector agency. While commentators have been saying no one will invest in us, the NTMA has actually issue two bonds in the last six weeks: €6 billion in January and €4 billion a few days ago. According to the NTMA, this constitutes 40 percent of our total borrowing requirement this year. And we’re not even two months into 2009. But here’s the real knee slapper: not only are investors not running away from Irish borrowing, they are, in fact queuing up and even being turned away – so high is the demand for our bonds.

-

In January, the NTMA launched a €3 billion bond. They got subscription requests of more than €7 billion. Thus, the NTMA decided to double the bond but even doing this, they had to turn investors away.

-

In the last bond issue for €4 billion, they got requests totalling over €5 billion. Again, they had to turn investors away. That certainly doesn’t sound like 'the markets' turning their backs on Ireland.

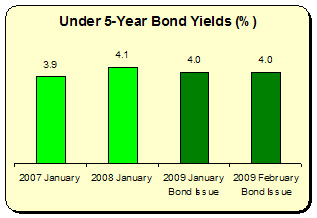

So what about our borrowing costs? Yes, they are high compared to Germany but as discussed here before, that is not due to Ireland’s fiscal crisis. Let’s chart this.

Irish borrowing costs have remained remarkably consistent. They are no higher or lower than they were two years ago. If investors were ‘pricing’ our borrowing costs out of the market – we should have seen some evidence of this through rising bond yields. We haven’t.

Irish borrowing costs have remained remarkably consistent. They are no higher or lower than they were two years ago. If investors were ‘pricing’ our borrowing costs out of the market – we should have seen some evidence of this through rising bond yields. We haven’t.

Yes, while our costs have remained static, those in other countries – most of them with debt levels much higher than ours – have fallen. This fall started to occur in the autumn of last year when investors fled the equities market in search of ‘safe havens’, of which Government bonds are one of the safest. This high demand lowered the costs of borrowing.

So why didn’t this happen in Ireland? Well, there was that little thing –the bank guarantee. The State took on a potential liability of more than twice our GDP. If that’s not designed to inflate our borrowing costs, I don’t know what is. Prime Time managed to obfuscate this issue. The recent drain on our deposits (i.e. money fleeing the country) was somehow conflated with our public finances, when in reality it is directly attributable to a collapse in confidence in our banking system – guarantee or no guarantee. The Government is vainly trying to prop up dead banks – and this is what is driving our borrowing costs. So how is this played out in the real world?

When Prime Time went to the panel for ‘analysis’, I just held my head in my hands. You couldn’t select a more one-sided panel of deflationists, real devaluationistsand fiscal conservatives: Dan O’Brien, Dr. Alan Ahearne, and Senator Shane Ross, with George Lee adding colour. What was their collective wisdom?

- Cut public expenditure

- Pile on tax after tax after tax on working people’s incomes

- Cut wages

On the way, some decent points were made. Senator Ross was correct when he described the Government’s failure to come clean with the people regarding the banking mess (‘everything’s opaque, everything’s hidden’). Alan Ahearne at least referred to the need to get the economy growing

'We need some sectors in the economy that are going to grow – and that’s all got to do with exports. That’s the way we’re going to grow out of this.'

True, too true. But he didn’t square this ‘getting sectors to grow’ with his prescriptions which would further depress economic activity (save for his claim that we have to cut wages which would have almost no effect in our modern export sector).

So this is how the debate is being played out.

- Misrepresent the facts about our borrowing capacity and debt levels

- Confuse the issues of our public finances with our banking system

- On the basis of that – argue for fiscal ‘consolidation’, ‘adjustment’, ‘retrenchment’

Banal words disguising the fact that there is, now, nothing safe from these deflationists. We have had calls for cuts in wages, cuts in social welfare (Richard Tol wanting to cut fuel allowances – people can just break up their furniture for fuel); cuts in all government programmes; even that once sacred cow – capital investment – is now a target for cuts, as Peter Sutherland proposed. Cut our living standards today, cut our living standards for the future – it’s all of a piece.

The divide in the economic argument is not so much between ‘left and right’ or ‘IBEC and ICTU’ or the ‘Government and opposition’: they still persist, they still inform (but as Enda Kenny proved on his Morning Ireland interview – the difference between Fianna Fail and Fine Gael is one of form, not content). It’s not even about ‘sharing the burden fairly’ for deflationary policies are wrong in principle. Regardless of who ‘carries the burden’, everyone will suffer.

The Left has yet to challenge the core contentions in this debate – not in a systematic and detailed way. What is our fiscal strategy to buttress a stimulus programme? Where and how can we create thousands of jobs – especially in the market economy – and save thousands more? How can we prevent our skill base from being stripped and thrown away (e.g. SR Technics)? What are the interventionist tools that we can employ and, if needed, to invent? And why are tax increases on low-to-average incomes wrong and why are public spending cuts wrong – beyond the ‘share the burden fairly’ argument? The Left is not leading the debate, it is following it.

And the ultimate divide in this debate is between those want to deflate the economy – cut it and trash it – and those who want to stimulate it, reflate it, grow it. That dividing line could throw up all sorts of new, curious, if only temporary alliances. But this is the new line in the sand and the Left should work with all those on the progressive side.

And between the two sides of this divide there is no compromise, no partnership, no ‘patriotic everybody’s-shoulder-to-the-wheel’. There is, as some have stated, a ‘fight for our economic lives’.

The only issue is - who will win. The first step is to enter the debate.

Leave a reply to Donagh Cancel reply