We have an affordability deficit. Even with low unemployment, solid job creation, relatively low inflation and reasonable economic growth, nearly half of households are finding it difficult making ends meet.

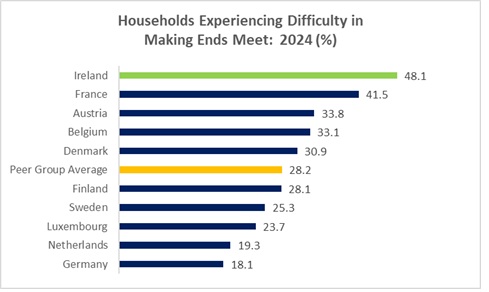

According to Eurostat, 48 percent of Irish households find it difficult to make ends meet, whether ‘difficult’, ‘fairly difficult’ or with ‘great difficulty.’ This compares to an average of 28 percent among our EU peer group – other high-income economies. That is a big gap.

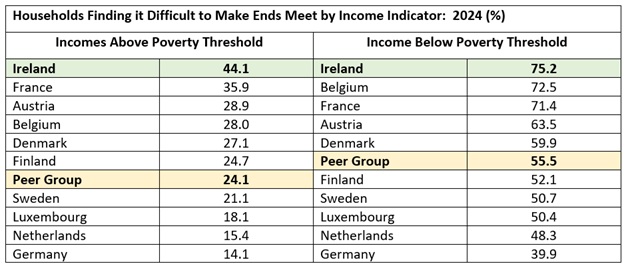

This difficulty is not confined to ‘poor’ households. For those households who are not at risk of poverty (by and large, households with one or two people in work), difficulties in making ends meet is still high.

For Irish households above the at-risk poverty threshold, 44 percent are having difficulties making ends meet. This compares to a peer group average of 24 percent – nearly half the Irish rate.

For those households at-risk of poverty, the situation is even grimmer: three-quarters are finding it difficult making ends meet.

A couple of more indicators:

- 56 percent of Irish households with dependent children are finding it difficult to make ends meet. This contrasts with 33 percent in our peer group.

- 55 percent of people with a disability find it difficult to make ends meet; again, in contrast with 36 percent in our peer group.

Households are facing a pincer movement of high prices and inadequate incomes. Even two-income households which, on paper, look to be comfortable can come under pressures with children, a mortgage, childcare fees, energy and commute costs.

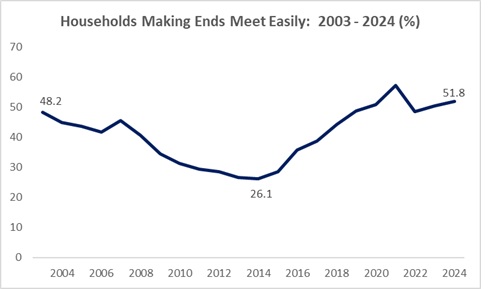

But for every household who experiences difficulties, there is a household making ends meet ‘easily’. 52 percent of households make ends meet ‘easily’, ‘fairly easily’ or ‘very easily’ (this contrasts with 72 percent in our peer group). But this doesn’t necessarily capture the full ‘life quality’ picture.

It may be easy for someone to make ends meet, but that doesn’t reduce the amount of time spent in traffic congestion, or reduce travel to work times. Making ends meet ‘easily’ doesn’t reduce waiting times in ER departments, or ease the financial situation of your adult children stuck with high rents.

Making ends meet ‘easily’ can also be precarious for many households.

Prior to the crash, 45 percent of households were making ends meet easily. However, after a few years of recession and austerity, this rate fell to 26 percent. The ‘easy’ life turned out to be fragile in the face of economic decline, rising unemployment and falling incomes.

Some Joined-Up Thinking

We need joined up-thinking in a multi-pronged strategy to give people a chance to make ends meet easily.

- Wages and Incomes: to boost wages we need collective bargaining – enterprise and sectoral – coupled with abolishing hourly low-pay by raising the minimum wage to the low-pay threshold; in 2026, that would mean approximately €16.00 per hour. Social Protection rates should ensure a minimum essential standard of living with increases linked to average wage increases.

- Reducing Living Costs: end pro-cyclical fiscal policies which fuel inflationary pressures (i.e. bring the underlying budget into balance and even surplus); provide affordable housing – both home purchase and rents – based on construction costs (which make up only 50 percent of market prices); reshape market prices (energy and block tariffs), and employ price regulation where appropriate.

- Universal Basic Services: provide public services for free or at rates so low they are not a barrier to access or result in financial burden. Free healthcare – including GP care and prescription medicine, truly free education, free childcare and public transport: the latter two would each dost the same price as cutting the VAT rate for hospitality.

- Access to Employment: even with low unemployment rates there are still 170,000 people outside the labour force (which means they are not counted as ‘unemployed’) but who want to work. The main reasons stopping them include caring duties and disability. Facilitating higher employment rates for those who want to work can help people make ends meet and alleviate labour shortages.

Temporary measures don’t necessarily address the structural issues behind living costs. There is a danger that subsidies will chase prices and while such supports can provide relief in the short-term, it can merely kick the affordability can down the road.

What progressives can do is provide a road-map to affordability by prioritising the many strategies needed to ensure that people can make ends meet without difficulty.

This should be seen as one of the foundations of an alternative government.

Leave a comment