Voices are growing louder. Government spending is getting out of control: ‘surging public spending’, ‘rising faster than planned’, ‘fiscal incontinence’; and the killer punch: public spending has doubled over the last 10 years. Reining in public spending is back on the agenda.

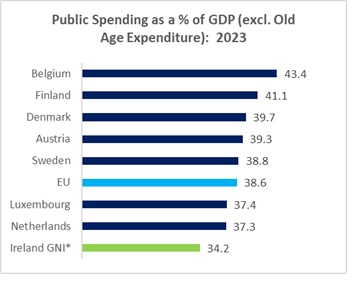

The reality is that we don’t spend enough – not nearly enough; not when we compare our spending to other EU countries. Such comparisons can be tricky, especially considering that so spending in other EU countries is driven by a high proportion of older people – much higher than Ireland. So the following excludes expenditure on older people – pensions, other social transfers and in-kind expenditure.

Not only is Ireland at the bottom of our EU Peer Group table (other small advanced open EU economies), it is well below the overall EU average. Among all EU countries Ireland ranks 21st out of 27 when it comes to spending, measured as a percentage of national income. We’d have to spend an extra €12.9 billion to reach the EU average.

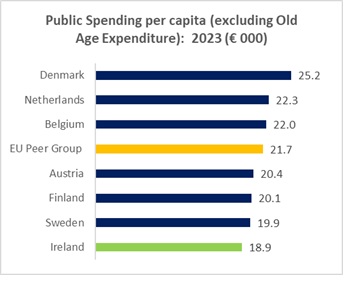

Another way of comparing public spending is to break it down by population; that is, public spending per capita. Again, we exclude old age expenditure.

This is a like-for-like comparison with other high-income economies. We exclude EU per capita expenditure (which is lower than Irish levels as it includes the nominal spending of much poorer economies such as Romania and Bulgaria).

And we find that Ireland is, again, at the bottom of the table. Spending on a per capita basis would have to rise by nearly 15 percent, or €14.7 billion. This is consistent with the results from the national income approach above.

- We would have to spend between an additional €13 billion to €15 billion to reach EU averages, depending on which measure is used. We don’t spend too much; we spend comparatively too little.

Spending Growth

What about the assertion that public spending has doubled over the last 10 years?

- In 2014 public spending was €73.3 billion

- In 2024 public spending rose to €125.1 billion

That’s a 71 percent increase, not doubling. But let’s drill further into this – by looking at per capita growth (which is the proper way to measure increases in both national income and government finances).

Between 2014 and 2024, public spending per capita rose by 48 percent. That’s a long ways from doubling. How does this compare with EU growth? EU public spending growth per capita rose by 49 percent during this same period.

So what have got so far?

- Ireland is a chronic and substantial under-spender compared to the EU and, in particular, our peer group.

- Irish public spending grew at a marginally lower rate than the EU average over the last decade.

So much for public spending being out of control.

The Real Problems with Fiscal Policy

The debate over how much we spend acts to gloss over the serious flaws in the Government’s fiscal policy. First, the economy is generating a budget deficit – described as an underlying deficit – not a surplus. It only turns into a surplus when, as one colleague put it, you count the ‘magic beans’ of the excess corporate tax receipts. With the economy at near-full capacity this is a recipe for fuelling inflationary pressures. You’d think there should be some attention to this risk given that, once again, Ireland has the highest prices in the EU, bar Denmark.

Second, running an effective deficit at this point in the economic cycle is negligent fiscal management. If the Central Bank’s worst, or even second worst, scenario comes true, we’ll be wasting the excess corporate tax receipts subsidising our underlying deficit – at a time when the excess receipts are falling and the underlying deficit is rising. We’ll be quickly back to debating spending cuts or tax increases; that is, austerity.

This state of affairs will challenge progressives. If we want to increase spending we will have to raise tax revenue. Building affordable houses, free health care, free education from pre-primary to third level, free or affordable childcare and public transport, stronger in-work benefits and poverty-reducing supports – as well as repairing our infrastructural deficits): this will cost money. If we don’t raise tax revenue, we will have to do without.

The Commission on Taxation provides a helpful template. Though one doesn’t have to support every proposal, its emphasis on raising tax revenue from capital, wealth, property and assets is both economically efficient and socially progressive. This, along with increasing employers’ PRSI and reducing or removing inefficient tax reliefs, would raise significant amounts.

The Left should have nothing to do with cutting taxes. We’re already in the hole by running an underlying deficit. We’ll just dig the hole deeper by pushing for tax cuts. Then, how are we going to close that gap between ourselves and our peer group?

Progressives can start to shape the fiscal debate and show the current coalition to be reckless. But we need the right framing, innovative policy responses, proposals to drive productivity (which can also be a source of new revenue) and no small amount of political confidence.

Leave a comment