Ibec’s Danny McCoy stated:

‘The most catastrophic mistake would be to try to index wage increases to price increases.’

Why? I suppose it has something to do with that wage-price spiral notion – the idea that wage increases to protect people from inflation will drive further inflation. There’s not much evidence for this, though. Recently, a senior economist at the IMF dismissed the idea.

‘A leading economist from the International Monetary Fund (IMF) has dismissed concerns that wage increases to help workers deal with rising living costs will spark a wage-price spiral. Gita Gopinath, first deputy managing director at the IMF, said during a panel discussion at the World Economic Forum in Davos on Wednesday that it is possible that wages could rise without driving inflation higher, with company profits declining instead.’

Oh, so maybe it’s not about wages and prices at all. Maybe its about profits. That’s what Aiden Regan thinks. Writing in the Business Post, Aiden explains.

‘. . . wages are not responsible for price increases today. On the contrary: increased corporate profits are. Big corporations with pricing power are taking advantage of supply chain bottlenecks and increasing prices over and above their labour and non-wage costs. This corporate profiteering coupled with rising energy prices, is what’s mostly responsible for the price increases that have occurred in the post-pandemic recovery period.’

In the US, the Economic Policy Institute estimates that in the six quarters to the end of 2021, profits contributed 54 percent to unit price increases with non-labour costs contributing 38 percent. Unit labour costs contributed only 8 percent. Fortune, the business publication, headlined a recent article:

‘U.S. companies post their biggest profit growth in decades by jacking up prices during the pandemic’.

Is this happening here? We don’t know. Irish data is not reliable due to multi-national accounting distortions (i.e. tax haven-type activities). The data coming from our peer group in the EU (other high-income countries) can give us a better read.

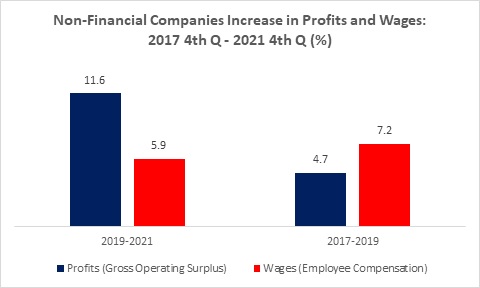

In the two years during the pandemic, profits in non-financial companies grew at nearly twice the rate as wages. This was a turnaround from the preceding two years – 2017-2019 – when wage growth outstripped profits. It is likely that Irish profit growth mirrors the wider European trend, if not exceeding it, given the weakness in Irish labour’s bargaining power.

It certainly does appear that energy companies are benefitting. Minister for Finance Paschal Donohoe stated that officials in his department ‘are evaluating the potential for such a proposal’ – that is, an excess profits tax. A 10 per cent tax would generate €60 million, based on energy providers' 2020 tax returns. This implies that energy companies have pulled in €600 million in excess profits. It would be interesting to make similar investigations throughout sectors where prices are also rising significantly.

There is, though, considerable pessimism regarding the possibility of obtaining wage increases to help off-set the impact of inflation. The Central Bank recently published the results of a survey of people’s wage expectations over the next year.

Slightly over half expect wages to stay about the same. While 31 percent expect a slight increase in earnings (with 2 percent expecting a lot) 14 percent expect a fall. This pessimism is growing. The same survey showed that only two months previously, in February, only 7.7 percent expected a decrease.

Wage falls and effective wage freezes will only exacerbate consumer spending in a high inflation environment. And the National Competitiveness and Productivity Council warned about this impact on consumer spending.

“Domestically focused SMEs can also be negatively impacted by lower discretionary consumer spending, as Irish individuals are forced to allocate more of their household budget to the essential goods and services whose prices have risen.”

So, pessimistic wage expectations and negative impacts arising from such pessimism. Mark Paul makes some provocative comments:

“Policymakers need to start coming up with better answers for workers than lumping responsibility on to their shoulders for a phenomenon — inflation — of which they are more victims than perpetrators . . . Some major corporate entities are pushing through price increases but also promising shareholders they will resume or increase dividends. It is increasingly difficult to preach pay restraint to workers when many captains of industry, and the investors for whom they work, remain so well paid . . . There is little evidence so far of any wage-price spirals in Ireland or anywhere in Europe. But there is plenty of evidence that profitable employers will have to get real on pay.”

So what should be the response? Raise wage expectations. Act on those expectations. Join a union. Make pay demands. Wage increases will be good for the economy.

The Government could kick start this by doing two things: capping energy prices and providing a supplemental increase in the national minimum wage (France and Belgium did this a few months ago). This would show the Government is attempting to get to grips with prices and living standards.

It’s not the only things they should do. But it would be a good start.

Leave a comment