When is an economy out of recession? When it returns to and exceeds the level at which it entered the recession. The economy exited the recession in 2014 – the year in which GDP and GNP exceeded the pre-crash levels. Seven years of recession but now we’re on the way; at least until the next slump.

But this doesn’t tell the full story. What about people’s incomes? Here the news is not so good. People’s incomes are still in recession. The CSO provides data on gross income and disposable income (after taxation) per capita. This data only goes up to 2014. I have stretched this out to 2017 based on ESRI estimates – so beyond 2014, these are just projections.

In 2014 – the last year we have CSO data – incomes were well below their peak: gross incomes were 11 percent below 2008 levels while disposable incomes were 15 percent below.

Based on the ESRI projections, gross incomes will not recover pre-crash levels until 2017 while disposable incomes will not recover until 2018 – a full decade of incomes recession.

Some will argue that incomes rose too high, too fast in the years preceding the recession. It certainly was the case that the entire economy including public finances and living costs were inflated by property boom. But even in this, real wages in the services sector rose at about half the national rate and in real nominal terms experienced the same growth as other EU-15 and sometimes less. In many instances, wage rises were going on rising childcare costs, health insurance, etc. The headline figures don’t tell the full story.

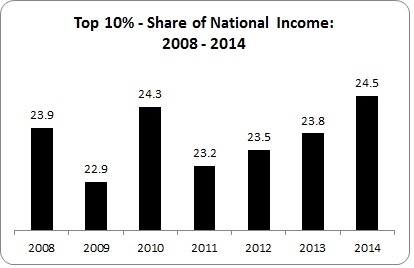

Of course, the above is just the average. It doesn’t tell us anything about the distribution of incomes – which groups have lost out, which groups have managed to protect and even increase their incomes. We can get some insight into this – but only up to 2014.

While it was a bit of a roller-coaster in the early years of the recession, since 2011 the top 10 percent income group have steadily increased their share of total national income. In 2014 – the year that average incomes started rising again – growth for the top 10 percent accelerated. Currently, the Irish top 10 percent income group takes the fifth highest amount of national income in the EU-15. We will have to wait on data to see if this is a trend with traction but so far the signs are not good.

The Irish political economy seems to have a problem in translating economic growth into incomes. While in 2017 gross incomes will only be marginally above 2008 levels (2.6 percent), real GDP levels will be over 20 percent higher (over 15 percent for GNP). As we proceed to the end of the decade, incomes should start to catch up.

But the big question is how equally the growth in those incomes will be distributed.

Cue the new Government.

Leave a comment