The Programme for Government has provision for cutting inheritance tax. This is bleak business. Cutting inheritance tax will be a bonanza for high-income groups. Welcome to the new politics, inseparable from the old politics.

The Government proposes to increase the tax-free threshold from the current €280,000 to €500,000. The regressive impact can be seen from this simple example. I inherit €500,000. Currently, I would pay 33 percent on the amount exceeding the threshold; that is €220,000. My tax bill would be €72,600. That is an effective tax rate of 14.5 percent. That’s not a bad deal (and arguably already too generous): I inherit half-a-million Euros and keep 85 percent of it after tax.

Under the new proposals, I would pay nothing.

There are many arguments for cutting inheritance tax but the most unimpressive is that it would somehow benefit low and middle income earners. The fact is that most people don’t have even the current threshold to give away in an inheritance.

The median net wealth (wealth after debts) for those aged over 64 years is €202,300. This means that 50 percent of this older-age group has net wealth less than this amount. That includes both financial and real (property) wealth. It is reasonable to assume that a significant majority have net wealth holdings of less than the current threshold of €280,000. Of course, not all disponers come from the older-age group but probably a majority does.

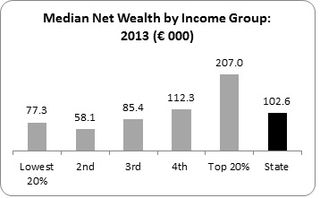

When we look at the national numbers we can get data on income distribution. The following table shows the median net wealth by quintile – or tranches of 20 percent.

The top 20 percent income earners have a median net wealth of €207,000 (again, meaning half of this group have a wealth of less than this amount). Throughout the state, half of all households have a net wealth holding of less than €103,000. [Note: the lowest income group has a median net wealth holding higher than the 2nd quintile; this can be explained by the fact the lowest group would contain older age groups reliant on state pensions but own their houses).

The top 20 percent income earners have a median net wealth of €207,000 (again, meaning half of this group have a wealth of less than this amount). Throughout the state, half of all households have a net wealth holding of less than €103,000. [Note: the lowest income group has a median net wealth holding higher than the 2nd quintile; this can be explained by the fact the lowest group would contain older age groups reliant on state pensions but own their houses).

Based on this, it is reasonable to assume that raising the inheritance tax threshold will have no impact on a significant majority of households.

Even if a household has a much higher level of wealth than the average, raising the thresholds may have little impact. I may pass on €500,000 on an inheritance but if I divide it equally between my two children, then they won’t be liable to tax under the current threshold.

Some argue that the gift/inheritance shouldn’t be taxed because it has already been taxed. This is debateable for two reasons. First, it is taxed in the hands of the recipient who, by definition, is only receiving it for the first time. Second, income is subject to multiple taxes (or double/triple, etc. taxation). I pay income tax on my wage. But I also pay USC on my wage; and PRSI. After tax, I continue to pay taxes – VAT, excise taxes, levies (ATM withdrawals, etc.). And the after-tax income that I spend in the shops is also subject to taxation; corporate tax for the business and income taxes for the employees. And so the cycle continues.

Still others have referred to the situation whereby a son/daughter inherits a house – but is forced to sell the ‘family home’ to pay the tax bill. Is this just anecdotal? I receive a house in an inheritance. If I already own a home, I have inherited a second home (adding substantially to my wealth). I can either rent out the house, earning income; or I can sell it. Either way, I receive a substantial gain – even after the tax bill.

If I rent, I can move into the house with full equity and increase my income through reduced rent payments. The tax bill is a once-off, my rent reduction is permanent. This is not to say there are not issues regarding inheritances and payments – I look at some of them below. But gaining a house through inheritance is a gift of a substantial asset.

The cut in inheritance tax is estimated to cost €75 million, not a trifling sum. However, the real issue is that ever since estate duties were abolished and replaced by the Capital Acquisitions Tax, inheritance tax revenue has been subdued.

There is a strong argument for an increase in inheritance and gift taxes, especially give these tight fiscal times. This argument gains force when we consider that this is a tax on unearned income. We tax unearned income so that we don’t have to impose that amount on earned income – a PAYE wage or the income of the self-employed or a business. Economic efficiency would see higher, not lower, taxation on unearned income.

There are three issues that could be considered in the context of a more progressive inheritance tax regime. First, is the issue of inheriting a house; currently, there is an implication that a child who is living in the ‘family home’ can only inherit tax-free if the parent is not living in the house (in other words, the parents have two houses). There are exceptions for those caring for a parent. If there is a problem in this area it should be cleared – so that a child living in the house, with conditions, is not barred because they share the house with the parent.

Second, consideration should be given to extending the situations whereby the inheritance tax can be paid over 60 months.

Third, prior to 1999, there are varying rates for inheritances – ranging from 20 percent to 40 percent. This added a progressive element to the tax. Reintroducing a low rate and top rate could also be considered.

But if we entering into an era of ‘new politics’ then the Government should bring forward evidence as to the distributional impact of cutting inheritance tax – who will gain and by how much? Is this a transfer to high-income groups from the rest of us?

In any event it will be interesting to see how the Government squares this commitment to cut inheritance tax with a commitment in the Government programme to poverty-proofing new policies.

I suspect it can’t be done.

Leave a comment