Don’t be taken in by the spin. Social protection payments have not been

protected. Not ‘core’ payments, not ‘non-core’

payments, not any payments. They have

been cut in actual terms, they have been cut in real terms, they have been cut in value. This is why people’s living standards

continue to deteriorate. The Government

claims they are protecting social protection payments. This claim is false.

Before we get into the main argument, though, let’s clear

something up. When people complain that

social protection payments are actually being cut – like Child Benefit, rent

supplement and other programmes – the Government insists that the only social

protection payments they were referring to was ‘core’ payments, or ‘basic’

payments or (and I’ve heard this used) ‘core, basic’ payments. This is not true. This is what the

Programme for Government states:

‘We will maintain

social welfare rates.’

There is no mention of ‘basic’ or ‘core’ in any other

adjective.

Nonetheless, ‘core’ social protection payments been cut and

I’m not just referring to payments to young people or invalidity pension to

those aged 65; all core payments have been cut in the real world we live in.

My €100 this year is cut by the level of inflation next

year. If inflation runs at 2 percent,

then my €100 is cut by 2 percent. It is

now worth only €98. I can only purchase €98

worth of goods and services. My living standard falls.

This is what is happening with all social protection

rates. And the cuts are

considerable. Let’s look at a few

examples involving households without children.

The Government’s failure to protect social protection

payments has resulted in substantial real

cuts (after inflation) in social protection payments. For a single pensioner, the cut is over €39

monthly while for a pensioner couple it is nearly €75. For the unemployed, it has been between €32

and €53 for single and a couple respectively.

Those on carers’ benefit have experienced a cut of €35 monthly. These all represent a real cut of 3.8 percent. This is substantial if you are on the poverty

line.

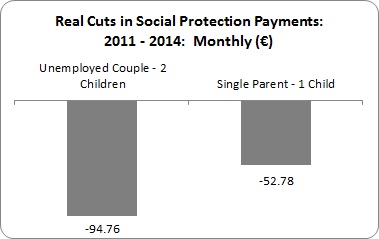

For households with children the cuts have been considerably

higher – especially given the nominal (actual) cut in Child Benefit.

For an unemployed couple with two children, the monthly real

cut is €95 per month – or 4.8 percent; for a single parent with one child, the

cut is €53 per month – or 4.7 percent.

This hardly constitutes ‘protection’.

Unfortunately, we only have data up to 2011 but the

CSO’s deprivation rate gives us some idea of how people are being

protected:

- 42.4 percent of the unemployed are officially categorised as

‘deprived’ (experiencing multiple deprivation experiences) - 35.9 percent of those unable to work due to illness or

disability - 14.2 percent of single elderly living alone

- 52 percent of those living in local authority housing (‘Rented

at below the market rate or rent free’) - 56 percent of single parents

Regarding the latter, as this would include all single

parents, the deprivation rate among those without work, or working part-time,

would be even higher.

We don’t know the trend since 2011. However, we can reasonably assume that real

cuts in social protection payments, combined with cuts to public services (cutting

home-help services for the elderly, cuts in disability support) is likely to

put upward pressure on deprivation rates.

Increasing social protection payments is not the solution to

ending deprivation or poverty but it is a crucial element. How would unemployed households with two

children fare if social protection payments had been protected, if payments were

€95 higher per month than they are now?

They would still be under pressure; they would still be living below the

relative poverty line (nearly 12 percent below). But it would be better. And better is better than not better.

Could the Government have addressed this in the last

budget? Yes. Social

Justice Ireland shows that a small increase in social protection payments –

2.7 percent, or €5 weekly for a single person – would only cost €231 million in

gross terms. I emphasise ‘gross’

because, given the high propensity to spend of low-income groups, almost all of

this would be returned to the economy.

The Nevin Economic Research Institute estimates that, after factoring in

the positive impacts (higher consumer spending, higher employment as a result),

SJI’s proposal would cost only €126 million in net terms.

€126 million? That’s

less than 0.1 percent of GDP. It would

have effectively had no impact on the deficit.

And if the Government had introduced a modest wealth tax – along

the lines suggested by Tom McDonnell – the deficit would have decline even

more than currently planned (or enact any number of tax proposals that would

impact on high income groups such as capital tax increases, etc.).

So there was a choice.

The Government made theirs. They decided

to let the living standards of those mired in poverty and deprivation fall even

further.

They decided not to protect social protection payments.

Leave a comment