In the run-up to the budget all the talk is of how many jobs

will be destroyed as a result of Government measures. Well, not really. But it should be. Ministers and Government backbenchers are

fond of quoting one measurement of employment that suggests 30,000 jobs

were created in the last year. Never

mind that this comes with so many caveats and represents ‘data-dredging’ (searching

for one or two stats that puts you in a good light regardless of the context). What they never, ever mention is that their

austerity measures are actually destroying thousands of jobs.

No one doubts that spending cuts and tax increases lowers

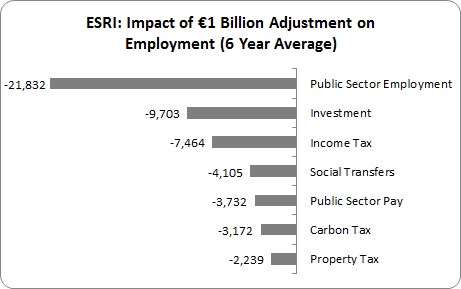

economic growth; this in turn lowers employment. The only question is how many jobs are being lost. I will summarise the estimates from the ESRI

and NERI, based on an adjustment of €1 billion (e.g. a €1 billion cut in social

protection payments, a €1 billion increase in property tax, etc.).

Not surprising, all measures destroy jobs. The biggest culprit is reducing public sector

numbers (this helps explain why cutting

public sector numbers actually increases the debt). The second biggest negative impact is

investment. The two adjustments that

have the least impact on employment are carbon and property tax. There are a few points to bear in mind:

First, the projection for investment is an

under-estimate. The ESRI does not

include the ‘supply-side’ impact (that is, the loss in employment from not

using the asset created by the investment – a road, building, telecommunication

network, etc.). According to the ESRI,

this under-estimate is ‘significant’.

Second, income tax has the third most negative impact. These estimates are an average of the impact

over six years. The impact varies over time. For instance, increasing income tax has only a

negligible impact in the first year it is introduced (reduces employment by

1,860). However, the deflationary

impact accelerates over the years so that by the fifth year the impact is

nearly five times that amount. I have

used the average.

Another feature of the income tax estimate is that it is

based on raising tax on all income groups.

It is reasonable to assume that if tax were increased on high-income

groups only (e.g. reducing tax reliefs) the impact on employment would be

lower.

NERI has also provided estimates.

In the NERI estimates, investment has the most negative

impact. While it is in excess of the

ESRI estimate, it includes the supply-side impact. In second place, is non-wage consumption; NERI doesn’t estimate reductions in public sector numbers. This refers to contracts to the private

sector for goods and services that are used in producing public services (e.g.

purchase of blackboards, hospital beds, computers and erasers). A big difference with the ESRI is the impact

of social transfers; under NERI the impact is twice as negative. The least negative impact is capital taxes.

It would be tempting (and I’ll give in to temptation below)

to try to break all this down and estimate the job destruction that occurred in

the last two budgets. A problem with

this approach is that the categories above do not neatly fit into the budgetary

items. Further, NERI and the ESRI use different

categories and different methodologies so mixing them together is not wholly satisfactory. So let’s just

take a snapshot of the different measures the Government has introduced over

the last two budgets and see what NERI and the ESRI estimate:

- Investment: the Government has cut public investment by

approximately €1 billion in the previous two budgets. NERI estimates a loss of between 18,000 and

19,000 jobs; the ESRI estimates a loss of between 9,000 and 10,000 (but

remember, the ESRI admits their estimate in this category is an

under-estimate).

- Indirect Taxes

(VAT and Excise): the Government has

raised approximately €1 billion in this category. NERI estimated job loss: between 9,000 and 10,000.

- Social Transfers: the Government has cut social transfers by

approximately €1.3 billion according to the budget papers but some were not

implemented (the 7 year-old rule for single parents). So let’s call this an even billion. NERI estimated job losses: between 9,000 and 10,000. ESRI estimated job losses: 4,000.

- Reductions in Public

Sector Numbers: Since the Government

has taken office, public sector numbers have fallen by 12,000. ESRI estimated job loss: 14,500.

- Non-Wage Consumption: this has remained stable over the last two

years but in 2014 the Government intends to cut this by approximately €300

million. NERI estimated job loss: between 3,000 and 3,500.

- Property Tax: this

tax is being introduced in two phases. The

ESRI estimated job loss, when the full property tax is implemented next year:

between 1,000 and 1,250.

Taken together, these are substantial job destruction

figures. It is difficult to be precise –

not only because all the pieces of estimates and adjustments don’t fit; but we

are dealing with models and averages.

But a ball-park figure would be that Budget 2012 and 2013 combined

resulted in the destruction of between 43,000 and 57,000. In other words, if there were no fiscal

adjustments, there would be approximately 50,000 more people at work. And this doesn’t count all tax measures (e.g.

capital). That’s a lot of jobs. Even if this crude estimate is off by 25

percent –this is huge.

That’s why it is a bit galling to hear Ministers say they

are 100 percent focused on job creation (and releasing statements every time the IDA

and Enterprise Ireland announce a new project) when at the same time they are

destroying tens of thousands of jobs.

All fiscal adjustments impact on employment – even ‘taxing

the rich’. Smart fiscal management would

pursue adjustments with the least impact on employment while promoting job

creation through higher investment and more productive use of current spending. Unfortunately, there is a shortage of smarts

among our rulers.

There is all this debate about whether Budget 2014 will have

€3.1 billion adjustments or €2.8 billion or €2.5 billion. What a great diversion. What we should really be debating is how many

thousands of jobs will be destroyed by Budget 2014.

Based on the past two budgets, it will be a lot.

NOTE: I’d like to

thank the Nevin Economic Research Institute for forwarding me their

estimates. I understand they will be

publishing their full impact studies shortly.

Leave a comment