Come with me, my payee / To the sea . . . the sea of debt / I want to tell you / How much I owe you

Do you remember when we met? / That’s the day I went into debt / I want to tell you / How much I owe you

With apologies to Phil Philips but his great

song came to mind when I read this little stat in the Fiscal Council’s

latest publication, The

Government’s Balance Sheet after the Crisis: A Comprehensive Perspective

‘Ireland had the fourth highest debt ratio in the Euro Area in 2012,

whereas in 2007 Ireland had the second lowest ratio. (Only three Euro Area

countries had debt-to-GDP ratios in excess of Ireland’s at end-2012 according

to Eurostat estimates: Greece (156.9 per cent), Italy (127.0 per cent) and

Portugal (123.6 per cent).’

Well, I

guess that’s what happens when you bail-out insolvent businesses while at the

same time pursuing austerity policies that actually increase the debt. But I’m afraid it’s worse than the bald

numbers the Fiscal Council presents.

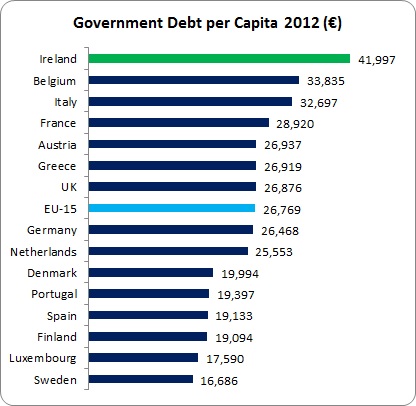

There are

different ways to measure debt – as a percentage of GDP, GNP, etc. But let’s measure it as a burden on people

– for its people who pay off debt. When

we look at

debt per capita this is what we find:

Ireland is

at the top, head and shoulders above all other countries – in particular,

Italy, Greece and Portugal which the Fiscal Council refers to as countries with

a higher debt when measured as a percentage of GDP. Why the difference?

Measurements

which use GDP as the benchmark can distort Irish data given that GDP is

flattered by the accounting practices of multi-nationals. For instance, when using Gross National

Income as the benchmark (which is equivalent to GNP) which removes

international flow such as profit repatriation, debt in Ireland is 143 percent

of GNI. This is the second highest, only

exceeded by Greece. But the fun doesn’t

stop there. The ESRI has found that even

our GNP/GNI is

inflated due to multi-national activities (undistributed profits of

headquartering multi-nationals). If this

was factored out, we’d be reaching Greek levels of debt.

We have to

be cautious with the above table. While

it shows Irish debt per capita as the highest in the EU-15, this doesn’t show

the capacity to absorb and repay debt.

For instance, I may have a high debt level but if my income is high, I

may be able to absorb it. Therefore, the

following shows the relationship between debt and income (GDP) per capita. Given that Irish GDP doesn't adequately

reflect the economy’s real capacity, I will use the Fiscal Council’s hybrid GDP

– a middle ground between two unsatisfactory benchmarks – GDP and GNP. In using this, I will further subtract that

portion of GNP that the ESRI estimates is inflated due to multi-national

accounting practices.

Ireland may

not be at the top – that prize goes to Greece – but we’re nearly there, ahead

of Italy and Portugal. We are an

incredible 75 percent above the EU-15 level of debt.

Many might

conclude that our debt is not sustainable.

In a rational world that might be true.

But this is Ireland.

Sustainability is not just an economic concept; it is a political one as

well. If people believe, however

reluctantly, that there is no alternative but to repay ‘our’ debts (‘our’

includes the debts of insolvent and non-existent businesses), then it will be ‘sustainable’. We will tax ourselves beyond levels which the

economy and households can afford. We

will suffer spending cuts – both nominal and real (i.e. after inflation) – beyond

any levels contemplated in Europe. We

will force the economy to become the handmaiden of debt-repayment. It can be done – provided you are willing to

suffer high levels of unemployment and deprivation, maintain the investment

crisis, and drive wages and incomes downward.

Unfortunately, there is a

political regime here in Ireland that wants to prove there is no debt that

cannot be repaid even if have to wreck livelihoods and

life-chances.

And people will be left to scramble for a life-raft, a buoy, a piece of driftwood –

anything that will keep them afloat in the sea of debt. But most of all, they had better learn to

swim.

NOTE: I will follow this up with a look at household debt. But for now, this is depressing enough.

Leave a comment