In the run-up to the budget all manner of proposals are

being put forward –tax measures, spending cuts.

We debate what sacrifice this or that groups can make to bring us to

the bail-out targets. There is no end of

combinations and computations. But the

one thing that is totally off the table – the one thing that we should never,

ever mention – is what contribution the business sector can make to repairing

the public finances. Pensioners, the

unemployed, low-paid, families – we debate the different ways they can make

continued sacrifices. But the business sector has been ring-fenced, protected,

safe-guarded.

The following estimates what contribution, in terms of tax

and social insurance revenue, the Irish business sector could make if it made

the same contribution as the average business sector in the EU-15 – and how

little Irish business actually does contribute.

Corporate Taxation

Never mind nominal tax rates – it is the effective tax rate

that matters; the percentage of taxation on profits when reliefs, allowances

and exemptions are taken into account. Tom

Healy, Director of the Nevin Economic Research Institute, has an important post

on this subject – pointing out that there are different benchmarks in assessing

the effective tax rate. For the

purposes of international comparison, I will use two estimates: net operating surplus and net entrepreneurial

income.

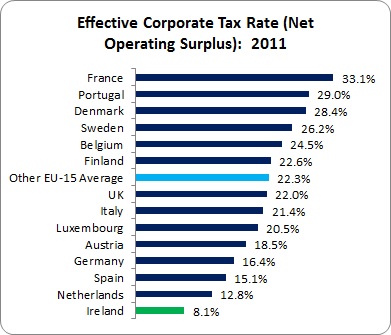

Net Operating Surplus: this traditional measure of profitability is

the amount of value-added left to companies after payroll costs and consumption

of fixed capital (decline in the value of fixed assets); in short, sales minus

costs. This is from Eurostat – here and here:

Ireland, unsurprisingly, is at the bottom of the table. On this basis, the Irish business sector

would have to pay an additional €6.7 billion into the Exchequer to reach the

average of other EU-15 countries.

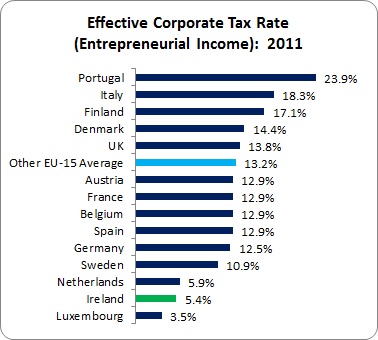

Entrepreneurial

Income: this is probably the better measurement. The CSO

describes it as ‘. . . a more

comprehensive measure of corporate profitability’. Here is Eurostat again:

In this tabulation Luxembourg beats Ireland to the bottom (it’s

worth noting that the EU’s investigation of corporate tax practices have

targeted the three countries at the bottom – Netherlands, Ireland and

Luxembourg). On this basis, the Irish

business sector would have to pay an additional €5.5 billion to reach the

average of other EU-15 countries.

To summarise this section – the Irish business sector would

have pay between €5.5 and €6.7 billion just to reach EU corporate tax averages.

Social Insurance

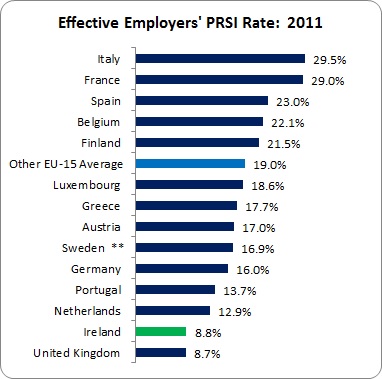

The second category through which employers contribute to

public finances is employer’s social insurance (or PRSI in Ireland). Here there is more certainty as to the actual

effective contribution rate.

Again, Ireland is a bottom-dweller, sharing this position

with the UK. Employers’ PRSI revenue

would have to more than double to reach the average of other EU-15 countries –

an increase of €6.4 billion.

* * *

If we were an average EU economy, if we had an average

business sector, if we had an average balance of taxation revenue – then we

should expect between €11.9 and €13.7 billion more in tax and social insurance revenue

from the business sector. But we don’t

have an average economy or business sector.

The main problem is that much of the corporate profits that are taxed

here are not generated here – they are ‘imported’ from other economies to take

advantage of our low tax rate (but do not, under any circumstances, confuse

this with being a ‘tax haven’ – it is merely ‘tax efficient’; and a gold star

to anyone who can explain the difference).

In any event, we don’t ask the business sector to assist in

the fiscal crisis. In fact, we give them

even more subsidies. In the last budget

there was an extension of the Employment and Investment Incentive, R&D tax

credits, relief for start-up companies, and real estate investment trusts.

The Irish business sector is not a partner in the drive to

repair our public finances. It exists

outside and apart. Repairing public finances is

for little people. Even when a small

increase in the corporate tax rate –2.5 percent – and a small increase in

employers’ PRSI – 1 percent – could, together, raise close to €1.5 billion;

even when after such increases the Irish business sector would still be at the

bottom of the corporate tax and social insurance tables; even this small

contribution cannot be countenanced.

Now, how about cutting even more home helps. And those disability groups – they have more

money than they know what to do with.

And, of course, those darned social protection payments. Who needs the help of the business sector

when there are so many who can take up even more of the burden?

Bring on Budget 2014.

Leave a comment