A number of Government Ministers – Richard Bruton in

particular – have claimed that

the economy is creating 2,000 private sector jobs per month. This is intended to show their policies are

working and that the economy is turning the corner. 2,000 jobs per month – it seems impressive

(until you consider the 290,000 unemployed, the nearly 80,000 on labour activation

schemes, the 156,000 who are working part-time but want to work more; and until

you consider that the Government is actively shedding jobs in the public sector). Still, creating 2,000 private sector jobs per

month is better than losing jobs.

But where does this stat come from? Is it real? Let’s go searching. There

are two data sources for private sector job creation.

Quarterly Household

National Survey

There are two ways to estimate growth: annually and quarterly year-on-year. The former estimates the number in a calendar

year, the latter estimates the growth in one quarter compared to the same

quarter in the previous year.

One problem with the Quarterly

National Household Survey (QNHS) is that we don’t have an annual estimate

of private sector employment. They

changed their methodology and, therefore, some quarters are missing going

back to 2011.

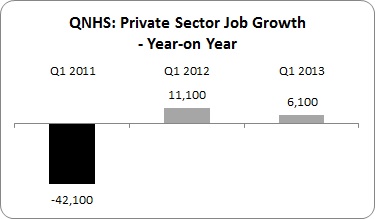

So let’s examine quarterly year-on-year growth in private

sector employment.

In the first quarter of 2011, employment in the private

sector fell by over 42,000 compared to the first quarter of 2010. In the first quarter 2012, the private sector

registered growth year-on-year– over 11,000. In the first quarter of 2013, employment in

the private sector grew again – by 6,100.

There are two things here:

first, private employment in the first quarter of 2013 grew at a slower

pace than in the previous year. You didn’t

hear that from the Government. Second,

6,100 jobs doesn’t equal 2,000 a month – it equals 500 a month.

But even these 500 jobs a month is subject to a number of

caveats:

First, part of this private sector employment increase

includes the Agricultural, Fishing and Forestry sector which the CSO has warned

us about. In the first quarter of 2013,

employment grew 15,800 over the year in this sector – an amazing result. But the CSO has started re-adjusting their

samples to align them with the 2011 census.

They

state:

‘In the case of the

Agriculture, forestry and fishing sector it can be noted that estimates of

employment in this sector have shown to be sensitive to sample changes over

time. Given the introduction of the sample based on the 2011Census of

Population . . . particular caution is warranted in the interpretation of the

trend in this sector at this time.’

Most of this 16,000 statistical increase in employment would

have been in the private sector (there would be some employed in public

enterprises such as Coillte). We can’t

make an estimate, but this could seriously distort the real level of private sector

employment.

Second, there are many labour

activation schemes that are included in employment numbers (e.g.

Jobsbridge, Community Employment Scheme, etc.).

Some of these would be in the public sector – approximately 25 percent

of Jobsbridge for instance.

But most would be in the private sector.

Over the year, the numbers on these schemes increased by 2,475. This, again, would lower the private sector

employment increase.

Third, there has been a considerable rise in precarious work,

or underemployment – those who are working part-time but want to work

more. A large proportion of these would

be in the low-paid sectors. In

the first quarter of this year, under-employment grew by 17,000 on a

year-by-year basis – most of these in the private sector.

So where does that leave us?

Private sector employment grew, according to the gross CSO numbers by,

500 a month in the year between the first quarter of 2012 and 2013. But when you remove the statistical fluke in

the agricultural sector and factor in the growth in labour activation scheme

participants and under-employment – it is probably the case that employment in

the private sector stagnated if not fell over the last year.

Earnings and Labour

Costs Survey

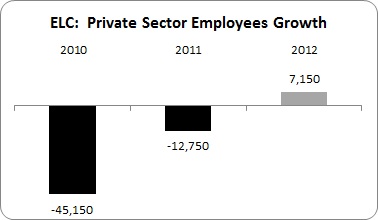

The second data source is the CSO’s

Earnings and Labour Costs survey (ELC).

This only measures the number of employees; it doesn’t include the

self-employed or assisting relatives.

The latest data only goes up the last quarter of 2012 but we can at

least make an annual estimate. What do

we find for private sector employment?

The ELC survey shows that on an annual basis (not quarterly

as above) the number of private sector employees fell in 2010 and 2011 but

starting rising last year – by 7,150.

This estimate excludes agricultural, fishing and forestry employees so

we don’t have the problem of the CSO’s statistical realignment issues. But we still have caveats.

Participants on labour activation schemes, which would be included

in these statistics, increased by 6,308 – most of these being Jobsbridge participants. Not all of these are in the private sector

but most are.

The annual increase in under-employment – again, most of

whom would be in the private sector – was 9,725.

Though we can’t nail down the number, it is likely that the ELC

increase of 7,150 would fall dramatically when labour activation participants

and the under-employed are factored in.

* * *

Where does that leave us?

At best, the headline figures show private sector employment growing by

somewhere between 500 and 600 a month over the last year. But when you factor in:

- The CSO statistical re-alignment in the agricultural,

forestry and fishing sector

- Increase in labour activation participants which are

included in employment figures

- The increase in under-employment

The actual increase in private sector employment is nearly

wiped out and could even turn negative over the last year.

In short, the monthly 2,000 private sector job increase

claimed by Government Ministers is nonsense. Now can we please have a realistic

presentation of what is happening in the labour market? If we can’t describe the situation

accurately, how do we know if what we’re doing is actually working at all?

Leave a comment