The Nevin Economic Research Institute, ICTU’s think-tank,

has looked into the budgetary future and finds there is a better way of doing

things. They have utilised all the tools

of economic analysis to show that, what they call Plan B, is a far better way

of doing business than what the Government intends. Their budgetary proposals would remove the

need for cuts in public services and social protection, increase investment, and

keep more people at work than under the Government’s plans – and all this while

maintaining the same pace of deficit reduction.

It doesn’t make grandiose claims (billions in soaking the rich, hundreds

of thousands more at work, etc.). It merely shows that there is an alternative

that is better. This is an analysis and

a programme that all progressives – in civil society, trade unions, political

parties (including the Labour Party) – can rally around, while providing that

commodity we need the most – hope.

NERI bases its proposals on a sophisticated model – the

HERMIN model which is used by other economists (see here for another

example).

‘The HERMIN model uses macro-economic data to allow

researchers to bring together different production sectors of the economy in a

complex model that relates producer, consumer, investor and labour market

behaviour to external developments in trade, prices and currency movements.’

I’m not suggesting that NERI’s modelling is superior to any

other, or that we should become seduced by models (all the models in the world

didn’t foresee the recession in the first place). However, it shows that NERI’s programme is

not a wish list or some back-of-the-envelope job. It is a serious piece of work that deserves

the same consideration as other programmes and analysis.

So what are they suggesting?

Namely, that the Government’s fiscal adjustments should be turned on its

head.

- The Government proposes that spending cuts make up 64

percent of the total fiscal adjustments.

NERI proposes that tax increases make up 85 percent of the total

adjustments.

- The Government intends to cut public investment by €550

million. NERI proposes to reverse this

cut and add an additional €500 million.

Under NERI, there will be €1 billion more investment flowing into the

economy, increasing its capacity to grow and putting people back to work.

- The Government intends a fiscal adjustment of €3.5

billion. But because the tax and

investment dynamic produces a better outcome, NERI proposes a fiscal adjustment

package of €2.7 billion.

So what are the results?

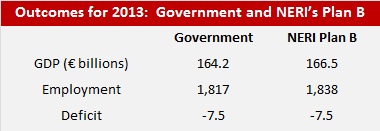

Under NERI’s Plan B, GDP rises by more than €2 billion above

the Government’s projection. There will

be 21,000 more people at work under NERI’s proposals. And the deficit will be the same. That’s the effect of a progressive,

investment-based, pro-growth economic strategy.

What’s particularly interesting – and here I’m working on my

own calculations, so any mistake is mine, not NERI's – is that not only are most budget cuts removed, the end

effect of NER’s strategy is that we would be able to spend more on public

services and social protection. This is

defined by what is called the ‘primary

current budget’. This refers to the

current budget (spending on public services, social protection, wages, etc. –

excluding the capital budget) minus interest payments. I have used investment as a substitute for

the capital budget.

Not only is primary current spending higher under the NERI

programme than the Government’s in 2013 (€1.3 billion higher), it is slightly

higher than this year and almost returns us to 2011 levels.

This opens up the scope for further increases in spending on

public services and social protection by re-directing spending within the current

budget – savings on public service efficiencies, removal of regressive

spending, and reduced unemployment costs.

NERI proposes a menu of progressive tax measures that could

be introduced which would spare low and average income earners and, therefore,

would limit the damage to the domestic economy.

I just want to draw attention to three measures under corporation tax:

- End the manipulation of carrying forward of losses – NERI

claims these are of dubious economic impact and regressive

- Abolish/Reform the treatment of undistributed reserves where

by company directors can manipulate the system to drawdown tax-free lump sums

of hundreds of thousands of Euros on retirement.

- Reform interest deductions – by imposing a limit on interest

paid by companies as a percentage of a company’s assets. This would prevent

public subsidisation of speculative debt.

These innovative measures wouldn’t impact on the corporate

tax rate (though the Government has claimed everything is on the table, the

corporate tax is not – in fact, its’ not even let into the dining room) but it

would remove inequitable tax avoidance.

NERI has presented us an authoritative template upon which

can rally the broadest possible coalition against failed austerity

policies. That doesn’t mean progressives

will agree with everything contained in the latest Quarterly Observer. I have a few quibbles with details. But you don’t build coalitions around

details, you build them around principles.

NERI’s principles of investment and tax-driven fiscal adjustments have

been shown to work.

Not a bad day’s work.

Leave a comment