Apparently, the Marquis didn’t like the window tax.

'The Marquis of Dowshire presented two petitions [to the House of Lords], one from Dublin, and the other from Belfast, complaining generally of the excessive burthen of taxes, but especially the Window tax which . . . bore most unfairly as well as most heavily upon them. The noble marquis said, that when the window-tax was originally proposed, Mr. Corry, then Chancellor of the Exchequer in Ireland, had urged it merely as a war tax, to subsist only for a limited time. The tax, however, was continued from year to year, in spite of various remonstrances urged in the most temperate manner at various meetings in a multitude of instances. The cause had been taken up by all classes and descriptions of men, who, though they had willingly submitted to the privations which they believed to be necessary in an urgent moment, yet trusted, in rational expectation and in the confident reliance on the word of a respectable minister, that the burden would be removed as soon as the cause for imposing it should have ceased. They found themselves mistaken.'

I wonder what the noble Marquis would make of the flat-rate household charge proposed by Minister Hogan.

A flat-rate tax is, in principle, odious. It is also economically irrational. But our Fine Gael Ministers seem to be making a habit of this, what with Minister Bruton going after the pay packets of the lowest paid in the economy.

We’ll know the details soon – the level of the charge, the range of exemptions and relief, and the sanctions against those who dare participate in a ‘won’t pay’ campaign – but the details are not important. The charge, by its very nature, will be regressive and socially backward.

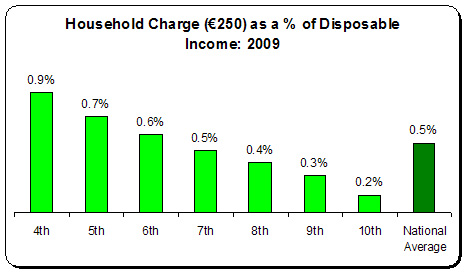

Let’s look at a sample distributional impact on income groups using the last EU Survey of Income and Living Conditions. The income levels will have changed – but what is at issue here is the relative impact. In 2009, what impact would a Household Charge of €250 have on different income deciles (I’m going to assume the bottom 30 percent of household will be exempt as most of them are fixed incomes – pensions, unemployment benefit, etc.)?

In this example, we find that households in the 4th decile – whose income is 37 percent below the national average – would take the biggest hit; the Household Charge would take out nearly 1 percent of their disposable income.

For the richest 10 percent of households, the Charge would only take out 0.2 percent.

I will let readers ponder the fairness of that.

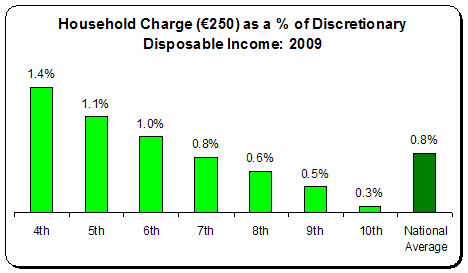

But as noted before, out of disposable income we must pay for certain necessities – food, heating, light, telephone, etc. These can be called ‘non-discretionary expenditures’. There is little we can do to adjust this spending by any significant extent (though, we could make Sunday a ‘fast day’ – give up food as Minister Bruton forces us to give up our Sunday premium).

What is left can be called ‘discretionary disposable income’ out of which we pay for everything else. So how would a Household Charge impact on that?

Not surprisingly, the regressive impact gets worse. Households in the 4th decile would find nearly one-and-a-half percent of their discretionary disposable income gone; the richest 10 percent would lose a mere 0.3 percent.

Again, I urge readers to ponder.

Not only is this socially regressive it is economically irrational. Taking a higher proportion from those who spend most of their income will reduce consumer spending and demand. This will lead to more businesses under pressure, a greater risk of higher unemployment, less tax revenue, etc.

If, however, the tables above were reversed – if those on the lower incomes only lost 0.3 percent while those on the highest income lost 1.4 percent, the damage to the economy would be far less; for the simple reason that taxing high income groups progressively will lead to mostly savings be reduced, not spending.

But in the strange world of Minister Hogan, working from an economic text that was last written with a hammer and chisel, a tax that is regressive and harms economic growth is alright by him.

What would the Marquis of Dowshire advise us? Remonstrate, hold meetings all over the place, bring together a broad range of people against this venal little tax.

In other words: organise, oppose, resist.

Leave a comment