Dan O’Brien – who is producing work at the Irish Times at a phenomenal rate – quotes approvingly from the Department of Finance:

Dan O’Brien – who is producing work at the Irish Times at a phenomenal rate – quotes approvingly from the Department of Finance:

‘In formulating policy, the Government took on board evidence from international organisations, such as the EU Commission, the OECD and the IMF, as well as the relevant economic literature which indicates that consolidation driven by cuts in expenditure is more successful in reducing deficits than consolidation based on tax increases. Past Irish experience also supports this view and suggests that confidence is more quickly restored when adjustment is achieved by cutting expenditure rather than by tax increases.'

You could write mountains of posts on just this one quote but I’ll just content myself with a small hill. ‘Relevant economic literature’ is one of those catch-alls – you can find just about any viewpoint, perspective, set of prescriptions from the economic literature you’re looking for. And if it agrees with your viewpoint its ‘relevant’ and if it doesn’t its ‘irrelevant’. Increase spending, cut spending, increase taxes, cut taxes, increase borrowing, cut borrowing – it’s all out there in the ‘economic literature’. Take your pick. You can even discover that Jesus wasn’t so hot on the minimum wage if you look hard enough.

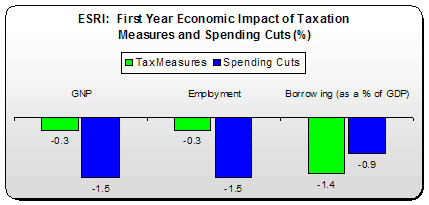

Fortunately, we have some really relevant literature to our current economic condition. The ESRI assessed the impact of tax increases (income, property and carbon) and spending cuts (public sector wages, public sector jobs and public investment) on the economy and fiscal deficit. Here’s what they found for ‘consolidation’ packages worth €3 billion each.

Well, well, well. Spending cuts would cut GNP growth by five times more than tax measures; five times as many jobs would be lost through spending cuts as opposed to tax increases; but – tax measures would yield more savings than spending cuts – 50 percent more savings.

Well, well, well. Spending cuts would cut GNP growth by five times more than tax measures; five times as many jobs would be lost through spending cuts as opposed to tax increases; but – tax measures would yield more savings than spending cuts – 50 percent more savings.

Let’s put some numbers on all this for 2011:

- Spending cuts will result in a fall of €1.5 billion in the GNP more than tax measures.

- Spending cuts will result in a fall of approximately of 24,000 more jobs than tax measures

That’s why spending cuts will deliver less net savings (after you factor in higher unemployment costs, less tax revenue and less economic activity) – over €800 million less than tax measures.

In other words, spending cuts will result in moe business failures, more unemployment and less deficit reduction. Tax increases, on the other hand, have a far less negative impact and greater yield for the Exchequer. These findings from the ESRI model were published eight months before the Department of Finance made that statement above. So this ‘economic literature’ was known to them. It’s just that it didn’t fit the viewpoint of the Government. Therefore, it was not considered ‘relevant’. Isn’t that convenient?

Now, I wonder what Jesus would say about spending cuts.

Leave a comment