Ah, a phrase we will be hearing throughout the next few weeks of wonderful, joyous (albeit, Ireland-less) World Cup football. It’s also an apt phrase for the reporting of economic reviews. IBEC has produced its quarterly commentary and the media was full of green-shoots:

Ah, a phrase we will be hearing throughout the next few weeks of wonderful, joyous (albeit, Ireland-less) World Cup football. It’s also an apt phrase for the reporting of economic reviews. IBEC has produced its quarterly commentary and the media was full of green-shoots:

‘Ibec has revised upwards its economic forecasts for 2010 and 2011 . . . net exports will make a positive contribution to growth in 2010 and that GDP will be -0.1 per cent as against its earlier forecast that it would be -0.7 per cent. The body has also revised upwards its GDP figure for next year, to 2.3 per cent from 2.1 per cent.’

Okay, some downsides (‘investment continues to have a significant drag on Irish economic growth’) but consumer demand is ‘helping to lift the economy out of recession’. So, forward to a brave future? Not just yet.

Yes, IBEC revised upwards its GDP projections for this year and next year based on higher exports. But (and this is a big but) they revised downwards all other indicators. In other words, they are more pessimistic about the domestic economy than they were a mere three months ago. The ref really missed that one.

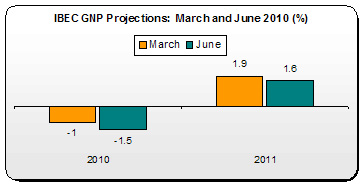

For 2010, IBEC revised GNP growth downward from -1 percent to -1.5 percent. In 2011, they previously thought GNP would grow by 1.9 percent. Now, they project a lower 1.6 percent. Put these together, IBEC believed the domestic economy would grow by nearly 1 percent over this year and next, now believe it won’t really grow at all.

For 2010, IBEC revised GNP growth downward from -1 percent to -1.5 percent. In 2011, they previously thought GNP would grow by 1.9 percent. Now, they project a lower 1.6 percent. Put these together, IBEC believed the domestic economy would grow by nearly 1 percent over this year and next, now believe it won’t really grow at all.

Why? Investment is still collapsing. Three months ago, they projected investment would fall by -11.4 percent over the two years; now they project the fall in investment to be nearly twice that. And while they are a bit more optimistic this year re: consumer spending, they revised downwards their 2011 projections.

Of course, this will have an impact on jobs. IBEC has revised downwards their projection for employment growth (nil in 2011); as a consequence, they revised upwards their projected unemployment rate – from 12.6 percent to 12.8 percent.

This is the year of the ‘trough’: the economy, whether expressed as GDP or GNP, will bottom out sometime this year. And it’s been a long way to the bottom – especially as Government policy has actively dug an even deeper hole. 2011 will be the start of the fight-back if you will – as the economy starts to grow. A constant theme here (and over at Progressive-Economy) is that spending cuts and tax increases on low and average incomes will depress growth going forward. If effect, deflationary policies will act like steel blocks tied to our ankles as we scrabble upwards out of the hole.

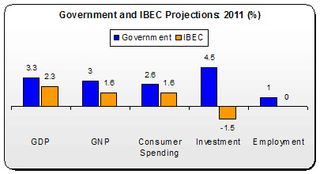

This is in evidence when we compare IBEC’s latest projections for 2011 with the Government’s projections from last December.

This is in evidence when we compare IBEC’s latest projections for 2011 with the Government’s projections from last December.

IBEC’s projections come in much lower than the Government’s in all categories – in particular GNP which is the driving force in our fiscal levels. The ref missed this one.

This the key question: if the IBEC projections hit the mark, how can reduced GNP growth, reduced consumer spending, still negative investment and no employment growth (the Government is projection 20,000 net new jobs next year) – how can all this translate into a reduced deficit?

Under the Government’s projections, the deficit will fall by 1.6 percent in 2011. However, to do this, we need growth, investment, spending and employment; under IBEC’s projections we will not get this. As a result, the deficit will remain above Government projections, debt will increase, interest payments will rise – what the TASC open letter described as a ‘low-growth, high-debt future’.

Of course, IBEC may be getting it wrong. Interestingly, though, their ‘write downs’ and growing pessimism regarding our domestic economy mirrors the EU Commission’s forecasts which I covered here. They, too, revised downwards all the key domestic indicators – though the ref missed that one, too.

The media is the ref. It’s not that commentators and interviewers should get stuck into the game – coming up with their own macro forecasts. But they should be highlighting the issues so as to inform the public and canvas the broadest range of opinions over why ‘this’ is happening or ‘that’ is not happening.

Without a good ref, the game deteriorates into a travesty – where skill is ignored and cheating is rewarded. When it comes to football, Ireland knows a bit about that.

We’re starting to get a similar sense of that about the economic debate as well.

Leave a comment