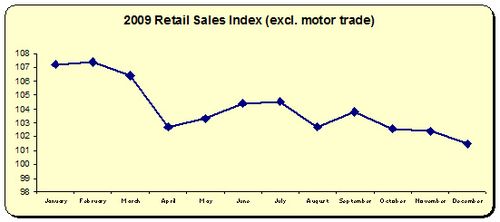

Following the St. Stephen’s Day sales there was much commentary to the effect that huge shopping crowds were signs of a new confidence resulting from the Government’s budget. We were waiting for tough action, we got tough action and now we are off in the shops with our credit cards. How the recently released Retail Sales Index must be a splash of cold water on all that.

Following the St. Stephen’s Day sales there was much commentary to the effect that huge shopping crowds were signs of a new confidence resulting from the Government’s budget. We were waiting for tough action, we got tough action and now we are off in the shops with our credit cards. How the recently released Retail Sales Index must be a splash of cold water on all that.

Not only were December volume sales down on the previous month at -0.9 percent, sales value were down even further, at -1.5 percent. This suggests that retailers are still cutting prices and margins in an attempt to maintain some sort of volume level. December sales fell at a faster rate than the yearly monthly average for 2010.

Some commentators have pointed to stability in some sectors such as clothing, etc. but its more like the stability of the ocean floor that the sinking ship finally hits. One suggested the sales index would return to modest growth once households 'realised that the public finances have stabilised' (yes, I'm sure that's the main topic of conversation at dinner tables throughout the country). Clearly, the fall in consumer spending will hit bottom out sometime this year. But commentators have been talking up a stabilised market since the summer. In September, one said, 'the incoming evidence continues to suggest that consumer spending is stabilising'. Yet sales continued to fall.

2010 looks set to be a difficult year. Social welfare and public sector wage cuts have just come on stream, unemployment and emigration is still rising, domestic interest rates will rise soon and when the ECB starts reducing the stream of cheap money to the banks, credit and overdrafts will become even more expensive and more difficult to get. And none of this includes the long-term trend of people trying to get out from under one of the largest household debt levels in Europe. All this does not bode well for a recovery in consumer spending. More likely, it will trough and then flat-line, growing only in the most sluggish way.

Only a few weeks into the New Year and all the indicators are going the wrong way: unemployment, Exchequer returns, redundancy notices and the retail sales index. We're still sinking. Yes, we'll eventually hit the ocean floor. But it will be a long swim back to the surface.

And, oh, those sharks.

Leave a comment